- Shares of Zoom have lost about half their value since January

- Q1 figures on May 23 expected to show how company is handling the return to the office

- Long-term investors could consider buying ZM stock at current levels

- For tools, data, and content to help you make better investing decisions, try InvestingPro+.

Shareholders of the video conferencing company Zoom Video Communications Inc (NASDAQ:ZM) have seen the value of their investment drop roughly 71.5% over the past 52 weeks and 51.6% so far this year.

Source: Investing.com

By comparison, the tech-heavy NASDAQ 100 Index has lost 23.6% so far this year. Meanwhile, the ARK Innovation ETF (NYSE:ARKK), which has about 8% of its portfolio in ZM shares, is down 54.3% since January.

In October 2020, Zoom stock was changing hands just shy of $590, a record high. Since then, it has been a painful ride lower.

As workers started returning to the office, on May 12 the stock hit a multi-year low of $79.03. ZM stock’s 52-week range is $79.03-$406.48, while the market capitalization currently stands at $26.7 billion.

California-based Zoom became a household name during the 'work-from-home' days of the coronavirus pandemic, in part, due to its user-friendly format. As a result, in fiscal 2021, revenue reached $2.7 billion, up 326% year-over-year (YoY). However, as online meetings decrease in numbers, the company may not be able to repeat this stellar performance in the coming quarter.

Yet, the global industry is forecast to reach $24.4 billion in 2028. Such an increase would mean a compound annual growth rate (CAGR) of 15.5%. Analysts concur that Zoom, which leads the video conferencing market, will benefit from such an increase in global revenues. Meanwhile, management is focused on growing the product’s ecosystem.

How Recent Metrics Came In

Zoom released Q4 and full-year 2022 metrics at the end of February. Quarterly revenue increased by 21% year-over-year to $1.07 billion. Adjusted earnings per share (EPS) was $1.29, up from $1.22, in the same period last year.

As of Jan. 31, total cash stood at $5.42 billion. Zoom serves 191,000 enterprise customers, an increase of 35% YoY.

On the results, CEO Eric S. Yuan stated:

“In fiscal year 2022, we delivered strong results with total revenue of more than $4 billion, growing 55% year over year along with increased profitability and operating cash flow growth as our global customer base continued to grow and find new use cases for our broadening communications platform.”

However, Wall Street raised eyebrows at the Q1 FY23 outlook. Management forecasts that total revenue will come between $1.070 and $1.075 billion and adjusted EPS between 86 and 88 cents.

Prior to the release of the fourth quarter results, ZM stock was changing hands around $132. At the time of writing, it is at $89.30, down roughly 30%.

Q1 metrics are expected to be released May 23. Investors should anticipate increased volatility in the coming days.

What To Expect From Zoom Stock

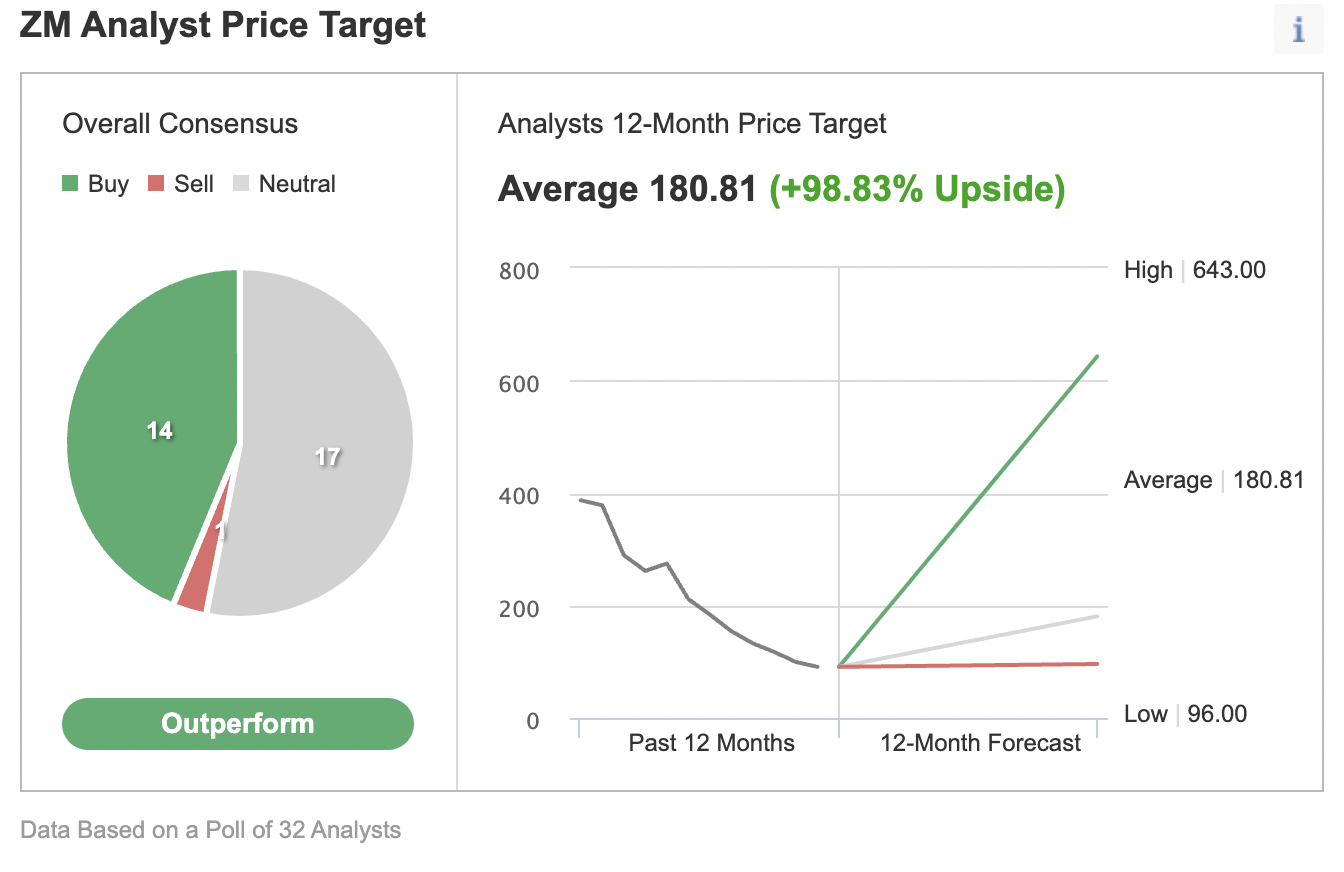

Among 32 analysts polled via Investing.com, ZM stock has an "outperform" rating with an average 12-month price target of $180.81 for the stock. Such a move would suggest an increase of about 98% from the current price. The target range stands between $643 and $96.

Source: Investing.com

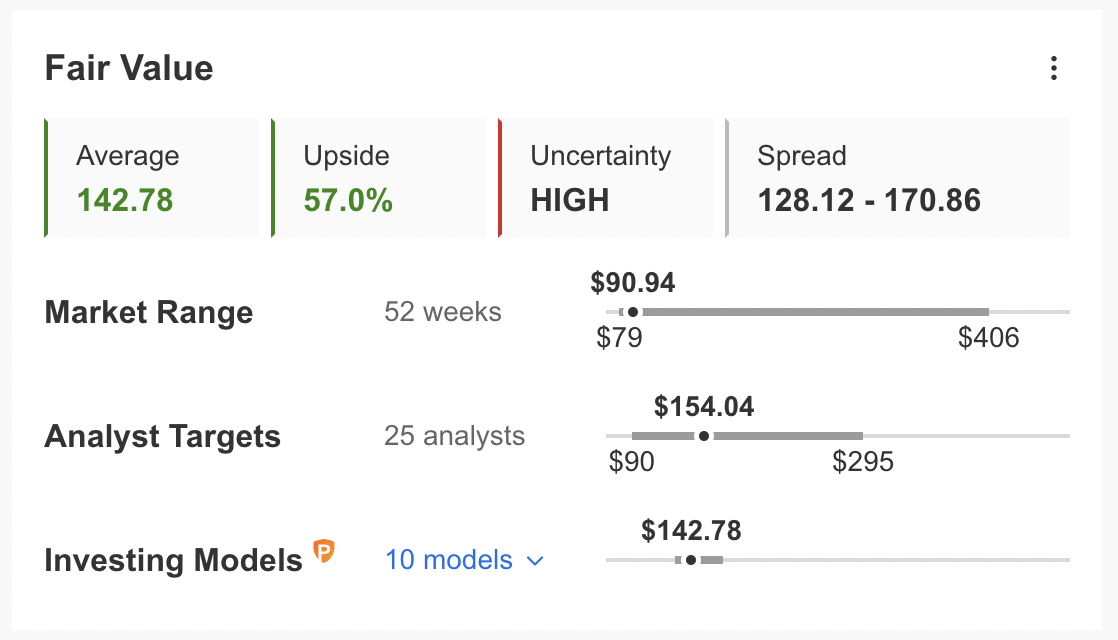

Similarly, according to a number of valuation models, including P/E or P/S multiples or terminal values, the average fair value for ZM stock on InvestingPro stands at $142.78

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase close to 57%.

We can also look at ZM’s financial health as determined by ranking more than 100 factors against peers in the information technology sector.

For instance, in terms of cash flow and growth, it scores 4 out of 5. It scores 5 out of 5 for profitability. Its overall score of 4 points is a great performance ranking.

At present, ZM’s P/B and P/S ratios are 20.1x, 4.6x and 6.7x. Comparable metrics for its peers stand at 13.5x and 11.3x. These numbers show that following the recent decline, ZM stock offers better value than many of its peers.

As part of the short-term sentiment analysis, it would be important to look at the implied volatility levels for Zoom stock options as well. Implied volatility typically shows traders the market's opinion of potential moves in a security, but it does not forecast the direction of the move.

ZM’s current implied volatility is about 27.3% higher than the 20-day moving average. In other words, implied volatility is trending higher, while the options markets suggest increased choppiness ahead. As we have already noted, shares are likely to be choppy ahead of the Q1 results release.

Our expectation is for ZM stock to build a base between $80 and $100 in the coming weeks. Afterwards, shares could potentially start a new leg up.

Bull Call Spread On ZM Stock

Zoom bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $153.49, as per the target provided by analysts.

Alternatively, investors who expect ZM stock to bounce back in the weeks ahead could consider setting up a bull call spread.

Most option strategies are not suitable for all investors. Therefore, the following discussion on ZM stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Intraday Price At Time Of Writing: $89.30

In a bull call spread, a trader has a long call with a lower strike price and a short call with a higher strike price. Both legs of the trade have the same underlying stock (i.e., Zoom) and the same expiration date.

The trader wants ZM stock to increase in price. In a bull call spread, both the potential profit and the potential loss levels are limited. The trade is established for a net cost (or net debit), which represents the maximum loss.

Today’s bull call spread trade involves buying the July 15 expiry 95 strike call for $10.60 and selling the 100 strike call for $8.70.

Buying this call spread costs the investor around $1.90 ($10.60 - 8.70), or $190 per contract, which is also the maximum risk for this trade.

We should note that the trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the ZM stock price at expiration is below the strike price of the long call (or $95 in our example).

To calculate the maximum potential gain, we can subtract the premium paid from the spread between the two strikes, and multiply the result by 100. In other words: ($5 – $1.90) x 100 = $310.

The trader will realize this maximum profit if the Zoom stock price is at or above the strike price of the short call (higher strike) at expiration (or $100 in our example).

Finally, we can also calculate the break-even stock price at expiration. In our example, it is $95 + $1.90 = $96.90. In other words, we add the net premium paid to the strike price of the long call, which is the lower strike (or $95 here). Therefore, on the day of expiry, the trader would need Zoom shares to close above $96.90 to break even from this trade.

Those traders expecting a gradual price increase in ZM stock toward the strike price of the short call (i.e., $100 here) could consider a bull call trade. Please note that the numbers we have used in the calculations do not include brokerage commission or fees.

Bottom Line

Over the past year, Zoom stock has come under significant pressure. Yet, the decline has improved the margin of safety for buy-and-hold investors who could consider investing soon. Alternatively, experienced traders could also set up an options trade to benefit from a potential run-up in the price of ZM stock.

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »