By Ron Bousso

LONDON (Reuters) - Global spending on oil and gas exploration in 2017 could fall below this year's $40 billion, but lower costs mean profitability will increase, consultancy Wood Mackenzie said in a report on Friday.

Faced with a 30-month-long oil price downturn, oil companies including Exxon Mobil (N:XOM) and Royal Dutch Shell (L:RDSa) have slashed spending budgets in recent years, with exploration bearing the brunt.

According to Wood Mackenzie, the share of exploration in overall oil and gas production investment will dip to a new low of 8 percent in 2017.

"Overall investment will at best match 2016 year's spend of around $40 billion, and may yet fall further," said Andrew Latham, vice president of exploration at Wood Mackenzie. That compared with a 2014 peak of $95 billion.

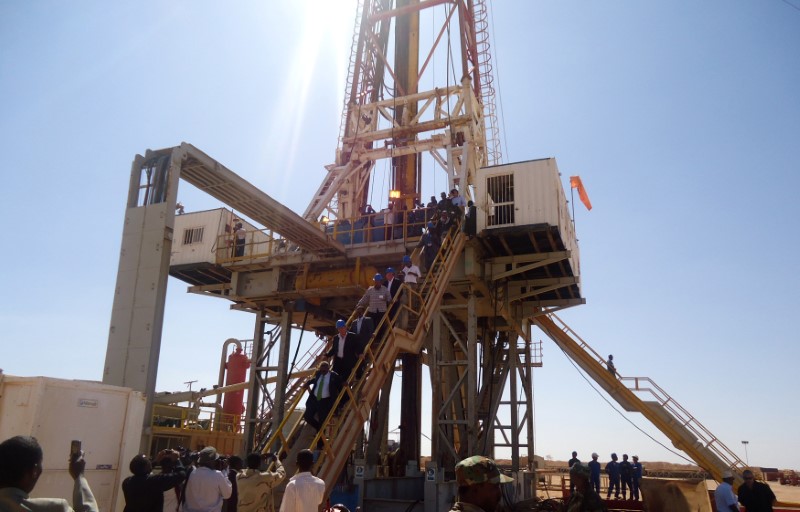

Lower costs of drilling rigs, simpler wells designs and cheaper seismic imaging mean well counts may nevertheless hold up close to 2016 numbers while returns improve.

"After a decade in the doldrums, the majors' returns from conventional exploration improved to nearly 10 percent in 2015. The rest of the industry is heading in the same direction. Fewer, better wells promise a brighter future for explorers," Latham said.

The rate of discoveries is not expected to fall next year and to average around 25 million barrels of oil equivalent per well.

The world's top oil companies have struggled to replace natural decline in production through exploration in recent years and will have to rely more on acquiring fields and smaller companies in the future, Latham said.