Markets are pricing almost six more rate hikes from here, and while we doubt the Bank of England would endorse that, we don't think it will want to push back heavily either given the recent tendency for inflation data to come in above expectations. Expect a 25 basis-point rate hike next week and only vague guidance on what's likely to come next.

Markets are pricing almost six more rate hikes

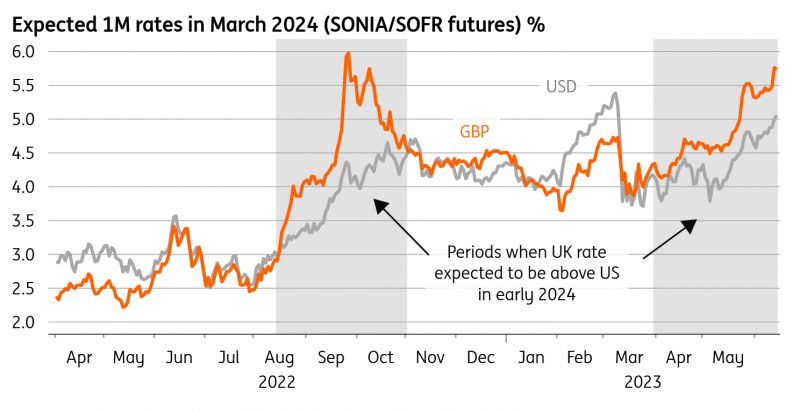

After some unwelcome inflation and wage data, markets now expect the Bank of England (BoE) to take rates close to 6% over the coming months. That equates to almost six additional rate hikes and is very close to the highs we saw in the midst of the ‘mini budget’ crisis last year. The divergence between US and UK rate expectations for later this year has become equally magnified.

Back then, the Bank of England explicitly warned investors that rates were unlikely to go as high as markets were pricing. So the question for Thursday’s meeting, where a 25bp hike is highly likely, is whether the Bank offers up similar pushback against investor expectations.

We think it’s unlikely, for three reasons. Firstly, the circumstances surrounding the spike in yields are quite different to last autumn. Back then it was a byproduct of market stress/poor functioning; now, it’s largely a consequence of sticky inflation and wage data.

Secondly, and with that in mind, the Bank has little certainty over where short-term inflation data are likely to go. So it’s doubtful that policymakers will want to make a pre-commitment on policy, only to have to change tack if data continue to come in hot.

And finally, the Bank has had ample opportunity to sound the alarm over recent days and has opted against doing so. Unlike the Fed and ECB, the BoE typically offers very little commentary between meetings. Without additional guidance, markets have interpreted the recent wage/inflation surprises as requiring a significant monetary policy response.

Markets once again expect UK and US rates to diverge

We doubt the BoE would endorse a 6% Bank Rate at this stage

But not pushing back against rate expectations is not the same thing as validating them. And we have strong doubts that the BoE will take rate hikes as far as markets expect.

Admittedly there’s no hard-and-fast rule that tells a central bank how high is too high. The BoE’s models have suggested that inflation will be well below target if rates were to go to the 5% area – let alone 6% – although policymakers have made it clear that they’re sceptical of these forecasts right now.

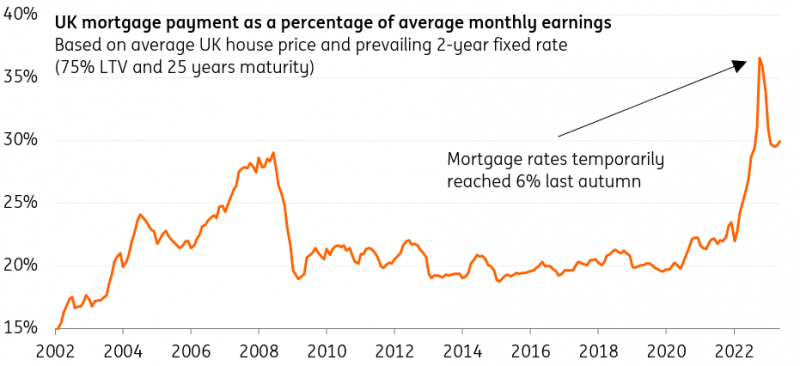

But if we look at the mortgage market – the main transmission mechanism for interest rates – then 6% rates would mean a homeowner with a 75% loan-to-value ratio would, on average, be paying close to 40% of their disposable income on repayments. That compares to roughly 30% at the peak going into the 2008 financial crisis.

The difference between now and then is that the share of households with a mortgage has fallen, and more people own their home outright now. And more importantly, around 90% of mortgages are fixed – predominantly for five years – a huge sea change compared to 10+ years ago when most were on variable rates. The result is that the length of time rates stay elevated is now arguably more important than the level, and the impact of 5%+ mortgage rates for a prolonged period would be large. The BoE is also right to highlight that the impact of past rate hikes is only now beginning to bite as a greater number of mortgage holders refinance.

Homeowners will be paying close to 40% of their average disposable income on repayments after refinancing

The inflation story should start to turn over the summer

Then there’s the inflation data itself. The dividing line on the committee right now seems between those hawks that are seeing persistent ‘second-round effects’ of higher energy/food prices, and the doves that think headline/core CPI is simply just lagging behind the wider fall in input and product price inflation over recent months (see a speech by BoE’s Dhingra).

Elements of both are true. April’s CPI figures were undeniably ugly, though some of the drivers – higher vehicle and alcohol prices, for example – are unlikely to form long-lasting trends. We agree with the doves that food inflation should begin to ease back in line with producer prices, while services inflation (particularly hospitality) should come under less pressure now gas prices are so much lower. The BoE’s own Decision Maker Panel survey of chief financial officers suggests pay and price expectations have also eased noticeably over recent months.

If nothing else, hefty base effects should ensure that the headline inflation rate comes down over the summer months and fluctuates around 6%, and to a lesser extent the same is true of the core rate.

Barring some further unpleasant and consistent surprises in the services inflation figures over the coming months, we think a 5% peak for Bank Rate seems reasonable. That implies rate hikes on Thursday and again in August.

However, as we discussed in more detail in a separate piece, we think the downtrend in wage growth is going to be slow – even if it has probably peaked. Labour market shortages look at least partly structural, and we suspect wage growth could end the year above 5% (7% currently). While that doesn't necessarily require the Bank to take rates much higher, it does suggest rate cuts are unlikely for at least a year, not least given the mortgage market structure discussed earlier.

Sterling trade-weighted index pushes back to early 2022 highs

Sterling can hold onto gains in the near term

Sterling continues to ride high. On a trade-weighted basis, it is returning to levels last seen in early 2022 before Russia's invasion of Ukraine. Barring a surprisingly soft May UK CPI on Wednesday, 21 June, it looks like sterling can largely hang onto those gains if the Bank of England does not push back against very aggressive tightening expectations.

Our strong preference has been that sterling will enjoy more upside against the dollar than the euro. Currently, we have a 1.33 end-year forecast for GBP/USD and the near-term bias is for 1.30 given what seems to be bearish momentum building against the dollar.

EUR/GBP has been weaker than we had expected. And next week's BoE meeting may be too soon to expect a bullish reversal here. Yet, consistent with our house view that the Bank Rate will not be taken as high as the 5.65% level currently priced by investors for the end of this year, we suspect that EUR/GBP ends the year closer to the 0.88 area, meaning that current EUR/GBP levels should make a good opportunity to hedge sterling receivables for euro-based accounts.

This analysis was first published on Think.ing.com.