August flash PMIs will offer updates on economic conditions at the crossroads of improving COVID-19 vaccination rates and the spread of the Delta variant. US economy watchers will also be kept especially busy with a string of official economic data, including US July core PCE figures and the second Q2 GDP estimate, as well as the Fed's Jackson Hole symposium on 26-28 August. Central bank watchers will also be eyeing the monetary policy meeting in South Korea.

Fed watchers' attention turns to the Jackson Hole symposium after the minutes of the FOMC July rattled the markets with policymakers further clearing the path to tapering. The flash PMI and core CPI releases will add further colour to the Fed's taper path. Weak readings could dispel some of the taper concerns, especially if the PMI shows rising virus case numbers via the Delta variant hitting the economy again, but solid readings could add to the unease in the market about a sooner than previously anticipated taper.

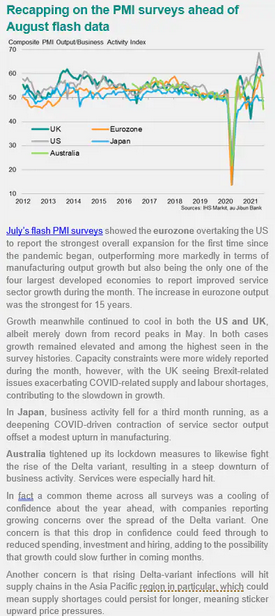

In Europe, growth cooled in July according to the PMIs after especially strong second quarters, so the August data will be important in assessing the extent to which these rebounds are being sustained or if rising infection rates are further dampening activity, as well as the extent to which shortages and capacity constraints are driving up prices.

Over in Asia, Japan and Australia's flash PMIs will be assessed for the impact of a sustained spread of the COVID-19 Delta variant in August, with both countries continuing to struggle to contain COVID-19 outbreaks.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."