Central bank meetings in the eurozone, Australia and Malaysia pack the week ahead, with the focus firmly on whether the European Central Bank (ECB) will update its asset purchase programme. China and the US will also release factory gate inflation figures amid continued COVID-19 related supply disruptions in August. In the UK, July GDP growth and trade numbers are also eagerly anticipated.

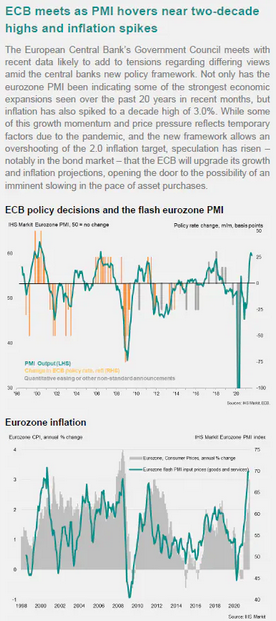

In line with the Fed, extraordinary support measures are being reviewed by the ECB with expectations that the net asset purchases under the Pandemic Emergency Purchase Programme (PEPP) may slow from this month. Indeed, flash IHS Markit Eurozone PMI data pointed to the economy growing at a rate little-changed from July's 15 year high midway into Q3, while price pressures remained steep by historical standards, supporting some paring back of these support measures. That said, the uncertainty caused by the recent COVID-19 Delta wave may encourage a more dovish stance.

The UK meanwhile finds a number of data releases including July GDP and trade figures. Facing significant supply chain and labour constraints in Q3, which were reported to have subdued output, the readings will be studied to assess whether the economy can sustain recent growth momentum.

In APAC, the RBA and BNM meet with no changes expected. China's August data will be the highlight instead after manufacturing sector conditions worsened for the first time since April 2020.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."