Central bank meetings will be held in Canada, Japan, New Zealand and South Korea in the coming week, which come alongside important inflation updates in the US, UK and the eurozone. We will also see early Q2 GDP readings from China and Singapore, in addition to a barrage of June data releases out of China and the US, notably including retail sales and industrial production.

The week's central bank meetings are expected to bring few surprises, but come at a time of rising uncertainty about renewed COVID-19 lockdowns and the scope for inflation to prove less 'transitory' than might have been anticipated. Although Asia-Pacific central banks such as the RBNZ and BOK have signalled increasing inclinations to raise interest rates in the medium-term, rising COVID-19 cases have led to renewed lockdown measures in many countries and therefore bring a new element of uncertainty to the global outlook. Sharp reductions in PMI survey gauges in many economies, especially in Asia, meant that - although the global economy continued to expand at a strong pace in June - regional divergences have hit record highs and supply shortages have reached unprecedented levels.

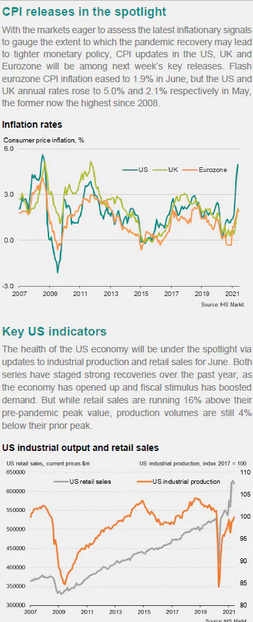

News of an ongoing supply shock brings the June inflation data into the spotlight for many economies including the US, the UK and the eurozone.

China's Q2 GDP reading will also be closely scrutinised for the state of expansion in the second quarter, and in particular the extent to which new COVID-19 outbreaks may have subdued growth.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."