Worldwide manufacturing and services PMIs will be released in the coming week for a detailed look into economic conditions into the start of Q4. Central bank meetings will meanwhile be in abundance including in the US, UK and Australia, while October's US nonfarm payrolls round off the week.

A packed week is lined up ahead, kickstarted by the worldwide manufacturing and services PMIs. These have been front-run by worrying signs of persistent supply constraints from the flash figures. However, while supply issues hit manufacturing, services growth was widely reported to have accelerated amid the waning COVID-19 Delta wave impact. Sector PMI data will also be due for a finer breakdown of sector performance in October, with autos under particular scrutiny after output collapsed in September.

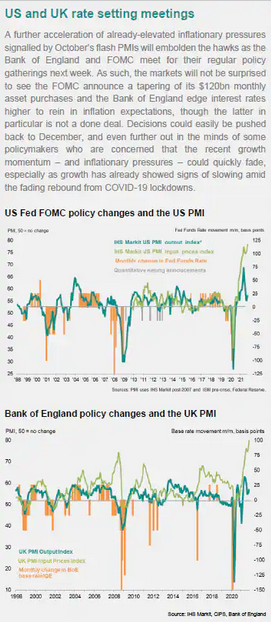

Central bank meetings will likewise fill the week. The highlight is expected to be the UK BoE meeting where expectations of a 15-basis points hike has been priced in by the market. Recent IHS Markit/CIPS UK PMI continued to point to record inflationary pressures, and accelerating growth, adding to signs that the BoE could be the first G-7 central bank to hike rates, though not all policymakers think the timing is right given uncertainties over the recovery path.

Finally, alongside tapering announcements expected at the FOMC meeting, US watchers will be scrutinising the October nonfarm payrolls after last month's disappointing jobs count. Wage growth will also be eyed for second-round inflationary pressures.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."