The week ahead brings inflation data due for the EU, UK, Japan, Canada and Italy, plus China's third quarter GDP. Consumer sentiment data for the Eurozone and the UK, plus retail sales figures for the latter, will also be eagerly awaited to gauge the cost-of-living impact. US releases include industrial production and some key housing market data.

Mainland China data are set to take the spotlight with markets assessing the impact of changing COVID-19 restrictions. GDP data are set to show improved economic growth, with our forecasters pointing to a 3.5% year-on-year expansion in Q3. Retail sales and industrial production numbers will provide more timely high-frequency data on the evolving situation, and are also expected to show improved performance. However, any improvements in the recent past are overshadowed by concerns about the extent to which China's growth will remain subdued amid efforts to contain COVID-19, and these worries may dominate the week's PBoC policy meeting. Our economists are pencilling in just 3.3% GDP growth in 2022 and a 4.5% expansion in 2024.

Industrial production numbers will be the standout release for the US this week, with growth expected to moderate only slightly from August. But housing data will also be keenly eyed for the impact of soaring mortgage rates.

With the UK remaining a major area of investor concern, upcoming data releases will be eagerly assessed for recession risks. September's PMI signalled the fastest decline in UK output since January 2021 as the cost of living crisis continued to hit consumer spending. Inflation numbers - out Wednesday - are anticipated to remain close to 40-year highs, and retail sales numbers are likely to come under pressure. Consumer sentiment data will bring an end to the week for UK releases and are likewise set to remain sombre.

Inflation data for the Eurozone should confirm inflation at a 70-year peak of 10%, while economic sentiment is expected to remain in negative territory.

In Asia, industrial production and inflation numbers for Japan are out while the RBA meeting minutes will be poured over after their smaller than expected rate hike.

US manufacturing under the spotlight

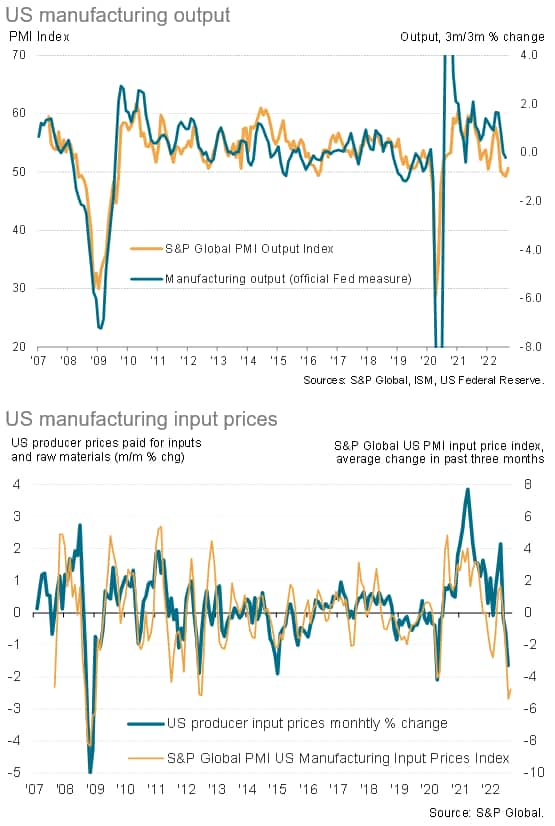

Industrial production data due out for the US are likely to show the manufacturing output trend continuing to deteriorate, according to S&P Global PMI and ISM survey data. This weakening trend is important as not only does it add to growing signals of slower economic growth both in the US and further afield, the weakening demand picture is contributing to lower inflationary pressures - in fact factory input costs are falling. This is in turn important as these lower costs should help bring consumer price inflation down.

Key diary events

Monday 17 October

Indonesia Balance of Trade (Sep)

Japan Industrial Production (Aug)

China FDI (Sep)

Italy Inflation Rate (Sep)

Canada BoC's Business Outlook Survey

United States Monthly Budget Statement (Sep)

New Zealand Inflation rate (Q3)

Tuesday 18 October

Australia RBA Meeting Minutes

China GDP Growth Rate (Q3), Industrial Production (Sep),

Retail Sales (Sep), Fixed Asset Investment (Sep)

Spain Balance of Trade (Aug)

Germany ZEW Economic Sentiment Index (Oct)

Italy Balance of Trade (Aug)

United States Industrial Production (Sep), NAHB Housing

Market Index (Oct)

Wednesday 19 October

Australia Westpac Leading Index (Sep)

China House Price Index (Sep)

United Kingdom Inflation Rate (Sep)

South Africa Inflation Rate (Sep)

Euro Area Inflation Rate (Sep)

United States MBA Mortgage Applications (Oct),

United States Housing Starts (Sep), Building Permits (Sep)

Canada Inflation Rate (Sep)

Thursday 20 October

Japan Trade Balance (Sep), Foreign Bond Investment (Oct)

Australia Unemployment Rate (Sep)

China PBoC Interest Rate Decision

Netherlands Consumer Confidence (Oct),

Netherlands Unemployment Rate (Sep)

Switzerland Balance of Trade (Sep)

France Business Confidence (Oct)

Indonesia Interest Rate Decision

Poland Employment Growth (Sep)

United States Jobless Claims (Oct),

US Philadelphia Fed Manufacturing Index (Oct)

New Zealand Balance of Trade (Sep)

Friday 21 October

United Kingdom Gfk Consumer Confidence (Oct),

United Kingdom Retail Sales (Sep)

Japan Inflation Rate (Sep)

Thailand Balance of Trade (Sep)

Canada Retail Sales (Aug)

Euro Area Consumer Confidence Flash (Oct)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

Americas: US industrial production, Canada inflation and retail sales

A number of key US data points will be released this week, notably including the industrial productions figures for September. PMIs in recent months have alluded to muted factory output performance, and markets are forecasting a 0.1% contraction in industrial production.

Canada's inflation and retail sales data will also be highly sought after, as economic woes continue to emerge in the form of weak employment numbers and a recession warning from the IMF. Retail sales fell 2.5% in July, but preliminary estimates suggest a 0.4% rebound is on the table. Inflation figures will also be watched for further signs of moderation.

Europe: EU sentiment and inflation, UK retail sales & inflation

With sentiment relatively weak across much of the global economy, latest EU and German consumer confidence figures are expected to remain subdued given persistent high inflation and growing economic gloom. In fact, the inflation figure - out Wednesday - will likely confirm a 10% rate of increase in September, the highest for 70 years. Outside the eurozone, UK data releases are expected to dominate headlines once again with inflation and retail sales figures likely to influence the already volatile market.

Asia-Pacific: China GDP, Industrial production, retail sales, Japan industrial production and inflation

A number of releases for mainland China will be eagerly anticipated to assess the impact of the region's zero-COVID policy and the associated restrictions. On the whole, restrictions have retreated over the third quarter, but the government is clearly retaining its strict approach. After moderating to 0.4% (YoY) in Q2 our forecasts point to a 3.5% expansion in GDP for Q3 (YoY). Industrial production and retail sales data are likely to signal growth remaining firmly in positive territory. The PBoC will also meet during the week to make a decision on interest rates while Indonesia's MPC will also convene.

Japan will also see industrial figures come to light, where the final release isn't expected to deviate to far from the previous estimate of 2.0% (YoY).

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."