- Verizon’s stock has lost more than 4% since January, hovering at multi-year lows

- Its recent FY22 outlook raised eyebrows

- Long-term investors could consider buying dips

Verizon Communications (NYSE:VZ) has seen the value of its investment drop more than 11.5% in the past 52 weeks and 4% so far this year. By comparison telecommunications peer, T-Mobile (NASDAQ:TMUS) stock is down 3.6% in the past year, but up more than 10% so far in 2022.

What a difference a year has made for Verizon shares. On May 10, 2021, shares in the communications giant went over $59 to hit a multi-year high.

However, as we write, it is at $49.80, a multi-year low. Readers who pay attention to technical charts, especially price and time cycles, may want to watch early May as a potential turning point in VZ stock price.

How Recent Metrics Came In

The New York headquartered, wireless leader released Q1 figures on Apr. 22. Consolidated revenue came in at $33.6 billion, implying a 2.1% increase year over year. Total wireless service revenue registered a 9.5% growth and reached $18.3 billion.

Meanwhile, total broadband net additions were 229,000, the best quarterly figure in more than a decade. Adjusted EPS in Q1 2022 was $1.35 versus $1.36 a year ago.

CEO Hans Vestberg commented:

"Our operational performance in the first quarter further positions Verizon for long-term growth and increases our competitive standing in mobility, nationwide broadband, the value market and above the network business solutions and applications.”

Management now anticipates that 2022 full-year adjusted EPS will be at the lower end of the previously guided range of $5.40 to $5.55.

Prior to the release of the quarterly results, VZ stock was around $55. Now, it is changing hands at around $49.80, a drop of more than 10%.

The stock’s 52-week range has been $49.54-$59.85, while the market capitalization stands at $209 billion. Meanwhile, the current price supports a dividend yield of over 5.1%.

Next Move In VZ Stock?

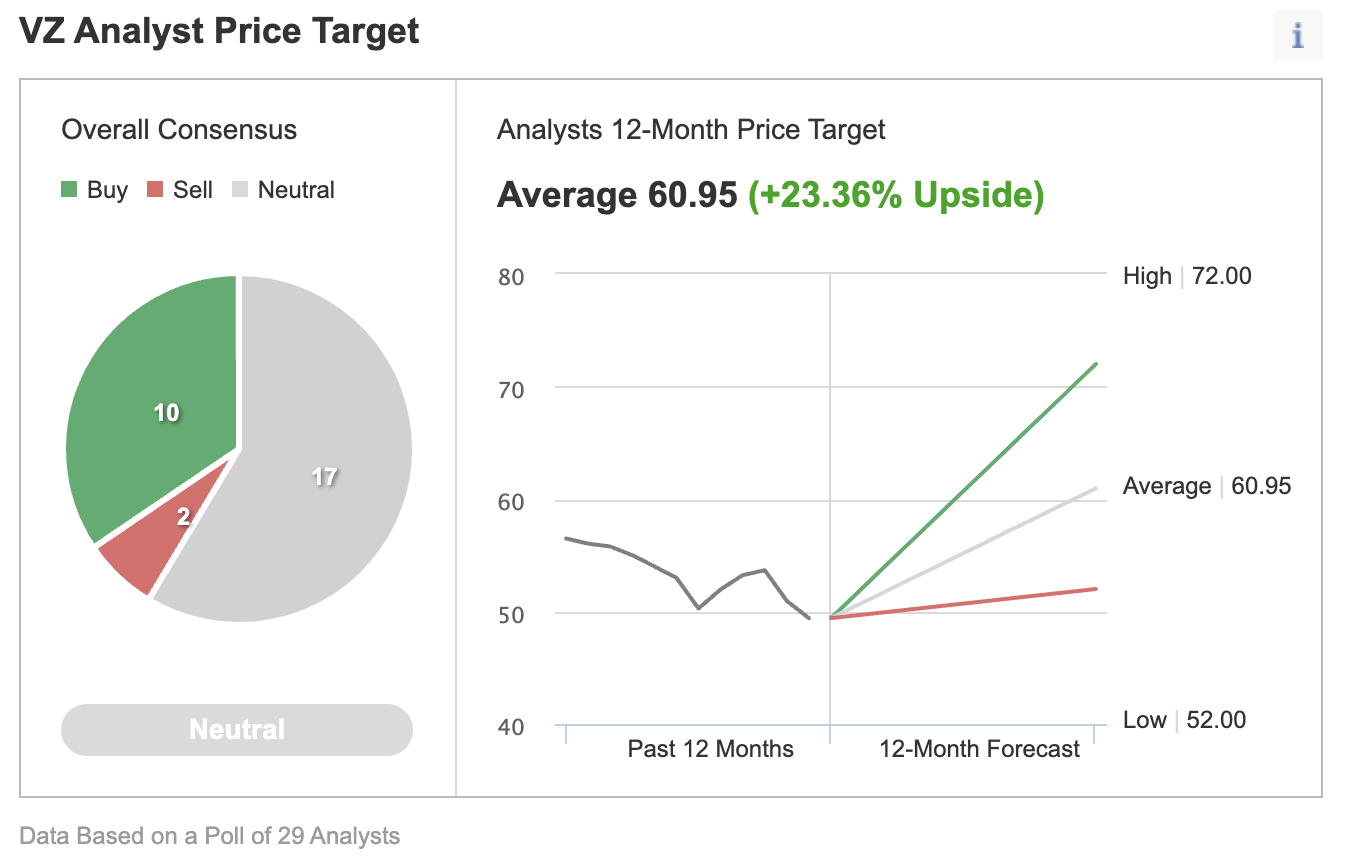

Among 29 analysts polled via Investing.com, VZ shares have a “neutral” rating, with an average 12-month price target of $60.95. Such a move would imply an increase of well over 22% from the current level. The target range is between $52 and $72.

Source: Investing.com

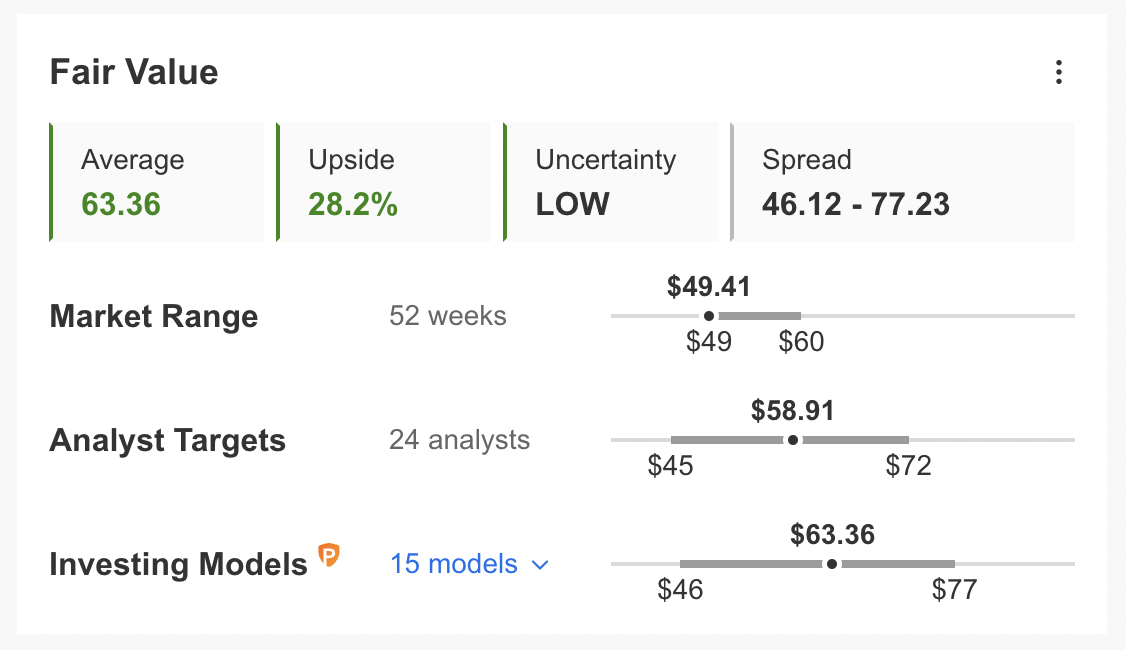

Similarly, according to a number of valuation models, like those that might consider P/E or P/S multiples or terminal values, the average fair value for VZ stock stands at $63.36.

Source: InvestingPro

As part of the short-term sentiment analysis, it would be important to look at the implied volatility levels for VZ options as well. Implied volatility typically shows traders the market's opinion of potential moves in a security, but it does not forecast the direction of the move.

Verizon’s current implied volatility is 20.9, which is higher than the 20-day moving average of 15.7. In other words, implied volatility is trending higher, while options markets suggest increased choppiness ahead.

Readers who watch technical charts may also be interested to know that a number of VZ’s short- and intermediate-term oscillators are oversold. Although they can stay extended for weeks—if not months—the decline in price could also be coming to an end.

Our expectation is for VZ to find strong support between the $45 and $47.5 level. VZ stock would likely trade sideways while it establishes a new base, and possibly start a new leg up.

Cash-Secured Puts On Verizon

Price At Time Of Writing: $49.80

Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing in VZ stock now. They could expect the shares to make a move toward $60.95, the analysts’ price target.

Those who are experienced with options could also consider selling a cash-secured put option in VZ stock—a strategy we regularly cover. As it involves options, this setup will not be appropriate for all investors. Therefore, for many of our readers, the following discussion is for educational purposes only.

Such a bullish trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own VZ shares for less than their current market price of $49.80.

A put option contract on VZ stock is the option to sell 100 shares. Cash-secured means investors have enough money in their brokerage accounts to purchase the security if the Verizon share price falls and the option is assigned. Understandably, this cash reserve must remain in the account until the option position is closed, expires or is assigned, which means ownership has been transferred.

Let's assume an investor wants to buy VZ stock, but does not want to pay the full price of $49.80 per share. Instead, the investor would prefer to buy the shares at a discount within the next several months.

One possibility would be to wait for VZ stock to fall further, which it might or might not do. The other possibility is to sell one contract of a cash-secured VZ put option.

The trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let's assume the trader is putting in this trade until the option expiry date of Aug.19. As the stock is $49.80 at time of writing, an OTM put option would have a strike of $45.

So the seller would have to buy 100 shares of VZ at the strike of $45 if the option buyer were to exercise the option to assign it to the seller.

The VZ Aug. 19 $45.00-strike put option is currently offered at a price (or premium) of $0.98.

An option buyer would have to pay $0.98 X 100, or $98, in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future. The put option will stop trading on Friday, Aug. 19.

Assuming a trader would enter this cash-secured put option trade at $49.80 now, at expiration on Aug. 19, the maximum return for the seller would be $98, excluding trading commissions and costs.

The seller's maximum gain is this premium amount if VZ stock closes above the strike price of $45. Should that happen, the option expires worthless.

If the put option is in the money (meaning the market price of VZ stock is lower than the strike price of $45) any time before or at expiration on Aug. 19, this put option can be assigned. The seller would then be obligated to buy 100 shares of VZ stock at the put option's strike price of $45 (i.e. at a total of $4,500).

The break-even point for our example is the strike price ($45) less the option premium received ($0.98), i.e., $44.02. This is the price at which the seller would start to incur a loss.

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This can be a way to capitalize on the choppiness in VZ stock in the coming weeks.

Investors who end up owning VZ shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts could be regarded as the first step in stock ownership.