(Bloomberg) -- Gold pared most of its earlier gains amid indications that Iran’s retaliation over the killing of a top general had a limited effect. Palladium rose to a fresh record above $2,100 an ounce.

Earlier, gold spiked above $1,600 for the first time in nearly seven years after Iran attacked military facilities hosting U.S. troops. There were no American casualties in the strikes, a U.S. official said, asking not to be named because the information hasn’t yet been made public.

Read the latest news and updates on Iran here

Earlier, U.S. President Donald Trump tweeted: “All is well! and “So far, so good!” He intends to make a statement later Wednesday.

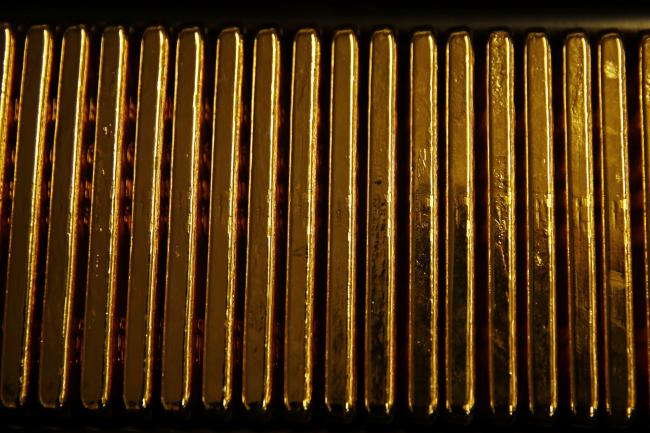

While gold’s blistering start to the year has been driven by the rising hostilities in the Middle East, the metal was already rallying last year as the Federal Reserve eased policy, governments added gold to reserves, and holdings in exchange-traded funds rose.

Spot gold jumped as much as 2.4% to $1,611.42 an ounce on Wednesday, the highest since March 2013. Prices had retreated to $1,577.73 by 12:51 p.m. in London.

In other precious metals, spot palladium climbed as much as 2.3% to hit a record $2,102.02 an ounce. Silver and Platinum were little changed.

“The Iranian missile attack has resulted in significantly higher risk aversion among market participants, prompting them to seek refuge in gold as a safe haven,” Daniel Briesemann, an analyst at Commerzbank AG (DE:CBKG).

Gold hasn’t been this overbought since 1999, with the 14-day relative strength index moving deeper into territory that typically suggests securities could see a pull-back soon.

Still, most analysts expect the metal would rise further if the crisis escalated.

“We’ve seen tactical positioning moving higher, but we haven’t seen some of that longer-term investment demand coming into play yet,” Suki Cooper, precious metals analyst at Standard Chartered (LON:STAN) Bank, said in an interview with Bloomberg TV earlier Wednesday. “There’s more likelihood that we’ll see prices continuing to rise.”