- Weak equity returns and above-average volatility have been a winning combination for covered call ETFs Selling premium

- Next year appears likely to bring more of the same volatility and price action

- With that in mind, here are three of the most popular call-writing funds as potentially strong plays

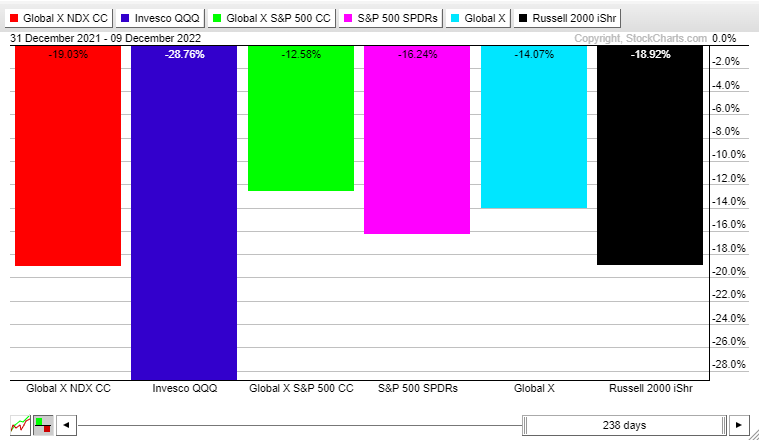

- The Global X NASDAQ 100 Covered Call ETF (NASDAQ:QYLD) has outpaced the popular Invesco QQQ Trust Nasdaq 100 ETF (NASDAQ:QQQ) by nearly ten percentage points year to date.

- The second-largest covered call fund by AUM is the Global X S&P 500 Covered Call ETF (NYSE:XYLD) - that one has produced about 4% of alpha against the SPDR S&P 500 (NYSE:SPY).

- Finally, the same trend is seen in small caps, with the Global X Russell 2000 Covered Call (NYSE:RYLD) down 14% total return in 2022 versus a 19% decline in the iShares Russell 2000 ETF (NYSE:IWM).

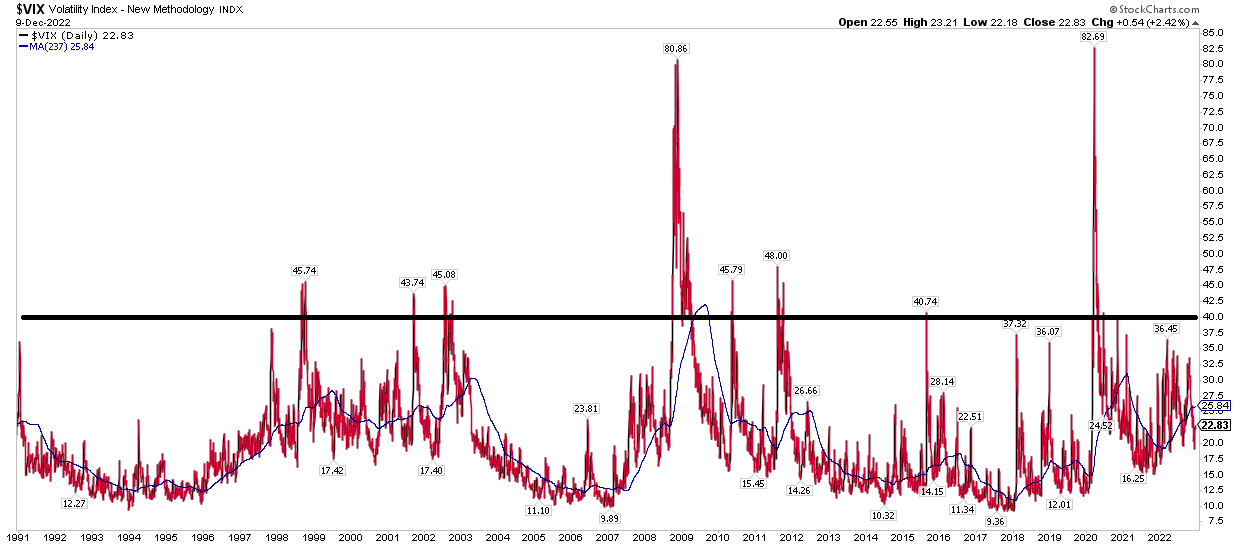

Volatility has run high in 2022, but forecasts of a massive spike in the CBOE Volatility Index have fallen flat. The best the bears have been able to muster this year is the occasional volatility spike to the mid to high 30s during the worst days on Wall Street.

That may be surprising considering all that has been dealt with, such as startling inflation readings, a Fed hell-bent on crushing stocks, a war, a housing market collapse, and record-high gas prices. You’d think some event, perhaps like the FTX downfall, would have triggered a rash wave of selling to send the so-called “fear gauge” to at least the mid-40s.

Volatility: High but Not Extreme This Year

Despite having a history of soaring above 40 during mini-panics, volatility, while averaging a stout 26 for the year, has been confined to a range between 19 and 37 using closing levels. For context, during its more than 30-year history, the VIX has averaged a bit under 20. As a result, option premiums have been a bit pricier than usual in 2022. That makes one group of ETFs look great.

Source: Stockcharts.com

Covered call ETFs use derivatives to enhance their yield. While it sounds complex, the strategy is quite simple. Most such funds just sell call options on the respective portfolio’s positions. During bouts of high volatility in the broad market and when equities are heading lower, these funds generally perform well.

I find that there are three major covered call ETFs that have gained steam in the last 12 months as volatility has turned above normal and as stocks continue to struggle.

The 3 Big Index Plays

Source: Stockcharts.com

Will selling calls against long stock positions pay off again in 2023?

That’s always a crystal-ball kind of question, but with volatility holding its own in the 20s and the first half of next year that could be rocky, these are decent plays to think about for active investors and those wanting some protection while still keeping equity exposure.

Knowing What You Own

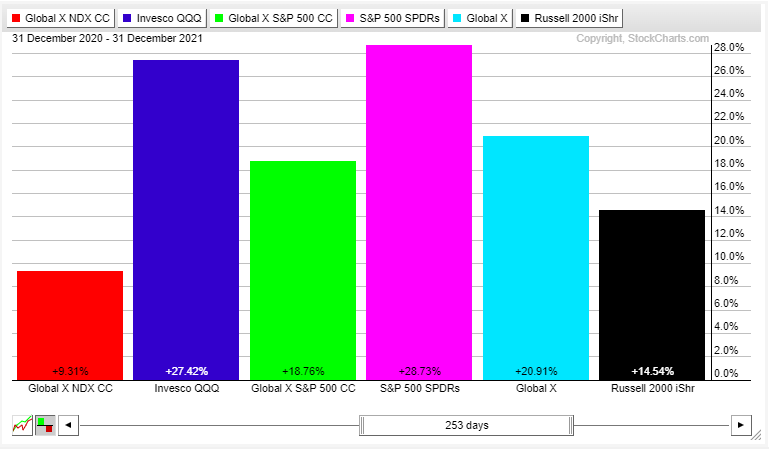

If markets go on to enjoy big gains and lower volatility, covered call ETFs will almost certainly underperform. Broad index funds beat this nascent ETF space by hefty percentages in 2021, though whippy and often trendless price action last year in small caps actually resulted in stronger returns in RYLD versus IWM. On fees, each of the three major covered call funds is not cheap, with 0.60% annual expense ratios.

Source: Stockcharts.com

The Bottom Line

Place your 2023 bets. If you see volatility continuing to run high along with mediocre at best equity returns, then it could be another solid year for covered call ETFs.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.