Proactive Investors - In the grand theatre of minerals, copper, with its lustrous, reddish-orange sheen, plays a leading role. It's a tale of geology, of markets, and of civilizations that have risen and fallen with the ebb and flow of this malleable metal's availability.

Copper deposits come in various forms and locales, each with its own geological fingerprint.

The most significant of these are porphyry deposits, a term that rolls off the tongue as smoothly as the molten magma from which these deposits originate.

These geological giants are formed by the cooling of magma chambers deep within the earth's crust.

Porphyry Deposits: Geological Freaks of Nature

They are the behemoths of the copper world, accounting for about 60% of the world's copper. Countries like Chile, Peru, and the United States are the Wall Streets of porphyry copper, hosting vast reserves that keep the global market humming.

Then there are the sediment-hosted stratiform deposits, which might lack the grandeur of their porphyry cousins but make up for it in their unique formation. Picture ancient seabeds, rich in organic matter, slowly compressing over millennia. These deposits, often found in the Central African Copperbelt, are like the bond traders of the copper world—less flashy than their equity counterparts but no less important.

Vein deposits, though smaller in scale, are the old souls of copper deposits. They tell tales of hot fluids coursing through rock fractures, depositing copper as they go. These veins lace through the rocks like a complex network of highways, transporting wealth into the nooks and crannies of the earth. The United States, particularly the historic mining state of Montana, has been a classic venue for these deposits, where fortunes were dug out of the rocky spine of the continent.

And let's not forget volcanogenic massive sulfide (VMS) deposits, the dramatic offspring of underwater volcanic activity. These deposits form as black smokers—underwater chimneys—spew metal-rich fluids into the ocean, where they react with the seawater and fall to the ocean floor as a sultry mix of minerals. Countries like Canada, with its famous Flin Flon deposit, have been key players in this market.

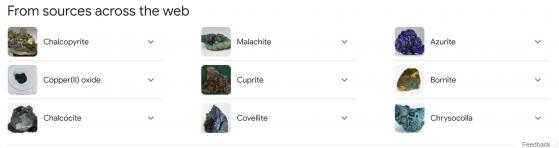

Each of these deposits brings with it a suite of ores, the raw materials of the copper trade. Chalcopyrite, bornite, and chalcocite are the marquee names here, the blue-chip stocks of the copper ore world. Chalcopyrite, with its brassy yellow colour, is particularly abundant. It's the main attraction in porphyry deposits and a reliable source of copper, though its entourage of sulfur and iron can make it a challenging commodity to process.

In Awe of Ore

Bornite (see below), with its peacock hues, is a showstopper, fetching the nickname 'peacock ore' for its vibrant array of colours. And chalcocite, the dark horse, is rich with copper content, often found lurking in the deeper, more sultry parts of the deposit.

Above are the riffs and variations. However, it is worth remembering that ores are broadly classified into two main types: sulfide and oxide, each with distinct characteristics and processing methods.

Sulfide: The Deep Vein Treasures

Sulfide ores are typically found deep underground and are the primary source of copper. They contain copper in the form of copper sulfide minerals, such as chalcopyrite (CuFeS2), chalcocite (Cu2S), and bornite (Cu5FeS4). These minerals are often associated with other sulfide minerals and metallic ores, such as pyrite (FeS2), molybdenite (MoS2), and silver (Ag).

The processing of sulfide ores involves crushing and grinding, followed by flotation, a process that separates the copper minerals from the waste rock. The resulting copper concentrate contains about 25-35% copper along with various sulfides of copper and iron, plus smaller concentrations of gold, silver, and other materials.

The next step is smelting, which involves heating and melting the concentrate in a furnace to produce copper matte, which is a mixture of copper sulfide and iron sulfide. The matte is then converted into blister copper, which is typically about 98% pure copper, through a process of oxidation and reduction.

Oxide: The Surface Bounty

Oxide ores are typically found near the surface and are less abundant than sulfide ores. They contain copper in the form of copper carbonate, sulfate, phosphate, and silicate minerals. Examples include malachite (Cu2CO3(OH)2), azurite (Cu3(CO3)2(OH)2), and cuprite (Cu2O).

These ores are processed differently from sulfide ores due to their different chemical compositions. The most common method is heap leaching, which involves piling the ore into large heaps, then irrigating the heaps with a weak sulfuric acid solution, which dissolves the copper content. The resulting solution, known as a pregnant leach solution (PLS), contains dissolved copper ions that are then recovered through solvent extraction and electrowinning (SX-EW) processes.

The SX-EW process involves extracting the copper from the PLS into an organic solvent, then stripping the copper into an electrolyte solution. The final step is electrowinning, where the copper is plated onto cathodes by applying an electrical current, producing nearly pure copper.

Mixed: Blending the Two

Some deposits contain a mix of both sulfide and oxide ores. These mixed ores pose a unique challenge for miners and processors, as they require a combination of processing methods to extract the copper. Typically, the oxide layers are processed first, as they are easier to access and treat, while the deeper sulfide layers are processed later.

Copper: The Alchemy of the Modern Age

In the grand narrative of copper, the plot thickens once the metal is wrested from the earth. The next act? Processing. It's a high-stakes drama where raw ore is transformed into the highly coveted, market-ready metal. Think of it as the backstage of a Broadway show, where the raw talent of ores gets a makeover into a star.

First up, we have the venerable method of smelting. It's the old guard of copper processing, a technique as ancient as civilization itself. Picture a furnace, flames licking the sky, as copper ore is combined with a stony mate called flux and a breath of air. The heat is intense, the chemistry complex, and the result? A layer of matte copper, sulking at the bottom of the smelter, and a slag of waste floating like the froth on a cappuccino. It's a method that's endured the test of time because, quite simply, it works.

Then there's leaching, the avant-garde of copper processing. It's like sending the ore to a spa, where it's treated to a luxurious soak in sulfuric acid or ammonia. The copper dissolves, enters into solution, and is later recovered through a process called solvent extraction and electrowinning (SX-EW). It's the copper equivalent of a liquid diet, and it's especially handy for low-grade ores that would scoff at the very idea of smelting.

Electrowinning follows, a process that could be likened to a magician's act. Here, copper ions from the leaching process are zapped with electricity, prompting them to deposit onto cathodes as 99.99% pure copper. It's a neat trick, one that skips the fiery furnaces and goes straight to the high-grade metal with a flash and a buzz.

And let's not forget refining, the final polish on our star before it steps out onto the market stage. Even the best smelting and electrowinning acts can leave behind a few impurities—like a smudge on a diamond. Refining is the meticulous art of removing these blemishes, often through electrolysis, where copper is further purified until it's ready for its close-up.

Each of these methods has its own fan base and critics. Smelting is the tried and true, but it's a bit of a diva, demanding high-quality ores and belting out greenhouse gases like an opera singer. Leaching and electrowinning, on the other hand, are the indie artists, making the most of lower-grade materials and often putting on a more environmentally friendly show.

In the end, the method chosen is a matter of economics, environmental considerations, and the quality of the ore body. It's a decision that can make or break fortunes, a strategic move in the high-stakes game of copper production.

So there you have it, the behind-the-scenes action that turns a stone into a star—or more accurately, copper ore into the conduits and currencies of our daily lives. It's a process that's as dynamic and diverse as the market it feeds, a testament to human ingenuity, and a crucial chapter in the ongoing saga of copper.

Copper: The Metal with a PhD in Economics

In the grand bazaar of global commodities, copper has long been the metal with a PhD in economics. Its price gyrations are not just mere numbers on a screen but a narrative of global economic vitality. The red metal, affectionately dubbed 'Doctor Copper', has been diagnosing the health of the market since humans first coaxed it from the rocks.

Take, for instance, the rollercoaster ride of copper prices in the tumultuous year of 2020. Three-month copper futures plummeted from the heady heights of $6,340 per metric ton to a sobering $4,731 on the London Metal Exchange in March, as the coronavirus pandemic sent shockwaves through the markets. But like a phoenix from the ashes, by May, copper clawed back, trading at over $5,200 per metric ton. It's a comeback story worthy of a Hollywood script.

But what are the plot points in this epic tale of economics? Let's break down the factors that make copper prices tick.

Copper's Cameo in Human History

Humans have been chummy with copper for over 10,000 years, with its earliest cameos in coins and ornaments. Fast forward to the Bronze Age, and copper's alliance with tin was the equivalent of a blockbuster superhero team-up. Today, copper's roles are diverse, from power generation to the unsung hero in your home's plumbing.

Copper's Global Stage

Copper's global trot has led it to some interesting locales. Chile, the Brad Pitt of copper deposits, leads the pack, followed by Australia, Peru, Mexico, and the United States. These mineral A-listers hold the lion's share of copper deposits, with a staggering 65% of the world's supply under their belts.

Chile and Peru: The Copper Titans of the Mining World

In the global arena of copper mining, Chile and Peru stand as the titans, their names synonymous with vast stretches of copper-rich terrain that have long quenched the world’s thirst for this essential metal. Their importance in the copper mining industry is not just significant—it's monumental.

Chile: The Copper King

Chile is the undisputed copper king, a heavyweight champion in the copper markets, producing more than a quarter of the world’s supply. The Atacama Desert, a vast, arid stretch of land, is home to the largest open-pit copper mine in the world, Escondida, which alone accounts for about 5% of global production. The country's copper deposits are part of the Andean Copper Belt, which extends from Chile into Peru, boasting the highest concentration of large-scale copper porphyry deposits anywhere on Earth.

Chile's dominance is underpinned by several factors:

Geological Bounty: The Andean geological formation has blessed Chile with abundant copper deposits that are relatively easy to access and of high grade, making them economically attractive to mine.

Stable Production: Chile has a long history of copper mining, with well-established infrastructure and a skilled workforce. This stability and experience translate into consistent production levels, even amidst global economic fluctuations.

Investment-Friendly Policies: The Chilean government has historically fostered a mining-friendly environment, with policies that encourage foreign investment and a legal framework that supports mining activities.

Peru: The Rising Contender

Peru, while trailing behind Chile, is no less significant. It's the world's second-largest copper producer and holds an estimated 13% of the world’s copper reserves. Peru's mining regions, such as Cerro Verde and Antamina, are testament to the country's mineral wealth, offering both sulfide and oxide copper ores.

Peru's importance is bolstered by:

Expanding Sector: Peru has seen a surge in exploration and new projects, which suggests that its copper production is set to grow in the coming years.

Diverse Mining Landscape: Unlike Chile’s focus on open-pit mining, Peru also benefits from a mix of both open-pit and underground mining operations, allowing for a diverse extraction strategy.

Economic Cornerstone: Copper mining is a cornerstone of the Peruvian economy, contributing to a significant portion of the country’s GDP and export earnings, which fuels further investment in the sector.

The Global Impact

The significance of Chile and Peru in the copper mining industry cannot be overstated. Their vast reserves and production levels mean that any shifts in their mining landscape—be it due to political changes, environmental policies, or labor strikes—can send ripples through the global copper market, influencing prices and economic forecasts.

Moreover, as the world increasingly turns to electric vehicles and renewable energy, both of which rely heavily on copper, the strategic importance of Chile and Peru in the copper industry is only set to grow. Their ability to efficiently and sustainably manage their copper resources is crucial, not just for their national economies, but for the global transition towards a greener future.

In essence, Chile and Peru are not just mining their own wealth; they are shaping the future of global industry and technology, one copper vein at a time.

Copper's Champions: The Top Five Mines Painting the World Red

In the grand global tapestry of copper production, a few mines not only stand out but stand above. These mining marvels are the Olympians of copper, the titans whose output floods the market and whose scale dwarfs the competition. Let's take a whirlwind tour of the top five copper mines that are the bedrock of the copper world.

1. Escondida Mine: The Chilean Colossus

At the pinnacle sits the Escondida Mine, a behemoth nestled in the arid expanse of Antofagasta (LON:ANTO), Chile. Owned by the mining giant BHP, this surface mine is the stuff of legends, churning out an estimated 1.06 million tonnes of copper in 2022. It's a copper fortress that's set to stand tall until 2078, a testament to the enduring legacy of Chile in the copper narrative.

2. Collahuasi Mine: The Andean Giant

Not far behind, the Collahuasi Mine stands proud in Tarapaca, Chile, a stone's throw from its cousin Escondida. Glencore PLC (LSE:LON:GLEN) holds the reins to this surface mining titan, which has produced a staggering 589.28 thousand tonnes of copper. With a lifespan stretching to 2108, Collahuasi is a name set to be etched in the annals of mining history for decades to come.

3. El Teniente Mine: The Underground Empire

Delving both above and below the surface in Cachapoal, Chile, the El Teniente Mine is a subterranean empire owned by Corporacion Nacional del Cobre de Chile. This brownfield site, a labyrinth of human endeavor, has extracted some 456 thousand tonnes of copper. Its veins run deep, with operations projected to continue until 2072.

4. Cerro Verde Mine: The Peruvian Powerhouse

Crossing borders into Arequipa, Peru, the Cerro Verde Mine paints the landscape with its vast open-pit operations. Freeport-McMoRan (NYSE:FCX), the mining maestro, orchestrates the extraction of 433.63 thousand tonnes of copper from this brownfield site. The mine's life expectancy reaches to 2052, ensuring Cerro Verde's place in Peru's copper chronicles.

5. Morenci Mine: The American Dream

In the rugged climes of Arizona, United States, the Morenci Mine cuts a striking figure against the desert backdrop. Another jewel in Freeport-McMoRan's crown, this surface mine has contributed 400.67 thousand tonnes of copper to the global market. With a timeline extending to 2044, Morenci is the American dream made of copper and grit.

These copper cathedrals are not just holes in the ground; they are the beating hearts of local economies, the engines of global industry, and the flag-bearers of technological progress. They are monuments to human ingenuity, where the earth's riches are harnessed, and the red metal begins its journey from the dusty cradle of mines to the pinnacle of modern civilization.

Copper's Corporate Titans: The Top Five Majesties of Metal

In the regal court of copper production, a few corporate sovereigns reign supreme, their output vast, their influence far-reaching. These are the barons of the red metal, the top five copper companies whose fortunes ebb and flow with the tides of the market.

1. Codelco: The Chilean Crown Jewel

At the zenith of the copper kingdom sits Codelco, the Chilean state-owned mining juggernaut and the world's largest copper producer. Despite a 16% dip in production to 332 thousand tonnes in Q2 2023, Codelco remains the industry's blue-blooded monarch. The company's output was dented by the capricious whims of weather and the inevitable pauses for pit stops and maintenance, particularly in its central southern operations. Yet, even with lower ore grades and the challenges at Chuquicamata, Codelco's crown remains firmly in place.

2. BHP: The Diversified Dynasty

A mere whisker behind is BHP, the diversified mining dynasty with a global footprint. With 328 thousand tonnes of copper mined in Q2 2023, BHP has seen a 5% year-on-year uptick, thanks in part to its strategic conquests of Prominent Hill, Carrapateena, and Carajas. The acquisition of OZ Minerals has bolstered BHP's copper coffers, showcasing its savvy in expanding its empire and securing its spot as a copper colossus.

3. Freeport-McMoRan: The North American Noble

Claiming the bronze medal is Freeport-McMoRan, the North American noble whose copper production reached 324 thousand tonnes in Q2 2023. Despite a 17% decline compared to the previous year, primarily due to lower ore grades across its North American operations, Freeport-McMoRan remains a formidable force in the copper realm, its fortunes as closely watched as the markets themselves.

4. Zijin Mining: The Chinese Copper Courtier

Zijin Mining, the Chinese copper courtier with a penchant for international resources, takes the fourth spot. With a production of 248 thousand tonnes, up 15% from the previous year, Zijin Mining is expanding its influence and control, asserting its position as a global copper power with a strategy that spans continents.

5. Glencore: The Resourceful Regent

Last but certainly not least is Glencore, the resourceful regent of the copper trade. Producing 244 thousand tonnes in Q2 2023, albeit a slight 3% decrease from the previous year, Glencore's narrative is one of strategic mining sequences and a keen eye on by-products. Its operations at Collahuasi and Antamina continue to be a lynchpin in its copper narrative.

These five copper companies are more than just miners; they are the architects of industry, the shapers of economies, and the silent partners in our everyday lives. From the wires that carry power to our homes to the coins jingling in our pockets, their copper runs through the veins of modern civilization. They are the unsung heroes of the metal world, and their tales are etched in the ledgers of global commerce.

The Economics of Copper

So, what sends copper prices on a wild ride? It's a cocktail of factors. The demand for copper is a reflection of industrial health. When factories hum and construction booms, copper prices dance to the tune of progress. Conversely, when the world catches a cold, as it did with the pandemic, copper feels the chill with plummeting prices.

Supply Side: A Miner's Tale

On the supply side, it's a miner's tale. The cost of extracting copper, the geopolitical stability of producing countries, and the environmental regulations all play their parts. A strike in a major mine or a new vein discovery can send prices spiraling or tumbling down.

The Speculative Spark

And let's not forget the speculators, those financial wizards who can fan the flames of the market with their trading strategies. Their crystal balls and market moves can amplify or mitigate the swings in copper prices.

In the end, copper's price is a barometer for the global economy, a metal with a doctorate that prescribes a dose of reality to the markets. It's a story of human progress, of supply and demand, and of the eternal dance between human civilization and the resources we so dearly depend on.

So, the next time you see copper prices making headlines, remember, it's not just a commodity; it's a narrative, a living, breathing testament to our global economic pulse.

Copper: The Investment Odyssey

So, you're looking to add a little copper sheen to your portfolio? Bravo! Investing in copper is akin to buying a ticket to a global economic rodeo. It's thrilling, a bit rough, and not for the faint-hearted. But fear not, intrepid investor, for here's your guide to lassoing the red metal and riding the bull market.

Copper Futures: The Time Travelers (NYSE:TRV) of the Market

Fancy a bit of time travel? Copper futures are your DeLorean. They allow you to agree on a price today for copper that'll be delivered tomorrow, or several months down the line. It's a bit like betting on the Grand National without knowing the horses—but with the right market savvy, the rewards can be substantial. Just remember, the future is as unpredictable as British weather, so pack an umbrella for potential downpours.

Copper ETFs: The Convenient Copper Conduit

Not keen on the idea of barrels of copper cluttering your garden? Enter Copper ETFs. These nifty financial instruments give you all the thrill of the copper price roller coaster without the hassle of physical storage. They're like having a virtual copper vault that you can peek into from your smartphone. It's copper exposure with convenience, and who doesn't like a bit of that?

Copper Mining Stocks: The Pickaxe Portfolio

If you prefer a more hands-on approach, copper mining stocks are your jam. By investing in companies that extract the metal, you're essentially buying a slice of the action. It's like backing the theatre production rather than the leading actor. Just bear in mind, mining stocks can come with their own drama—operational mishaps, geopolitical plot twists, and the occasional environmental critique.

Physical Copper: The Tangible Treasure

For those who like to keep it old school, physical copper is the way to go. This is copper you can hold, admire, and store in a vault, or perhaps even make into an avant-garde coffee table. It's the bullion of the industrial metal world. Just remember, with great copper bars come great responsibility—think storage, insurance, and a decently sized forklift.

The Risks: Copper's Kryptonite

Now, let's talk risks. Copper may be a superhero in the industrial world, but it has its kryptonite:

Commodity Price Volatility: Copper is a moody metal. Its price can soar to the heavens or plummet to the depths based on market sentiment, economic winds, and supply disruptions.

Currency Twists and Turns: Since copper prices are in US dollars, if you're playing the game in pounds or euros, currency fluctuations can either be a windfall or a wipeout.

Mining Mayhem: Mining companies can hit gold or hit a wall. Operational risks, regulatory changes, and the whims of Mother Nature can all affect your mining stock's performance.

Geopolitical Jenga: The game of global politics can be less like chess and more like Jenga. One wrong move and things can topple, affecting copper supply and, consequently, prices.

Environmental Reputations: In an era where green is the new black, environmental issues can tarnish the shine of copper companies, affecting their stock value.

Copper: The Verdict

Is copper a good investment? It can be as solid as a Roman coin or as slippery as a politician's promise. It's essential, versatile, and with the green energy revolution, it's like the popular kid in the global economic schoolyard. But remember, copper's charm comes with challenges. Diversify, stay informed, and maybe, just maybe, you'll find that investing in copper is your portfolio's golden ticket.

Copper Outlook: 2024

The copper market is anticipated to enter a phase of surplus in 2024 following a period of equilibrium in 2023, according to the latest analysis by the International Copper Study Group (ICSG) from their recent Lisbon meeting. The surplus for 2024 is now estimated at 467,000 metric tons, a substantial increase from the 297,000-metric ton surplus forecasted at the ICSG's April meeting.

For the current year, the ICSG has revised its deficit prediction from 114,000 metric tons down to a negligible 27,000 metric tons in the context of a global market that handles around 26 million metric tons annually.

The ICSG acknowledges the provisional nature of these projections, recognizing that real-world market balances can diverge from their predictions due to unexpected events.

Current patterns reveal a decline in demand from Western economies, with a projected decrease of 1.0% in copper use, especially noted in the European Union and North America. In contrast, China's production appears robust, with an estimated increase in usage by 4.3%, driven by the nation's focus on sectors critical to the green transition, such as renewable energy and electric vehicles.

Despite the complex global economic landscape, the ICSG's outlook for 2024 remains cautiously optimistic, with the global usage growth forecast slightly reduced from 2.8% to 2.7%. Nevertheless, this anticipated increase in demand is expected to be surpassed by a forecasted 4.6% rise in global refined copper production next year, following an upwardly revised estimate of 3.8% growth for 2023. China's significant contribution to this increase through its expanding smelting and refining capacities is noteworthy, with further boosts anticipated from new operations in Indonesia, India, and the U.S.

The projection of a larger-than-expected surplus for the next year has surprised market observers, contrasting with the ICSG's current-year forecast of a balanced market. Most market analysts had predicted a surplus for both years. Reflecting these concerns, copper prices have recently fallen below the $8,000 metric ton threshold, influenced by the immediate interplay of supply and demand, despite copper's favorable long-term prospects in the shift to sustainable energy sources.

Read more on Proactive Investors UK