Worldwide services PMI will be due in the coming week for a detailed look into the impact of recent developments from the Ukraine war and the rising cost of living upon the service sector in March. Meanwhile the March Fed FOMC minutes release will be the highlight from amongst the central banks while the RBA and RBI also convene. A string of inflation data will also be expected from APAC economies next week.

The market remains coalesced around two key themes, the Ukraine war and tightening monetary policy, though sentiment improved this week as investors calmed themselves around the idea of rising interest rates. Peace talks between Russia and Ukraine also helped to soothe some frayed nerves. Although developments around the Ukraine war remain highly uncertain, the impact on inflation and thereby central bank policy will continue to be studied next week, most notably via the March Fed minutes and services PMI releases.

While flash PMI surveys pointed to the easing of COVID-19 restrictions cushioning the blow from rising costs on business activity for developed economies in March, the implication of these burgeoning price pressures upon consumers remains a delicate issue. Fed minutes from the March FOMC minutes will therefore offer insights into the Fed's resolve towards taming inflation back towards the approximate 2% target. As it is, the RBI may be one to move ahead with raising interest rates to tackle above-target inflation at their April meeting next week. The RBA, on the other hand, is expected to stay patient and hike rates only later in the year.

Given the focus on prices, particularly on the back of both the Ukraine war and China lockdowns, March CPI data across a number of APAC economies will also be in focus.

US sees higher inflation and stronger growth, for now

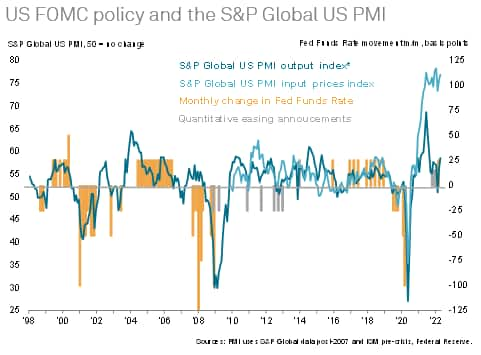

Traders will be eagerly awaiting the minutes from the latest FOMC meeting to assess the likely path of future rate hikes. The Fed hiked by 25 basis points at the last meeting, raising interest rates for the first time since 2018 to take the Funds target range to 0.25-0.50%, with a further six hikes signalled during 2022. However, an even more aggressive near-term hike path is being increasingly viewed as likely by the markets, reflecting the need to rein in inflation expectations.

The case for more aggressive rate hikes was strengthened by the latest survey data. S&P Global's US PMI showed US businesses not only reporting input cost inflation pressures to have persisted at a near-record rate in March, according to the early 'flash' estimate, but also stronger output and demand growth. New orders growth surged to the highest rate since last June, reflecting the reopening of the economy from COVID-19 containment measures.

Although the survey also reflected a pull-back in firms' expectations about growth in year ahead, the overall level of confidence remained well above the pre-pandemic average, suggesting that - contrary to some bond market indicators - companies are not anticipating a downturn just yet. However, we remain keen to evaluate the extent to which the rebound from the pandemic could get blown off course by the headwinds of the Ukraine war, soaring prices, and of course higher borrowing costs.

Key diary events

Monday 4 Apr

China, Taiwan Market Holiday

India S&P Global Manufacturing PMI* (Mar)

Germany Trade Balance (Feb)

Eurozone Sentix Index (Apr)

Eurozone Producer Prices (Feb)

Canada Building Permits (Feb)

United States Factory Orders (Feb)

Tuesday 5 Apr

China, Taiwan Market Holiday

Worldwide Services & Composite PMI* (Mar)

South Korea CPI Growth (Mar)

Japan All Household Spending (Feb)

Philippines CPI (Mar)

Thailand CPI (Mar)

Australia RBA Cash Rate (Apr)

Norway Housing Prices (Mar)

United States International Trade $ (Feb)

Canada Trade Balance C$ (Feb)

United States ISM Non-manufacturing PMI (Mar)

Wednesday 6 Apr

Hong Kong S&P Global PMI* (Mar)

China (Mainland) Caixin Services PMI* (Mar)

India Repo and Reverse Repo Rate (8 Apr)

India S&P Global Services PMI* (Mar)

Germany Industrial Orders (Feb)

United Kingdom Markit/CIPS Construction PMI (Mar)

Eurozone Retail Sales (Feb)

United States FOMC Meeting Minutes (Mar)

Thursday 7 Apr

Australia Trade Balance (Feb)

Switzerland Unemployment Rate (Mar)

Germany Industrial Output (Feb)

United Kingdom Halifax House Prices* (Mar)

Norway Manufacturing Output (Feb)

United States Initial Jobless Claims

Friday 8 Apr

Japan Current Account (Feb)

Norway GDP (Feb)

Taiwan CPI (Mar)

Taiwan Trade Balance (Mar)

Canada Unemployment Rate (Mar)

United States Wholesale Inventories (Feb)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

Worldwide services PMI surveys for March

Services PMI data will follow the release of manufacturing PMI figures in the coming week. Preliminary PMI survey data for March showed only a modest impact from the Ukraine war on major developed economies' growth, as the boost from easing of COVID-19 containment measures offset rising cost pressures and supply chain constraints, aggravated by the Ukraine crisis. After digesting the manufacturing figures for insights into the state of ongoing supply constraints and the corresponding implication for prices and output in March, it will be pertinent to study the passthrough of any cost pressures to services next week. This is especially important against the backdrop of more hawkish central bank stances adopted around the world, which may provide additional headwinds for businesses already concerned with rising business costs.

North America: Fed FOMC minutes, February US factory orders, trade data, Canada March employment figures

Fed FOMC minutes from the March meeting will be released next Wednesday. While a 50-basis points hike in May is largely viewed to be a certainty by the market, the minutes will still be scrutinised for details on the Fed's resolution towards keeping inflation to approximately 2%, in addition to their balance-sheet shrinking plans.

Europe: Eurozone producer prices, retail sales, Germany trade and industrial output data

Eurozone February producer prices and retail sales data will be due in the coming week while Germany trade and industrial orders and output figures are also released. That said, the focus may be on the final PMI data for the latest March updates.

Asia-Pacific: RBA, RBI meetings, South Korea, Philippines, Thailand and Taiwan CPI data

The Reserve Bank of Australia (RBA) and Reserve Bank of India (RBI) meets next week with only the latter expected to raise rates in April. This follows elevated inflation in India with consumer prices crossing the central bank's upper tolerance of 6% at the start of 2022. While no hike is expected in Australia just yet, bets are growing that increased fiscal stimulus will add to pressure on the RBA to tighten policy.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."