Kamala Harris boosted by The Magnificent 7, global gold reserves surpass the euro as central banks' second most held asset, and de-euroisation vs. de-dollarisation.

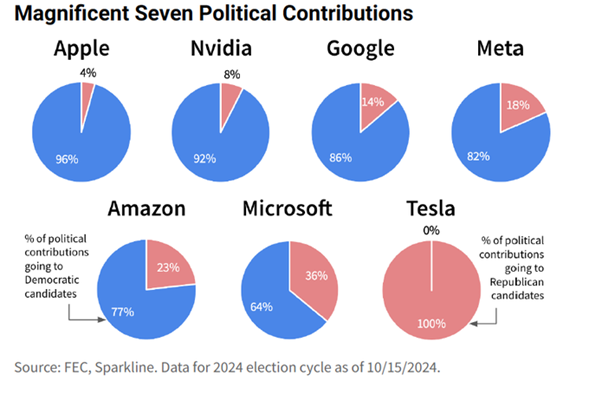

The United States’ tech giants have shown considerable generosity during the U.S. presidential campaign.

The chart below displays the percentage breakdown of donations made by each member of the Magnificent 7 to the two parties: Democrats in blue and Republicans in red.

It’s clear that Kamala Harris and the Democrats receive overwhelming support from the leading U.S. tech companies, with one exception. Can you spot the outlier?

Source: Meb Faber on X

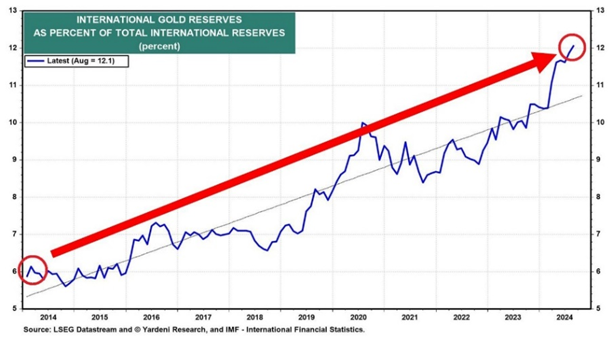

The Share of Gold in International Reserves Continues to Rise

Global gold reserves now account for 12% of total international reserves in 2024, the highest level since the 1990s. This share has doubled over the past decade.

Gold has also surpassed the euro as the second most held reserve asset by central banks.

Source: Global Markets Investor

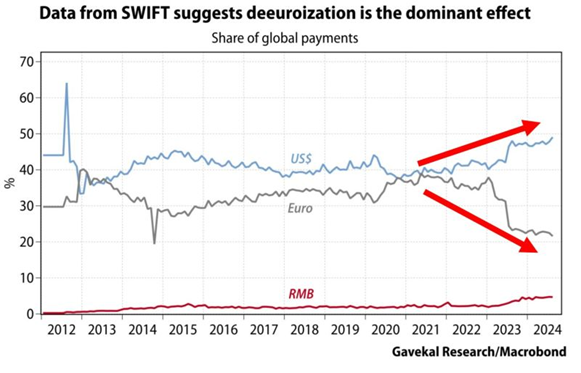

De-Euroisation Rather Than De-Dollarisation?

Chinese President Xi Jinping says that BRICS must promote a new financial system, stating:

“There is an urgent need to reform the international financial architecture, and BRICS must play a leading role in promoting a new system that better reflects the profound changes in the international economic balance of power."

Is the global reserve currency status of the US dollar under threat?

The fact remains that the share of the US dollar in global payments rose to 49% in 2024, its highest level since 2012. It was 40% at the start of 2022. Meanwhile, the euro's share has collapsed to 21%. The fall of the US dollar does not seem so imminent.

Source: Global Markets Investor, Gavekal

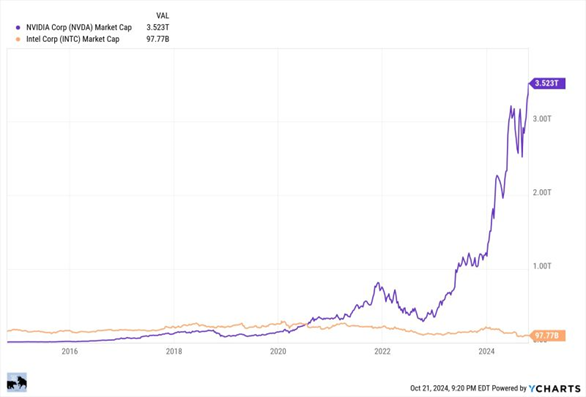

Nvidia’s Market Cap Is Now 36 Times That of Intel

Nvidia's (NASDAQ:NVDA) market capitalization is now close to $3.5 trillion, while Intel’s (NASDAQ:INTC) is under $100 billion. Just 10 years ago, Intel was 16 times larger than Nvidia.

Source: Ycharts

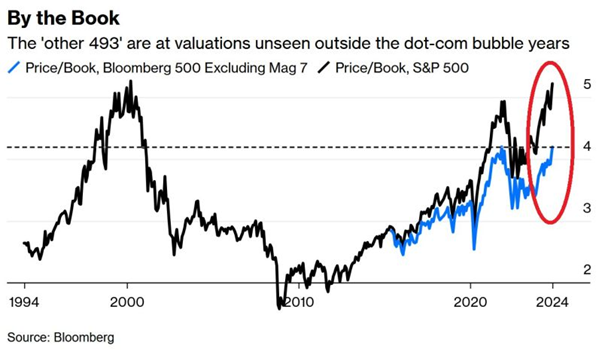

The S&P 500 Price-To-Book Ratio Reaches Levels Seen at the Dot-Com Bubble Peak

The price-to-book ratio of the S&P 500 currently stands at 5.2x, the highest on record, and similar to the level reached at the height of the Dot-Com bubble in 2000.

Excluding the Magnificent 7, the price-to-book ratio is 4.2, which remains relatively close to historic highs.

Source: Bloomberg