Fed FOMC, BoE, BoJ, BI, CBC meetings, US and China production data

The week ahead will see an abundance of central bank meetings across the US, UK, Japan, Indonesia and Taiwan. Retail sales and industrial production data will also be due from the US and China. The UK meanwhile releases employment data for February while Japan and the eurozone issue inflation figures.

Central bankers will be making their moves to tackle inflation in the coming week starting with the US Fed, which is expected to kickstart its rate hike cycle. While a 25-basis point hike had been well-telegraphed, the path forward remains less certain amid Russia's invasion of Ukraine. The latest IHS Markit Investment Manager Index revealed that US equity investor risk appetite had slumped on the back of geopolitical and macroeconomic concerns, while many retained the view that more tightening than currently signalled may be on the way due to a protracted supply chain crisis. As such, the Fed's projections and stance will be closely studied in the coming week.

Meanwhile the BoE and CBC are expected to join the Fed in lifting policy rates in the coming week. A rate hike in March will mark the third consecutive meeting in which the UK central bank raises rates, a move to tackle inflation with January consumer price inflation now at the highest in 30 years. Taiwan CBC is likewise set to commence hiking of rates but could keep it gradual amid external uncertainties. In all cases, however, policymaker reaction to the Ukraine war remains a key element of uncertainty.

Over in the data docket, the US and China both release retail sales and industrial production data for February. Japan, Canada and final eurozone inflation data will also be closely watched for the pre-Ukraine crisis picture on prices. Eurozone industrial production and UK labour market data are also key diary events.

Central banks meet amid high uncertainty

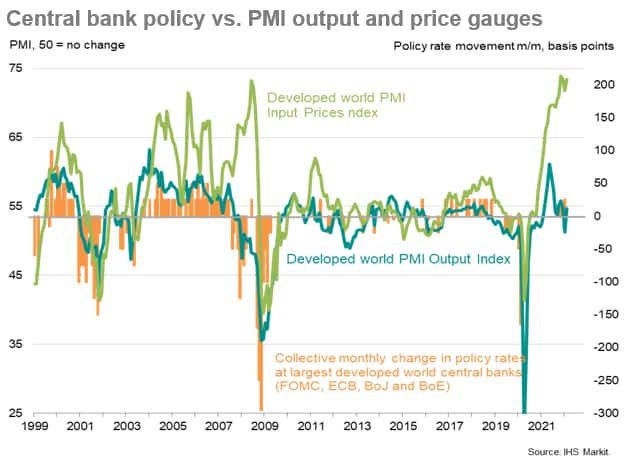

Economic forecasts of growth and inflation have been largely made redundant by the invasion of Ukraine, posing downside risks to growth while adding to inflationary pressures. Growth is invariably being affected by sanctions as well as the likely hit to business confidence from the war.

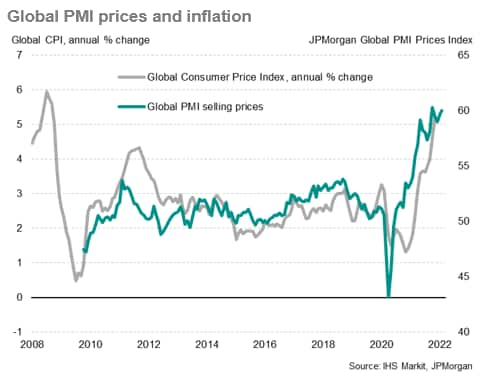

However, European supply chains are also again being disrupted adding to downside growth risks but also exacerbating inflationary pressures, the latter already hit by soaring energy prices. PMI data showed that, although some supply chain disruptions were starting to ease in February, rising energy and staff costs had pushed prices higher at a rate approaching prior record highs. Envy not, therefore, the central banks that meet in the coming week to determine the correct path for monetary policy in this environment.

Global PMI prices and inflation

Central bank policy vs. PMI output and price gauges

Key diary events

Monday 14 Mar

India CPI and WPI Inflation (Feb)

Tuesday 15 Mar

Australia RBA Meeting Minutes (Mar)

South Korea Export Growth Revised (Feb)

Australia Home Price Index (Q4)

China (Mainland) Retail Sales, Industrial Output, Urban Investment (Feb)

Indonesia Trade Balance (Feb)

United Kingdom Labour Market Report (Feb)

Germany ZEW Economic Sentiment (Mar)

Eurozone Industrial Production (Jan)

United States PPI Final Demand (Feb)

Canada Manufacturing Sales (Jan)

Wednesday 16 Mar

New Zealand Current Account (Q4)

Japan Trade Balance (Feb)

United States Retail Sales (Feb)

Canada CPI Inflation (Feb)

Canada Wholesale Trade (Jan)

United States Business Inventories (Jan)

United States NAHB Housing Market Index (Mar)

United States Fed Funds Target (NYSE:TGT) Rate (16 Mar)

Thursday 17 Mar

Japan Machinery Orders (Jan)

Australia Employment and Unemployment Rate (Feb)

Singapore Non-Oil Exports (Feb)

Taiwan Discount Rate (Q1)

Eurozone HICP (Feb, final)

United Kingdom BOE Bank Rate (Mar)

United States Housing Starts (Feb)

United States Initial Jobless Claims

United States Philly Fed Business Index (Mar)

United States Industrial Production (Feb)

United States Capacity Utilization (Feb)

Indonesia 7-Day Reverse Repo (Mar)

Friday 18 Mar

India Market Holiday

New Zealand GDP Prod Based (Q4)

Japan CPI (Feb)

Japan BOJ Rate Decision (18 Mar)

Malaysia Trade (Feb)

Canada Retail Sales (Jan)

United States Existing Home Sales (Feb)

What to watch

North America: Fed FOMC meeting, US retail sales, industrial production, Canada inflation data

The US Federal Open Market Committee (FOMC) meeting will be held 15-16 March with the meeting statement, economic projections and Fed chair Powell's presser to follow. The Fed is widely expected to kickstart their rate hike cycle in the March meeting, commencing with a 25 basis points (bps) increase, despite the uncertainties caused by the Ukraine invasion. This had been well communicated by Fed chair Powell in his latest testimony to Congress alongside signals that the FOMC will soon announce plans for shrinking the Fed's balance sheet. The Fed's updated dot plot and views towards the balance sheet will be closely scrutinised by the market for future policy clues.

February US retail sales and industrial production figures will also be due, with growth of both expected to slow month-on-month according to consensus.

Europe: BoE meeting, UK employment figures, German ZEW survey, eurozone industrial production, final CPI data

The Bank of England convenes for the second time this year and is expected to deliver their third consecutive 25 bps hike. At least one more hike is expected in 2022, likely at the May meeting. The BoE's rate hike cycle has been one aimed at taming above-target inflation with February PMI data backing the impetus, seeing solid output growth and accelerating price inflation.

Asia-Pacific: BoJ, BI, CBC meetings, China retail sales, industrial output, Japan CPI

APAC central banks across Japan, Indonesia and Taiwan also updates their monetary policy settings in the coming week, with the Taiwan CBC expected to commence hiking rates in the March meeting to reflect the US monetary policy tightening and higher local import costs, though keeping the path of rate increases gradual amid external uncertainties.

China's data barrage will be due Tuesday with industrial output growth set to slow according to consensus, though stabilisation had earlier been seen for China's manufacturing production in February.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."