The Markets are waiting now to know Trump's nominee to take Janet Yellen office as a new Fed's Chairman but what could Trump's choice lead to?

Trump is planning for replacing The Fed's Chief Yellen who is to end her term next February and he said that he is to announce his nomination by this Friday.

It has already become obvious to the markets that Trump can find his way to intersect into the monetary policy too, after receiving earlier last September The Fed's vice president Stanley Fisher's resignation letter.

Now the Turn come on The Fed's Chief Yellen who will end her term next February and the current strongest candidate for taking her place is The Republican Jerome H. Powell who has a strong experience in the financial markets and has been a Fed governor since 2012.

While US is now closer than before to reach a Tax overhaul deal and the financial policy is in need to go in tandem with the monetary policy to not erode the Political and Financial efforts which have been exerted to pass the budget blueprint last week.

Powell who can be a suitable person to do that job is a supporter of Yellen's current gradual pace of tightening policy and it is important issue to not bother the financial markets which are waiting for more than that from the New candidate of Trump to support the risk appetite by imposing new easier leverage regulations.

As Trump announced more than once during his campaign and after taking the office that he wants easier financial regulations, as long as the credit crisis concerns diminished and the economic activity is running well right now.

Trump is not in favor of strong dollar and prefers weaker dollar for supporting the exporting activity and lowering the imports volume for raising the capacity utilization and the demand for jobs in US.

The current United States Secretary of the Treasury Steven Mnuchin has said it also clearly more than once that "a weaker currency is somewhat better for trade".

We should not ignore in the same time other candidates to be Yellen's successor such as;

The Stanford Economist John B. Taylor who has criticized the Fed’s monetary policy and he is preferred to the Vice President Mike Pence.

The National Economic Council director and President Donald Trump's top economic advisor, Gary Cohn who can be stronger than Powell in shifting the current leverage regulations toward easier stance and that can be read as an stimulating action hurting the greenback and supporting the inflation.

Gary Cohn has tried previously to revive the hopes of reflation by saying that he expects tax reforms to be passed this year denying his intention to resign over Trump’s reaction to riots in Charlottesville.

The markets are to focus ahead this week on The FOMC rate decision which is expected to come with no change keeping the fund rate at 1.25%, before the current widely expected interest rate hiking by 0.25% next December.

The current benign inflation pressure in US is expected to take the attention of market participants who want to know whether or not it is to tackle the Fed's gradual pace of tightening ahead.

After US PCE which is the Fed's Favorite inflation barometer has shown yesterday yearly rising in September by 1.6% as expected after increasing by 1.3% in August and its core figure excluding food and energy has shown increasing by 1.3% to be as the median forecast and as the same as August.

We have also by this weekend b God's will, the release of US labor report of October which is expected to show adding 300k of jobs, after losing 33k out of the farming sector on the hurricanes negative impact in September and also it is expected to show unchanged unemployment rate at 4.2%.

The average earning per hour is expected to show monthly rising by 0.3%, after soaring by 0.5% in September has signaled increasing of the wage inflationary pressure spurred the interest rate hiking expectations.

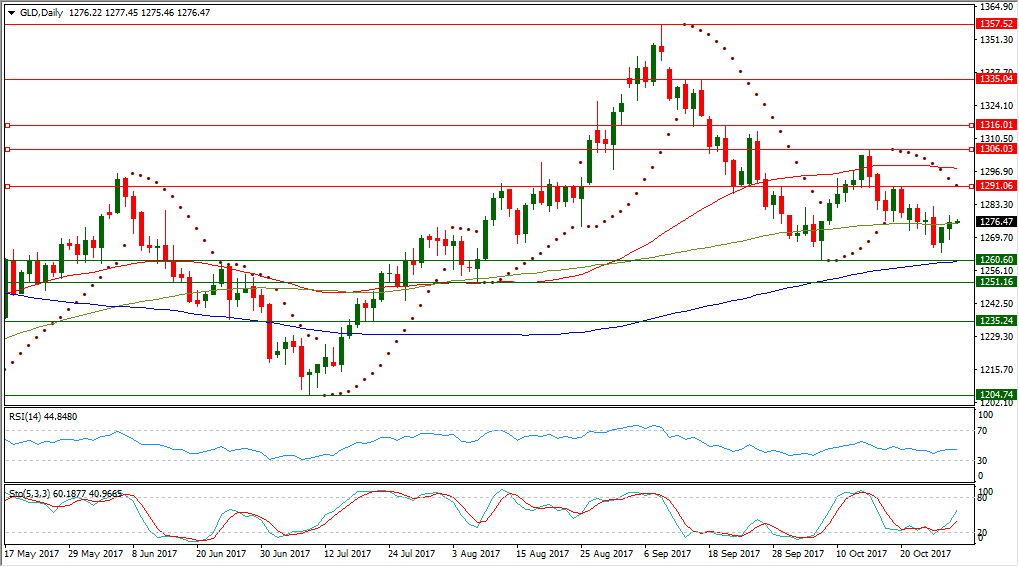

The Gold is now moving in intersection with its daily SMA100 below its daily SMA50 but above daily SMA200 which supports it over longer range.

The descending pressure on gold lost momentum by bouncing up last Friday from $1263.73 to keep its supporting level which has been formed on Oct. 11 at 1260.6 unbroken.

XAUUSD is now trading in its 9th consecutive day of being below its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today $1291.23.

XAUUSD daily RSI-14 is referring now to existence inside its neutral area reading 44.848.

XAUUSD daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in its neutral territory at 60.187 leading to the upside its signal line which is in the same area at 40.968.

Important levels: Daily SMA50 @ $1298.33, Daily SMA100 @ $1275.53 and Daily SMA200 @ $1260.03

S&R:

S1: $1260.60

S2: $1251.16

S3: $1235.24

R1: $1291.06

R2: $1306.03

R3: $1316.01