A flurry of central bank meetings take place across the globe in the coming week, encompassing Canada, the eurozone and Japan, and we get glimpses of Q3 growthviaGDP prints from the US and the eurozone. Several key countries will also release inflation readings.

The ECB monetary policy meeting will be in focus amid the elevated price pressures faced by the bloc. Greater recognition that inflation may be more persistent than expected has been made by policymakers, placing attention on how the ECB will position itself in the accompanying meeting statement and press conference. That said, the ECB is not expected to take any further action at least until the December meeting, when new projections are expected. Separately, the BoJ and BoC are likewise expected to remain on hold in the coming week but markets will be keen to digest any rhetoric surrounding the resilience of the recoveries and the transitory nature of inflationary pressures.

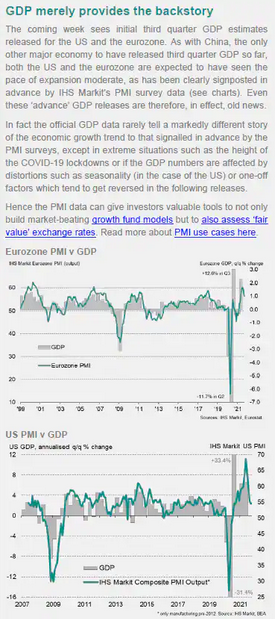

Meanwhile, Q3 growth momentum will be studied amidst the release of quarterly GDP from the US and the eurozone. Slower growth had been the case assessing the recent string of IHS Markit PMIs, showing that growth across both the US and the eurozone had remained strong but visibly weaker than Q2 thanks largely to the Delta variant and supply shocks.

Finally, ahead of the October PMI releases due at the start of November, we will see a series of official CPI figures across the likes of the eurozone and Australia, shedding insights into price conditions amid sustained supply and energy market woes.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."