Good Morning Everyone!

Remember, today at 2pm, a group of middle-aged financial experts determines whether or not millions of Robinhood (NASDAQ:HOOD) traders get margin called.

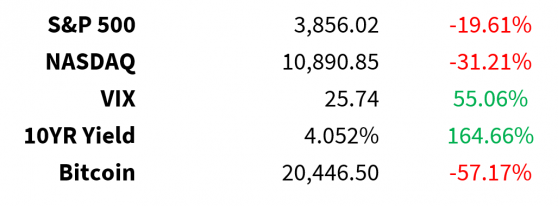

Prices as of 4 pm EST, 11/1/22; % YTD

MARKET UPDATE 2 p.m. Fed Reserve Rate decision

- Volatility is relatively LOW heading into the Fed Meeting

- 4th straight rate hike of 75 basis points expected

- More important: messaging on how the Fed proceeds from here

- 2:30 p.m. Powell press conference

- Will Powell say: we are not done

- Powell can’t be happy about the spectacular rally in the DOW in October / this is not what Powell wants

China orders a 7-day lockdown of iPhone City (Foxconn’s main plant in Zhengzhou)

- Foxconn had a Covid flare-up that forced 200,000 staff into quarantine

- Lockdown will last until November 9

- The abrupt action reflects Beijing’s Covid Zero approach

- Apple (NASDAQ: NASDAQ:AAPL) pre-market is down 1%

Russia

- said it would resume participation in the Ukrainian grain deal

- Wheat down 6%, Corn down 2%

Crude 88 flat

- API Crude and product inventories out last night had little impact on Crude

- Fed Day is more important

Maersk container vessels

- A bellwether for global trade

- Believes global demand will shrink by 4% in 2022 and will be down in 2023

Amazon (NASDAQ: NASDAQ:AMZN) hit a new year-to-date low yesterday

- Amazon paused hiring in their Ad business

- Any cost cutting measures will be viewed positive by investors

Autos

- U.S. supply 32 days 18 month high

- U.S. SAAR 15.3 million units 17 month high

- Incentives were down 47% year-over-year but up 2.7% month-over-month

- Inventory days supply is 32 days vs. 30 days last month and 23 days last year

- Mix remains strong favouring trucks: Car vs. light truck mix at 21% / 79%

Opioid Settlement

- Final settlement positive for pharmacies

- $12-13.8 billion for the big three retail pharmacies

- $21 billion announced in 2021 for the big 3 distributors

- CVS (NYSE: CVS) + 2%

- Walgreens Boots Alliance (NASDAQ: NASDAQ:WBA) +2%

- Walmart (NYSE: NYSE:WMT) flat

Earnings

- Advanced Micro Devices (NASDAQ: NASDAQ:AMD)

- Mondelez (NASDAQ: NASDAQ:MDLZ)

- Airbnb (NASDAQ: ABNB) beat but guide below street

- McKesson (NYSE: MCK)

- Public Storage (NYSE: NYSE:PSA)

- Devon Energy (NYSE: DVN) Earnings and FCF beat, capex below consensus

- AIG (NYSE: AIG) EPS beat

- Prudential (NYSE: LON:PRU) EPS beat

- Energy Transfer (NYSE: ET)

- CVS Health (NYSE: CVS) agreed to pay $5 billion to settle opioid lawsuits

- Estee Lauder (NYSE: NYSE:EL) -8%, guide down to 2023

- Progressive Insurance (NYSE: PGR)

- Humana (NYSE: NYSE:HUM)

CRYPTO UPDATE International regulation

-

G-20 will prioritize crypto regulation

- Third objective of India’s G-20 presidency

- Year-long presidency

- Takes over starting in December

-

Hong Kong warming up to crypto

- Exploring giving access to retail crypto trading and ETFs

- Considering range of pro-crypto measures

-

Mainland China much more strict

- Blanket ban on all crypto in September 2021

Recent crypto trademark filings

- Visa (NYSE: NYSE:V)

- PayPal (NASDAQ: NASDAQ:PYPL)

- Western Union (NYSE: WU)

- Viking Cruises

- Ulta (NASDAQ: ULTA)

- Del Monte (NYSE: FDP)

- Kraft (NASDAQ: KHC)

- Inn-N-Out

- Takis

- Moët Hennessy

- Formula One

- DraftKing (NASDAQ: DKNG)

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga