Q2 GDP updates will be due for the UK, Russia, and Singapore in the coming week, alongside a series of inflation data for the US, India, China, Germany, France, and Italy. At the same time, India and the UK will release industrial production data while Thailand will hold a central bank meeting.

Attention turns to the UK, Russia, and Singapore where Q2 GDP figures will shed light on economic performance in the midst of geopolitical uncertainty and surging inflation. Last week saw the release of worldwide manufacturing, services, and construction PMIs which pointed to a general slowdown in growth. For the UK, output rose at a softer pace while business activity increased at a quicker rate in Russia. Singapore, meanwhile, registered a marked increase in output amid stronger client demand. Nevertheless, steep price pressures were once again evident. Besides ongoing inflationary pressures, July PMI data alluded to persisting supply constraints and difficulties sourcing material inputs. China's zero-COVID policy still poses some concern on the supply front, however.

Inflation figures will flow thick and fast this week with Italy, Germany, and the US seeing releases on Wednesday. Rates of inflation are expected to remain high with the US core inflation figure forecasted to come in around the 6.1% mark, while latest figures for Italy (Jun: 8%) and Germany (Jun: 7.6%) are expected to remain high and similar to those seen in June. Elsewhere, China has seen relatively tame rates of inflation, albeit the highest for two years. Meanwhile, India has seen inflation rates surge, though rates of increase are starting to subside, according to latest PMI data.

The Bank of Thailand will hold a central bank meeting this week, though the interest rate is expected to remain around the 0.5% mark.

Finally, sentiment data for the US will reveal how household perceptions have changed over the month. The index has remained low in light of scorching inflation, geopolitical uncertainty, and concerns over the macroeconomic environment.

Rising interest rates, a little too late?

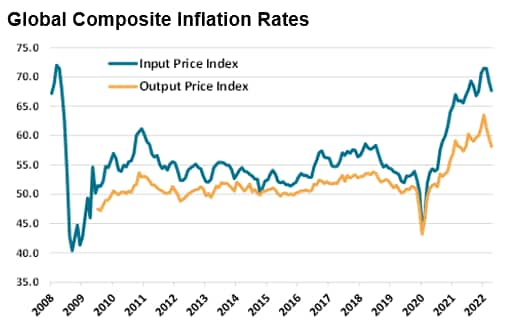

Latest PMI data signalled easing inflation rates on average across the global economy. Cost pressures were at a five-month low in July, while selling price inflation eased to a ten-month low. Improvements across the supply side, thanks to the alleviation of pandemic restrictions in China, and notable falls in client appetite resulted in the waning upward pressure on cost burdens and charges for the second month running. Although remaining historically elevated, the PMI data suggest that price pressures have already peaked.

Despite cooling price pressures according to the PMI, breaking the precedent, the Bank of England have raised interest rates by a further 50 basis points to 1.75%, signalling a sixth consecutive rise in rates since last December. Furthermore, more rate hikes are also projected at the Fed.

With global economic growth slowing sharply in July (led by developed nations), central banks once again find themselves in difficulty. It will be interesting to see if central banks adhere to a further tightening of monetary policy which they seem to be committed to. While it is necessary to ensure that the economy does not overheat as it had been in the wake of the COVID-19 recovery, it also becomes important to not seriously curtail demand and growth. That said, recessionary fears have recently been amplified while at the same time, rate hikes and rapid inflationary pressures continue, causing some concern over the future economic outlook.

Key diary events

Japan Bank Lending (Jul), Eco Watcher Survey Current (Jul)

Switzerland Unemployment rate (Jul)

Greece Inflation Rate (Jul)

Czech Republic Unemployment Rate (Jul)

Brazil BCB Focus Market Readout

New Zealand Retail Card Spending (Jul)

Tuesday 9 August

Singapore market holiday

United Kingdom BRC Retail Sale Monitor (Jul)

Australia Westpac Consumer Confidence Index (Aug)

Philippines Unemployment Rate (Jun), Balance of Trade (Jun), GDP Growth Rate (Q2)

Denmark Balance of Trade (Jun)

Hungary Inflation Rate (Jul)

Portugal Balance of Trade (Jun)

Brazil Inflation Rate (Jun), BCB Copom Meeting Minutes (Jul)

Wednesday 10 August

South Korea Unemployment Rate (Jul)

Japan PPI (Jul)

China Inflation Rate (Jul)

Germany Inflation Rate (Jul)

Italy Inflation Rate (Jul)

Brazil Retail Sales (Jun)

Thailand Interest Rate Decision

United States Core Inflation Rate (Jul), Monthly Budget Statement (Jul), Wholesale Inventories (Jun) MBA Mortgage Applications (Aug)

Russia Inflation Rate (Jul)

Thursday 11 August

Australia Consumer Inflation Expectations (Aug)

China New Yuan Loans (Jul)

France IEA Oil Market Report

Mexico Industrial Production (Jun)

United States PPI (Jun), Continuing Jobless Claims (Jul), Initial Jobless Claims (Aug)

Singapore GDP (Q2), Current Account (Q2)

Brazil Business Confidence (Aug)

Friday 12 August

Japan Foreign Bond Investment (Aug)

France Unemployment Rate (Q2), Inflation Rate (Jul)

United Kingdom GDP Growth Rate (Q2), Balance of Trade (Jun), Construction Output (Jun), Goods Trade Balance (Jun), Industrial Production (Jun), NIESR Monthly GDP Tracker (Jul)

Spain Inflation Rate (Jul)

Italy Balance of Trade (Jun)

Euro Area Industrial Production (Jun)

India Inflation Rate (Jul), Industrial Production (Jun),

United States Michigan Consumer Sentiment Prel (Aug)

Russia GDP Growth Rate (Q2)

What to watch

Industrial production data for the Eurozone and UK

June industrial production data will be released for the Eurozone and the UK this week. This follows last week's manufacturing PMIs which pointed to a contraction in manufacturing production in both the UK and the Euro area. The latest releases have signalled the destructive impact that client uncertainty, weak demand and inflation has had on domestic sales. Though, it was also clear exports have also taken a hit.

Americas: US Inflation, MBA mortgage applications, and sentiment data

Last week saw some key releases for the US, namely the US non-farm data, US construction spending, PMIs, ISM surveys, and balance of trade data. This week, US inflation data will reveal how prices have fared as the fed tightens their monetary policy.

Close followers of the housing market will keep an eye on MBA mortgage applications which have started to increase in recent weeks while sentiment data will also be widely watched this week.

Europe: Inflation data for France, Italy, Germany, and Spain

Consumer price inflation rates will be released for a large number of European countries this week including France, Italy, Germany, and Spain. July's PMI survey releases indicated a general slowdown in input costs, though still suggest that we may continue finding elevated CPI readings in the upcoming release.

The Eurozone has been especially hard hit by rising costs, and in recent months inflation rates have been well above target. Yet, the ECB has been reluctant to tighten monetary policy rates in fears of plunging the economy into a recession, which looks more and more imminent.

Asia-Pacific: Thailand interest rate decision, India and China Inflation, and Australia sentiment

The Central Bank of Thailand will meet mid-week to discuss their monetary policy, although its widely expected that interest rates will remain unchanged. Meanwhile, after last month's interest rate decision, India will see inflation and industrial production figures come to light. The S&P Global India manufacturing PMI suggested strong production growth and waning inflationary pressures.

Disclaimer: "The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting, or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty, or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions, or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trademark of Markit Group Limited."