Worldwide PMIs, US payrolls, BoC, RBA and BNM policy meetings

Markets will inevitably be dominated by the Ukraine crisis, though from an economic data perspective worldwide manufacturing and services PMIs will be released, with the first trading week of March also bringing the latest US labour market report. Central bank meetings in Canada, Australia and Malaysia will also be in focus while key GDP data will be released across Switzerland, Australia, India and South Korea.

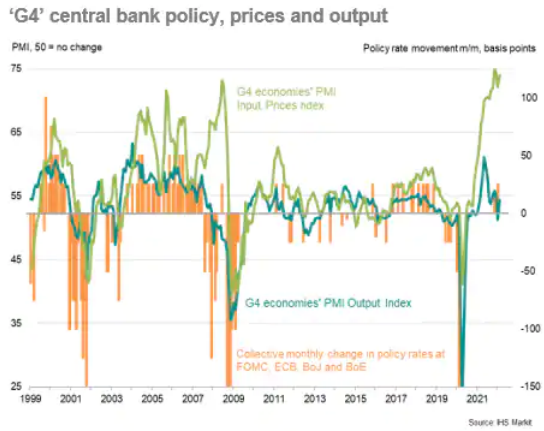

Following a week of heightened risk sentiment surrounding the Russia-Ukraine crisis, global markets will find the release of worldwide PMI figures in the coming week for both manufacturing and service sectors. Flash PMIs have so far preluded developed world growth rebounding in February, and the global figures will be in focus in the coming week for confirmation of this trend on a global scale. G4 economies had also seen price pressures persist according to flash PMIs, a trend that may only garner further attention as the latest geopolitical unrest pushes up commodity prices.

Central bank meetings will be in abundance at the start of March with the Bank of Canada (BoC) being the highlight in the coming week. Expectations are for the BoC to move ahead with raising interest rates from their March meeting to tackle rising inflation and amid a tight labour market.

On economic data, both inflation figures and GDP numbers will also be released around the world from the eurozone to Australia. Higher inflation figures may once again stoke concerns of more hawkish central bank pivots to avoid 'falling behind the curve'.

Central banks juggle rising prices with downside risks to the growth outlook

Final PMI numbers are published for manufacturing and services, which will allow central banks to assess economic trends prior to the Ukraine conflict. Flash PMI surveys for February showed economic growth rebounding from the worst of the Omicron economic impact, which turned out to be both modest and short-lived in the US and Europe. However, persistent supply constraints - both in terms of raw material supply issues and labour shortages - not only constricted manufacturing production but also led to further upward price pressures, which were in turn exacerbated by soaring energy prices.

These trends of recovering output and rising prices therefore put further pressures on major central banks to normalise monetary policy and manage inflation expectations lower.

However, inflation risks have now risen with the Ukraine crisis, while risks to outlook for demand, and broader economic growth, have meanwhile shifted to the downside due to the conflict.

The war has further lifted commodity prices, notably energy (but also likely food in Europe), while the supply disruption could worsen, especially if safety stock building ramps up again. Although the final PMI numbers released in the coming week were collected prior to Russia's invasion of Ukraine, the February PMIs will be important in assessing the Omicron impact outside of the US and Europe, especially in Asia, and in particular for any deterioration of global supply lines at a time of escalating conflict.

How the messaging from the central banks might be affected by the conflict in Ukraine will be important to watch, commencing with RBA, BoC and BNM meetings this week.

Key diary events

Monday 28 Feb

Indonesia, Taiwan Market Holiday

Japan Industrial Output and Retail Sales (Jan)

Thailand Manufacturing Production (Jan)

United Kingdom Nationwide House Price (Feb)

Switzerland GDP (Q4)

United Kingdom Mortgage Lending and Approvals (Jan)

India GDP (Q3)

Canada Producer Prices (Jan)

Tuesday 1 Mar

India, Indonesia, South Korea Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Feb)

China (Mainland) NBS Manufacturing PMI (Feb)

Australia RBA Cash Rate (Mar)

Indonesia Inflation (Feb)

Germany Retail Sales (Jan)

Germany CPI (Feb, prelim)

Canada GDP (Q4)

United States ISM Manufacturing PMI (Feb)

Wednesday 2 Mar

South Korea Industrial Output (Jan)

Australia Real GDP (Q4)

Germany Unemployment Feb)

Eurozone HICP (Feb, flash)

United States (ADP) National Employment (Feb)

Canada BoC Rate Decision (2 Mar)

United States Fed Beige Book

Thursday 3 Mar

Indonesia Market Holiday

Worldwide Services & Composite PMI * (Feb)

South Korea GDP (Q4)

Australia Trade Balance (Jan)

Malaysia Overnight Policy Rate (3 Mar)

Switzerland CPI (Feb)

Eurozone Producer Prices, Unemployment Rate (Jan)

United States Factory Orders (Jan)

United States ISM Non-manufacturing PMI (Feb)

Friday 4 Mar

South Korea CPI (Feb)

Japan Unemployment Rate (Jan)

Philippines CPI (Feb)

Thailand CPI (Feb)

Germany Trade Balance (Jan)

United Kingdom Markit/CIPS Construction PMI* (Feb)

Eurozone Retail Sales (Jan)

United States Non-Farm Payrolls, Unemployment (Feb)

What to watch

IHS Markit Manufacturing and Services PMIs

Worldwide manufacturing, services and composite PMIs will be released in the coming week for a look into how global economies had fared amid varying degrees of COVID-19 Omicron variant disruptions. Flash PMIs have indicated the developed world growth had broadly rebounded in February as the Omicron wave subsided. The same may not be said of Japan as the Omicron wave continued to rise into early February.

Meanwhile supply constraints remained widespread and price pressures persisted, according to flash PMIs. The eurozone notably saw prices rising at a record rate, a trend to similarly track for other economies, adding pressure for more aggressive central bank policy tightening around the world.

Recap January's PMI developments with our Monthly PMI Bulletinor refer to our release calendar for a full schedule of upcoming PMI updates.

North America: US labour market report, ISM PMIs, BoC meeting decision

February US non-farm payrolls, unemployment rate and average hourly earnings figures will be released on Friday to provide a first look into the US labour market conditions as the economy rebounds from the Omicron wave. Private sector employment was shown to have expanded strongly in February according to the latest IHS Markit Flash US Composite PMI. The current consensus points to a 381k non-farm payroll gain.

The Bank of Canada meanwhile is expected to respond to rising inflation and a tight labour market by raising interest rate by 25 basis points in the March meeting.

Europe: Eurozone, Germany inflation, retail sales, Germany trade data, Switzerland Q4 GDP

Inflation numbers from the eurozone and Germany will be released for January after PMI figures indicated persistent price pressures for the global economy.

Asia-Pacific: RBA, BNM meetings, Australia, India, South Korea GDP

The Reserve Bank of Australia and Bank Negara Malaysia hold policy meetings next week with no changes expected.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."