(Bloomberg) -- Oil slipped back to near a three-month low, ending a brief surge when Yemen’s Houthi rebels said they attacked an oil facility in Saudi Arabia.

Prices had jumped above $54 a barrel in New York after the rebels said they launched missiles and drones at Saudi Aramco’s Jazan plant in the kingdom’s south. Airports in the region and the Khamis Mushait base were also targeted, Houthi spokesman Yahya Saree said on television.

The rally soon subsided amid skepticism about the claim. Aramco (SE:2222) didn’t immediately respond to questions about the report. In June, the Houthis announced a missile strike on a power plant in Jazan, but Aramco subsequently said its facilities were “fully operational.”

Futures remained about 14 cents up for the day, mostly supported by U.S. industry data showing a drop in crude inventories and a broader rebound in commodities and equities as traders assessed the impact of China’s coronavirus outbreak.

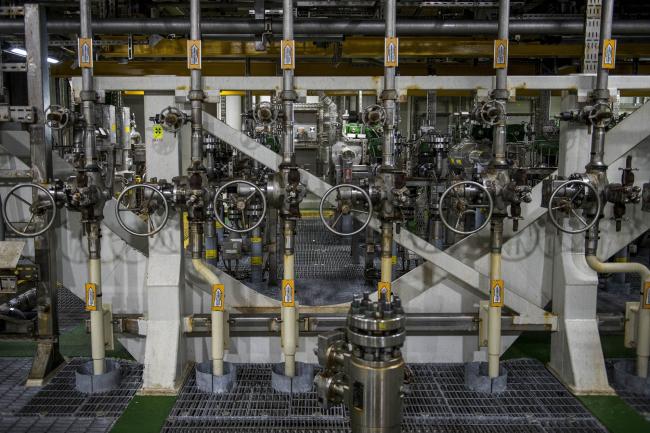

Jazan is the site of a 400,000 barrel-a-day Aramco refinery but the city, near the border with Yemen, isn’t home to crude oil production facilities or major export terminals. The refinery and petrochemical complex there isn’t yet operating at its full capacity, but is expected to do so in the second half of 2020, Aramco said at the time of its initial public offering last year.

West Texas Intermediate for March delivery was at $53.66 a barrel on the New York Mercantile Exchange as of 9:11 a.m. local time. The contract settled 0.6% higher on Tuesday. Brent for March settlement advanced 41 cents to $59.92 a barrel on the London-based ICE (NYSE:ICE) Futures Europe exchange.