An action-packed week ahead promises an abundance of central bank meetings, including the US Fed FOMC, BoE and BoJ policy meetings, while flash September PMIs offer all-important fresh clues on economic conditions.

Given signs of stagflation gleaned from recent PMI and official data, positioning by central bankers in the week ahead will be crucial in guiding monetary policy expectations and market movements alike. Following the ECB's 'recalibration' of its asset purchases, the US Federal Reserve's September FOMC meeting is widely expected to give an update on the timing of its asset purchase tapering, but no significant changes are meanwhile expected from the BOE, BOJ and APAC central banks. In the main, policymakers are likely to be eager to seek more clarification on growth and inflation trajectories after the Delta wave fades, keeping all options open in the meantime.

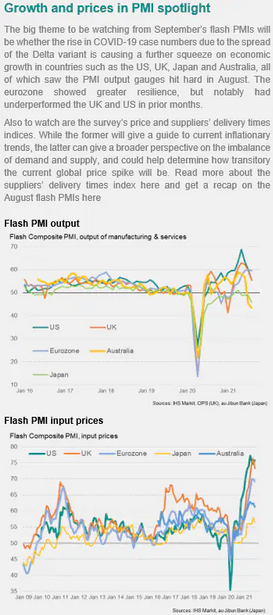

Some clarification may come from the flash PMIs, which will offer a first glimpse of economic conditions in September across the world's largest developed economies. The extent to which supply constraints continue to affect Western economies will be especially in focus in the manufacturing PMIs, providing a key bearing on inflationary pressures, just as the services PMIs will be studied for their reflections of how on-going COVID-19 Delta variant spreads have affected consumer demand into September.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."