The sixth round of talks between the U.S., Mexico and Canada over the North American Free Trade Agreement (NAFTA) kicks off today in Montreal (moved forward two days from the original January 23 start date for reasons unknown) and markets are watching to see if an actual deal will ever be penned and what the fallout might be.

President Donald Trump has repeatedly claimed that the 24 year old pact is perhaps the worst trade deal that the U.S. ever made and has vouched to either achieve a better agreement in line with his “America First” ideology or terminate it all together.

While the baseline claim that the U.S. needs to force firms to produce products back within its borders in order to create jobs for Americans is popular with the voter base that made Trump president, several homegrown factions are actually against the revamp of the NAFTA agreement amid fears that a change in policies would actually hurt their business.

Debate Over Economic Impact

One of the major sticking points in negotiations has been the U.S. insistence on the rules of origin for the auto industry. The U.S. wants to raise the minimum threshold for sourcing auto production to be 85% from NAFTA members and 50% of the total from the U.S. itself, compared to the current agreement for 62.5% to be sourced from the member countries.

U.S. automakers Ford (NYSE:F), General Motors (NYSE:GM) and Fiat Chrysler (NYSE:FCAU) have not been quiet in their insistence that these changes would not be positive for the American people, arguing that it would add thousands of dollars to car costs in the U.S.

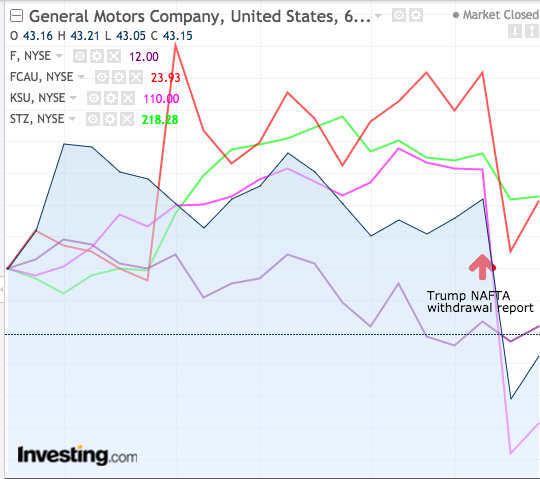

Aside from the debate over the economic effects, taking a look at the stock moves on January 10 (image below), when Canadian government sources said they were increasingly convinced that Trump would pull out of NAFTA, gives a clear signal of what investors think the move would imply for company value.

Apart from the drops in the aforementioned stocks, other firms were also affected such as railroad track owner Kansas City Southern (NYSE:KSU) which offers significant cross-border transportation services for companies or Constellation Brands (NYSE:STZ) which imports beer brands such as Corona Extra and Modelo Especial to the U.S. as part of its international alcohol operations.

As recently as January 18, Trump continued the attack the trade agreement via his Twitter account: “NAFTA is a bad joke!”

Trump has been very outspoken about the “evil” of trade deficits. However, it’s worthwhile to remember that they are simply a matter of subtracting exports from imports and are not inherently bad.

In economic terms, a country’s trade balance tends to move toward surplus during recessions, as its citizens cannot afford imports, and tends to shift toward a deficit during periods of economic growth when internal supply cannot handle strong demand. As a rule consumers need outside products.

Eliminating NAFTA would theoretically increase the number of jobs domestically if the producers in the U.S. are actually able to increase output and replace imports to meet internal demand, but, at the same time, it would also likely mean more expensive goods for American consumers as external competition is quashed.

It also is relevant to note that trade wars could cut down on demand for “Made in USA” products as any retaliatory tariffs would make American products less competitive price-wise. In short, shrinking the trade deficit makes sense, but not if doing so comes at the expense of export growth.

American Farmers Could Suffer

Such a situation may well be a concern for American farmers, long thought to be a large portion of the Trump voter base.

The latest available information from the the U.S. Department of Commerce’s International Trade Administration (ITA) shows that Mexico remained the U.S.’ third largest agricultural trading partner in 2016, accounting for nearly 12% of total American agricultural exports and 53% of Mexico’s total agricultural imports.

The report does in fact inarguably state that Mexico is “favored” via trade. Mexico exported a record $23.8 billion worth of agricultural products to the U.S. in 2016, while total agricultural exports from the U.S. were valued at $18.7 billion.

However, a strict numbers game does not necessarily reflect the reality for American consumers. The U.S. population is much larger than Mexico's and cutting off the Mexican supply could mean possible shortages and/or increasing costs for American households.

Plus, American farmers could be hit. The report, released in September 2017, evaluating current NAFTA negotiations, warned that:

“...the geographic and tariff advantages that are enjoyed in Mexico are likely to continue to make the United States the best import option for most major agricultural goods. That said, Mexico is looking for alternate sources of supply given the charged political climate.”

“Since 1994, when NAFTA entered into effect, bilateral agricultural trade between the United States and Mexico has expanded almost fivefold,” the ITA, which collaborates with 19 U.S. government agencies on its fact-finding mission, found.

“At the same time, agricultural exports from the United States to Mexico have grown at similar rates, reflecting the mutually beneficial outcomes NAFTA has provided,” the report added.

“If we lose Mexico as a customer, it will be absolutely devastating to the ag economy,” Philip Gordon, a longtime farmer of wheat, corn and soybeans in Michigan, told The New York Times in April.

U.S. State-by-State Exposure to NAFTA

A wider analysis from Fitch Ratings looked at the regional impact on trade with a focus on individual states.

Fitch used U.S. Census Bureau data to ascertain that North Dakota was first among states in terms of its export exposure to Canada. By merchandise value, 82% of North Dakota’s exports were sent to Canada in 2016, while New Mexico ranked number one by volume of exported goods shipped to Mexico (43% of total exports).

After North Dakota, Maine, Montana, Michigan, Vermont, Ohio, Missouri, South Dakota and Indiana had the largest export exposures to Canada. Fitch noted that major export industries in these states include farm products, energy (i.e. oil and natural gas), machine parts, and automotive products.

The report highlighted that 11 U.S. states, including those listed above, send 30% of more of their exports to Canada, and 24 others rely on the Canadian market for at least 20% of their export volumes. Goods imported into these states are also heavily weighted towards Canada, in terms of both industrial and consumer goods.

Meanwhile, Canadian goods accounted for 82% of Montana’s imports by merchandise value, 69% of Vermont imports, and more than 50% of the value of all goods imported into North Dakota, New Hampshire, and Wyoming in 2016.

Mexico absorbed 40% of Texas’ exports by product value in 2016, putting into question if the state will allow NAFTA termination to “mess with Texas”.

Similarly, according to Fitch, the Mexican domestic market received 38% of Arizona’s and 15% of California’s exports.

Fitch also made special mention of Michigan because of the complex automotive supply chain that has developed with NAFTA.

“Mexico was the destination for 22% of Michigan’s exports by value, consisting chiefly of automotive and heavy machine components, in 2016,” these analysts found.

“Likewise, South Dakota (25%), Nebraska (23%), Iowa (19%), Kansas (18%) and Missouri (18%) have deep exporting relationships with Mexico, mainly because of their large agricultural sectors,” Fitch noted.

“A unilateral U.S. withdrawal from NAFTA would sharply increase import tariffs overnight, entailing potentially substantial costs for U.S. importers and consumers,” Fitch concluded in one of its reports.

In another warning, the credit rating agency stated that “U.S. states and regions along the borders are vulnerable to falling tax receipts resulting from reduced border traffic.”

NAFTA Status Quo

Trump has, quite logically, been playing hardball, as would any politician, pumping his rhetoric for what his voter base wants to hear, but investors may do well lay aside the subjective political diatribe and evaluate the possible real outcomes on their stocks.

“Ultimately, if negotiations fail and NAFTA ends, it is likely to be politics that is responsible, as each government has infused the talks with homespun political considerations that are largely defensive and intended for domestic audiences,” Fitch global head of sovereign ratings James McCormack said.

“None appears willing to tolerate an outcome in which its electorate could perceive political leaders as either surrendering new-found principles or allowing the country to be taken advantage of in reaching an agreement,” he added.

This political “reality show” may well be what has convinced economists that the threat of ending NAFTA all together is nothing but talk. That may well be why only four of 45 economists from Mexico, Canada and the U.S. polled last week by Reuters said they thought the deal would be terminated, with the rest expecting an updated trilateral agreement that “would not differ radically from the current one”.

Respondents in the poll cited the energy and technology industries as among potential winners from renegotiation while autos, manufacturing and agricultural companies could suffer.

However, the economic impact of a modernized pact will largely be neutral or positive for each country and their currencies, the economists forecast.

The fact that negotiations in Montreal were moved forward two days from the original January 23 date, actually took us by surprise although it’s not clear that anything has really changed.

We think the move was likely designed simply to gain “political points” for all three countries, especially since it moves in direct contradiction to prior indications from political leaders.

Trump himself recently appeared to soften his urgency on an outcome with regard to NAFTA in the face of the July presidential elections in Mexico, saying in an interview with The Wall Street Journal, “I’m leaving it a little flexible because they (Mexico) have an election coming up. So I understand a lot of things are hard to negotiate prior to an election.”

“I thought that was a sensible suggestion from the President. I think all of us are mindful of the Mexican elections,” Canadian Foreign Affairs Minister Chrystia Freeland said after Trump’s remarks.

Bloomberg, citing sources close to the matter, said that January 27 and 28 have been tentatively reserved for reports to chief negotiators, who handle some of the toughest issues, and were preparing for a January 29 ministers’ meeting.

Talks beginning on Sunday were said to focus on energy, investment, financial services, agriculture and some “other issues”. The high-tension subject of rules of origin, particularly relevant with regards to the automotive sector, was reported to be reserved for the final days of talks, as in previous rounds.

All in all, it’s unclear that this expanded schedule for the Montreal talks is anything more than a political slight of hand to show that all three countries are “working hard” to reach an agreement. Trump needs to show his commitment to campaign promises while Mexico is preparing for elections.

Markets are still likely to be jittery when it comes to U.S. stocks with high exposure to trade issues, while currency markets, particularly the Mexican peso, could see some jolts as the political soap opera plays out.

Our assumptions are that politicians on all sides will make a lot of noise and all claim victory at the end, with an updated pact that will have little economic impact. Such is politics.