This article was written exclusively for Investing.com

On Tuesday of last week, Treasury Secretary Janet Yellen confessed on CNN that “I didn’t fully understand” when she said last year that the inflation that the economy was seeing was transitory.

Well, that’s just peachy.

It’s truly wonderful to hear that our Treasury Secretary, the former Chairperson of the Federal Reserve, when faced with rising prices following massive government spending and spiraling money growth, “didn’t fully understand” why that might be potentially problematic. Lots of people didn’t call that correctly.

But someone in her position(s) should be truly embarrassed about that. “Massive government spending financed by money creation at the central bank” is literally the recipe for inflation.

It is hard to believe at this point that investors have any confidence in central banks at all; and yet, this is one of the undergirding assumptions behind the idea that inflation will remain anchored and mean-reverting. I showed the chart below in last week’s article, indicating that blue-chip economists as a group expect inflation to mean-revert to the 2% range. Why? Well, because consumers have inflation expectations at 2%.

And why are they anchored at 2%, when everything is going to seed around us? Well, because consumers have confidence in the Federal Reserve.

And why do we think that consumers still have confidence in the Federal Reserve? Because investors are keeping long-term inflation expectations around 2.5%, which is where they have been for a long time.

Source: Bloomberg

Of course, the reason that the market price to clear long-term inflation risk is low is partly because the Fed worked hard to remove bonds from the market and still hasn’t put them back. Remember, one of the big reasons the Fed gave for buying bonds during crises, since the original QE back in November 2008, was the “portfolio balance channel:” the idea is that if the central bank takes safe assets away then investors will be forced to go into riskier assets. In this way, they substituted for ‘animal spirits’ which were supposedly lacking.

I don’t think that anyone believes animal spirits are lacking anymore, but let’s also not pretend that these long-term rates indicate that investors and more importantly consumers, who are not necessarily the same as investors, are confident in the long-run trajectory of inflation.

Maybe they are, but the assumption seems sporty to me. And circular. And, in any event, I’m not sure that consumers’ confidence in how the ship is being steered is enhanced by Yellen’s admission that she had no idea what the rudder was for.

Of course, we all make mistakes. And I may have made one by declaring that the March CPI was going to be “peak CPI” because of difficult comparisons with last year. CPI will be released on Friday this week and it is still likely the case that Core CPI will decline on a year/year basis (Consensus 5.9% from 6.2%) even though the month/month expectation of +0.5% (which would be 6% annualized) is not exactly soothing.

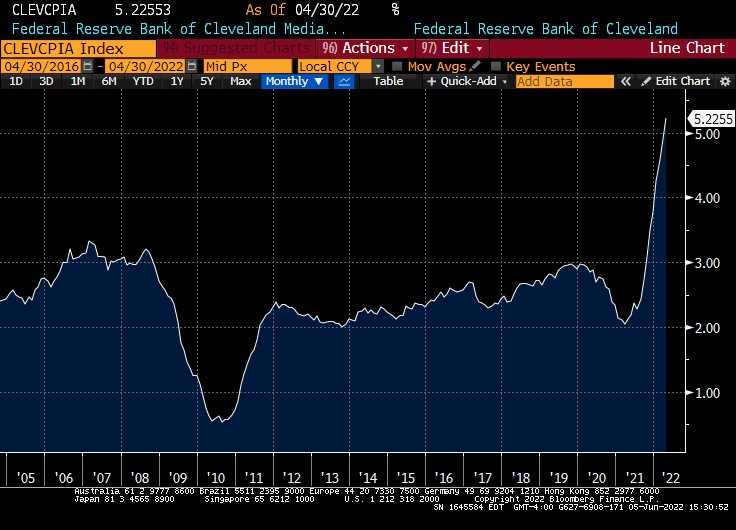

Median CPI, though, is very likely to rise from its current 5.23% y/y pace. And, thanks to the continued rise in gasoline prices it is even possible that headline CPI (Consensus: +0.7%, +8.3% y/y) could surprise higher and beat March’s 8.54% high.

The interbank market on Friday was exchanging that risk at a price implying 8.48%.

Source: Bloomberg

If the headline rate sets a new cycle high, you can bet that the torches and pitchforks will be out en masse, and I can’t think it will be a good thing for the equity market.

Taking a Step Back…

The Fed’s balance sheet has now officially started its run-off, as T-bills have started maturing for which the Fed will not roll into new issues. But the real game begins with the June 15th maturity of an old 3-year note. The Fed owns $15bln of $38bln that is maturing. The Treasury this week is issuing $44bln of a new 3-year note that settles on June 15th. So, if the Fed was rolling its holdings, there would be a $15bln bid and the Treasury would only need to find $29bln of non-official buyers. And, with $23bln of other notes maturing, that would only be $6bln of “new money” and no big deal. But if the Fed were to sit this one out, the Treasury will need to find $21bln in new money.

When the Fed says that they will allow bonds to mature, rather than selling them into the market, as a way of reducing its balance sheet, it sounds very soothing and easy. “Like watching paint dry,” as a former Fed Chairperson…I think her name was Yellen?...once described the process. And the maturing of bonds is certainly unexciting. The potentially exciting part is trying to find $21bln in new buyers every couple of weeks.

I don’t really expect that we will get fireworks at the auction this week. The Fed won’t bid for zero—they own $132bln of securities maturing in June, and they are only trimming $30bln per month from the portfolio, so their bid will likely just be a few billion less in each auction.

It’s the constant drumbeat of trying to find new money that will be the challenge. The last time around, it was more like watching paint cans explode. But this is the cost of quantitative tightening. If easing is good, then tightening is bad. It can’t be otherwise: if adding liquidity was good but removing it had no impact, then we could have a perpetual money machine by switching between QE and QT. That’s obviously nonsense.

Let’s just hope that fiscal policymakers “fully understand” this time.

***

Michael Ashton, sometimes known as The Inflation Guy, is the Managing Principal of Enduring Investments, LLC. He's a pioneer in inflation markets with a specialty in defending wealth against the assaults of economic inflation, which he discusses on his Cents and Sensibility podcast.