On Thursday, Morgan Stanley (NYSE:MS) maintained an Equalweight rating on Moderna (NASDAQ:MRNA) and raised its stock price target on the stock to $95 from $85. The firm cited upcoming events as potential catalysts for the biotechnology company's shares.

The adjustment follows a quarter that Morgan Stanley described as "generally in line," indicating that Moderna's recent performance met the firm's expectations. Looking forward, the firm pointed to specific events that could influence the stock's movement in the near term.

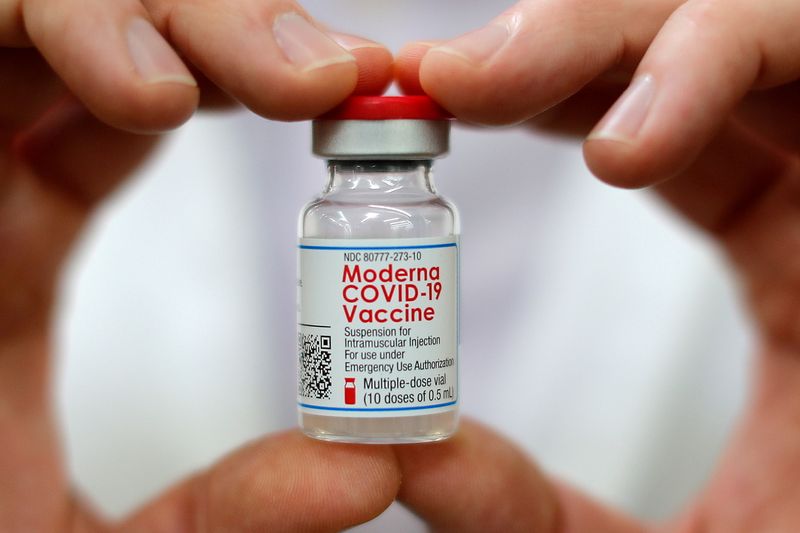

One such event is the Prescription Drug User Fee Act (PDUFA) date for Moderna's Respiratory Syncytial Virus (RSV) vaccine, scheduled for May 12, 2024. This date is significant as it is when the U.S. Food and Drug Administration (FDA) is expected to complete its review of the vaccine's Biologics License Application (BLA).

Following the PDUFA date, the Advisory Committee on Immunization Practices (ACIP) is set to convene for a panel and recommendation session on June 26-27, 2024. The outcome of this meeting could further impact the stock, as ACIP's recommendations often guide vaccination practices.

Moreover, the American Society of Clinical Oncology (ASCO) conference, taking place from May 31 to June 4, 2024, is noted as another key event for Moderna. The conference is a major gathering for oncology professionals and could provide a platform for the company to present new data or updates on its oncology-related treatments.

The new stock price target of $95 represents Morgan Stanley's updated valuation of Moderna's stock based on these forthcoming catalysts and the company's current financial standing.

InvestingPro Insights

As Moderna (NASDAQ:MRNA) approaches significant milestones in its development pipeline, real-time metrics from InvestingPro provide a detailed financial perspective on the company's current status.

With a market capitalization of $48.09 billion, the company's financial health is under scrutiny, particularly considering its P/E ratio, which stands at -9.17 based on the last twelve months as of Q4 2023. This figure points to investor concerns about profitability, aligning with the anticipation of a sales decline in the current year, as noted by analysts.

InvestingPro Tips indicate that Moderna's management has been actively buying back shares, a sign that could be interpreted as confidence in the company's future prospects. Moreover, the company holds more cash than debt on its balance sheet, which provides a cushion against financial headwinds. Still, it is important to note that Moderna is not expected to be profitable this year and has experienced weak gross profit margins, at -39.28% for the same period.

Despite these challenges, Moderna's stock has seen a significant uptick over the last six months, with a price total return of 56.48%. This recent performance suggests that investors may be optimistic about the company's long-term growth potential, as evidenced by a strong return over the last five years. For readers interested in deeper analysis, there are 11 additional InvestingPro Tips available at https://www.investing.com/pro/MRNA, which can be accessed with a yearly or biyearly Pro and Pro+ subscription. Don't forget to use coupon code PRONEWS24 to get an additional 10% off.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.