NEW YORK - Pfizer Inc. (NYSE: NYSE:PFE), the global biopharmaceutical company, has declared a quarterly cash dividend of $0.42 per share for the second quarter of 2024. This dividend is payable on June 14, 2024, to shareholders of record at the close of business on May 10, 2024. This upcoming dividend marks the 342nd consecutive quarterly dividend to be distributed by the company.

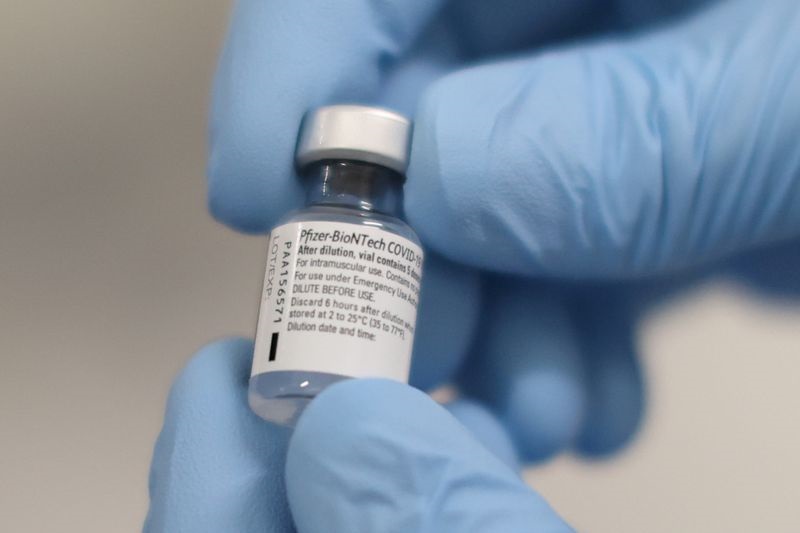

Pfizer is known for its contributions to the healthcare sector, focusing on the development and manufacturing of medicines and vaccines. The company has a longstanding history of 175 years in the industry, working to improve the lives of patients worldwide. Pfizer's commitment to healthcare innovation and access aligns with its role as a leading biopharmaceutical entity.

The dividend is part of Pfizer's ongoing practice of returning value to its shareholders and reflects the company's financial health and its board of directors' confidence in its stability and growth. Dividends are a way for companies to distribute a portion of their earnings to investors, and Pfizer's consistent dividend payout history demonstrates a steady performance over the years.

The information regarding the dividend was made public through a press release statement by Pfizer Inc. Shareholders looking forward to the dividend payment should ensure they own the company's common stock by the specified record date. As with all financial decisions, investors are encouraged to consider their own circumstances and consult with financial advisors if necessary.

Pfizer continues to be active in the healthcare market, working to advance treatments and support healthcare systems around the world. The company maintains a presence on various social media platforms and its corporate website, where it shares information relevant to investors and the public.

This dividend announcement is an essential piece of information for current and potential investors, providing insight into Pfizer's financial practices and its dedication to shareholder returns.

InvestingPro Insights

Pfizer Inc. (NYSE: PFE) has showcased a strong commitment to its shareholders through its consistent dividend payments, and the latest dividend announcement for the second quarter of 2024 is a continuation of this practice. Here are some key insights from InvestingPro that investors might find valuable when considering Pfizer's financial health and future prospects.

InvestingPro Tips for Pfizer underscore the company's robust track record in rewarding investors. Notably, Pfizer has raised its dividend for 13 consecutive years, highlighting a dependable commitment to shareholder returns. Additionally, the company has maintained dividend payments for an impressive 54 consecutive years, which speaks volumes about its financial stability and prudent management.

From a financial data standpoint, Pfizer's market capitalization stands at a solid $149.04 billion, reflecting its significant presence in the pharmaceutical industry. The company's Price/Earnings (P/E) ratio is currently at 20.46 when adjusted for the last twelve months as of Q4 2023, which may indicate the market's expectations for future earnings growth. Furthermore, Pfizer's dividend yield is notably high at 6.38%, making it an attractive option for income-focused investors.

For those seeking more in-depth analysis, there are additional InvestingPro Tips available that could provide further clarity on Pfizer's financial outlook. For instance, analysts have revised their earnings downwards for the upcoming period, and the stock is trading near its 52-week low, which may influence investor sentiment.

InvestingPro offers a comprehensive set of tools and insights for investors looking to delve deeper into companies like Pfizer. By using the coupon code PRONEWS24, investors can get an additional 10% off a yearly or biyearly Pro and Pro+ subscription, which includes access to a wealth of financial data and expert analysis. For more tips on Pfizer, including insights on its earnings multiples and stock volatility, investors can visit InvestingPro at: https://www.investing.com/pro/PFE.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.