Moderna , Inc. (NASDAQ:MRNA) has reported a recent sale of common stock by one of its top executives. Shannon Thyme Klinger, the company's Chief Legal Officer, sold shares totaling over $26,000.

On May 29, 2024, Klinger sold 183 shares of Moderna's common stock at an average price of $144.50 per share, amounting to a total transaction value of $26,444. This sale was part of a tax withholding obligation related to the vesting of restricted stock units (RSUs). According to the filing, these shares were sold to cover tax withholding obligations and were not discretionary sales.

The transaction was disclosed in a regulatory filing with the U.S. Securities and Exchange Commission. It is important to note that the sales executed by Klinger followed the vesting of RSUs, which is a common practice for executives to manage tax liabilities associated with the vesting of equity awards.

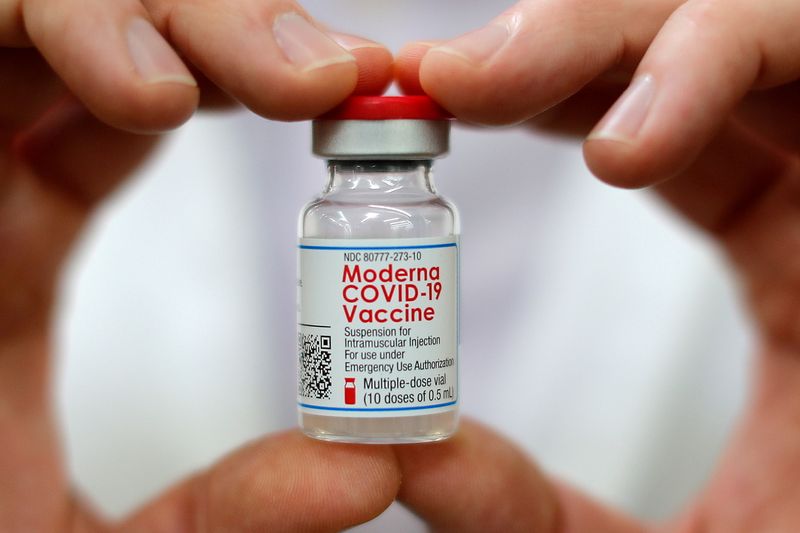

Moderna, based in Cambridge, Massachusetts, operates in the biotechnology industry, focusing on developing mRNA-based therapies and vaccines. The company has been at the forefront of the biotech sector, particularly known for its COVID-19 vaccine.

Investors and the market often monitor insider transactions as they may provide insights into an executive's view of the company's stock value and future performance. However, insider sales can occur for various reasons and may not necessarily indicate a negative outlook on the company's prospects.

For more detailed information on the transactions, interested parties can refer to the full Form 4 filing available on the SEC's website.

InvestingPro Insights

Moderna's financial position reveals some intriguing facets that investors might consider. While the company's Chief Legal Officer has recently sold shares, the broader financial context can provide additional insights into the company's status. According to InvestingPro data, Moderna's market capitalization stands at $58.06 billion, reflecting its significant presence in the biotechnology industry. Despite facing challenges, as indicated by a substantial revenue decline over the last twelve months of -65.78%, the company holds a P/E ratio of -9.73, suggesting that investors are anticipating future earnings recovery.

Looking at performance metrics, Moderna's stock has experienced a sharp decline over the past week, with a -9.81% total return. However, over the last three months, the stock has seen a remarkable total return of 60.36%, showing a rebound in investor confidence. This volatility in stock price movements is a key characteristic that investors should be aware of when considering Moderna's stock.

Among the InvestingPro Tips, it's noteworthy that 11 analysts have revised their earnings estimates upwards for the upcoming period, which could signal optimism about Moderna's future performance. Additionally, despite analysts anticipating a sales decline in the current year, Moderna's strong cash position, holding more cash than debt, is a positive sign of financial health and stability.

For investors seeking a more in-depth analysis, there are 14 additional InvestingPro Tips available on InvestingPro, which can be accessed for Moderna at: https://www.investing.com/pro/MRNA. To gain further insights and make more informed investment decisions, use the coupon code PRONEWS24 to get an additional 10% off a yearly or biyearly Pro and Pro+ subscription.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.