European stocks were mixed in early trade – the DAX and Euro Stoxx 50 rose again while the FTSE 100 fell, with Shell (LON:RDSa) and BP (LON:BP) leading the decline as lower oil prices dragged. Shares in Metro Bank (LON:MTRO) tumbled 19% as private equity group Carlyle ended talks over a potential takeover. Housebuilders rose after a positive update from Crest Nicholson (LON:CRST). National Grid (LON:NG) shares were steady despite an upgrade to its profit outlook as higher energy prices boosted the bottom line.

Royal Mail (LON:RMG) shares rallied 5% on a huge surge in parcel volumes and return to profits in the first half of its financial year. The pandemic has forever shifted consumer habits, and Royal Mail has benefited as we do more shopping online. Positive restructuring and largely getting the union monkey off its back have helped, too. Shares recovered 60% in the last 12 months, though the stock is about a fifth off its June high. For the full year, management expect £500m in adjusted operating profit. Operating profits in the first half rose to £311m from a loss of £20m a year before. Parcel volumes are up a third on two years ago, though with a tough comparison on last year UK volumes fell 4%. However, GLS volumes were up 8%. The company also said it plans to return £400 million to shareholders via a £200 million share buyback commencing immediately and £200 million special dividend.

US stocks fell but remain anchored to the 4,700 area with futures back up there this morning. Apple (NASDAQ:AAPL) was well bid, as was Tesla (NASDAQ:TSLA), and tech supported the broader market as energy and banks fell. Bond yields fell, with United States 10s back under 1.6%, helping Gold recover some ground at a high this morning of $1,870 from a low yesterday of $1,849. Philly Fed manufacturing, weekly unemployment claims and a few Fed speakers to look forward to later in the session.

Oil plumbed a 6-week low despite a larger-than-expected draw on US inventories as the bearish sentiment remains in force amid warnings of oversupply, whilst the White House has requested several nations release barrels from their strategic reserves to lower prices. Joe Biden has also engaged the Federal Trade Commission to investigate US oil majors over possible illegal behaviour that is driving up prices. Of course, he would never look to his own damaging energy policies...Biden knows high pump prices hurts him but he’s so in hock to the green mafia that he can’t possibly imagine that the simplest way to lower gasoline costs would be to increase US output. Releasing reserves is not a long-term solution – signs of oversupply are already there. Rising covid cases and concerns over lockdowns in Europe may have had some small impact on the demand side.

WTI trades under $77 to test the 38.2% retracement area. Looking at a potential visit of the $73 area. Our bearish MACD crossover at the end of Oct was a great sell signal, as it has often proved lately.

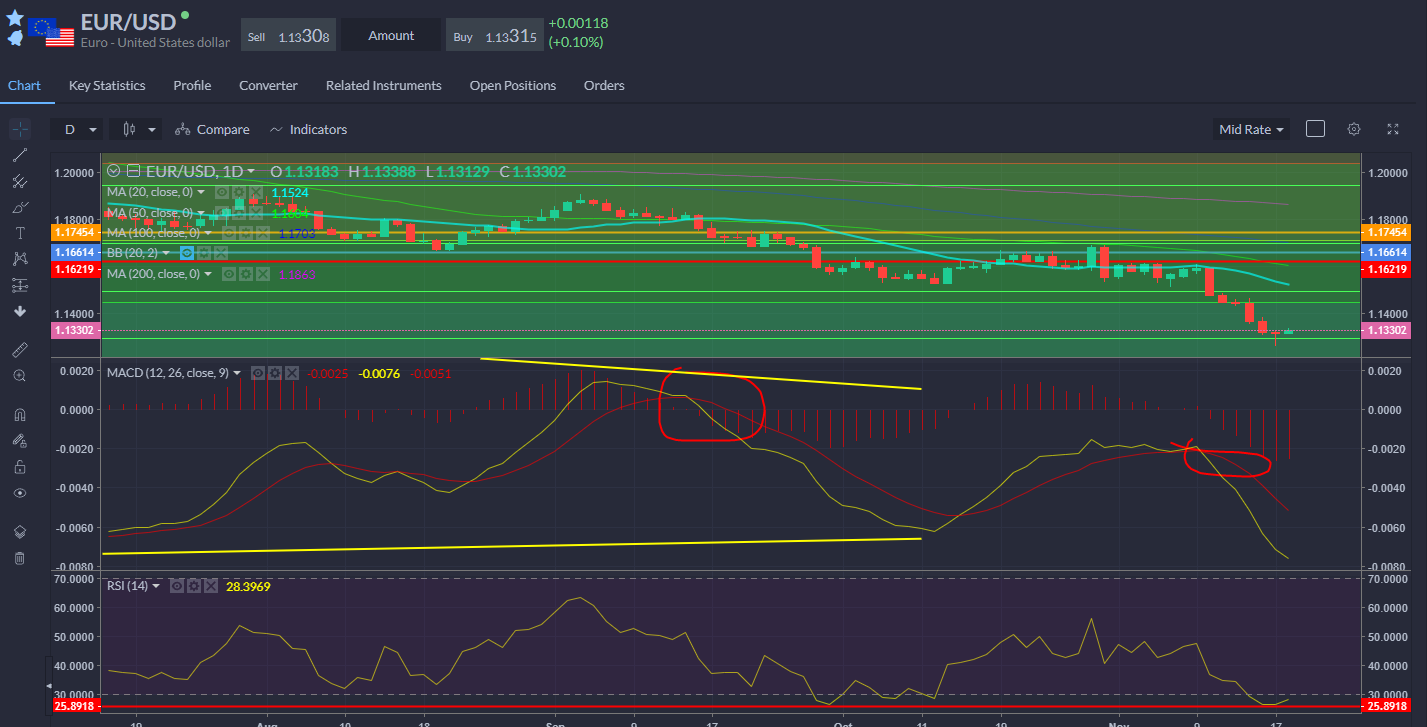

Dollar looking a tad tired this morning after yesterday’s jump. EURUSD is reclaiming some ground after finding support around the 61.8% retracement of the swing higher from Mar’20 to Jan’21, but still looks weak and susceptible to further declines with sellers still apparently in charge. GBPUSD is also firmer, approaching 1.35 with a definite shift in momentum.