Real estate investment trusts (REITs) allow investors to participate in the growth of real estate, one of the most important sectors of the economy. According to the National Association of Real Estate Investment Trusts (NAREIT):

“REITs invest in the majority of real estate property types, including offices, apartment buildings, warehouses, retail centers, medical facilities, data centers, cell towers, infrastructure and hotels.”

Exchange-traded funds (ETFs) that focus on REITs offer the benefit of greater liquidity than investing in direct real estate. In addition, investors do not have to worry about various costs and legal issues (for example, related to mortgages, estate agents or tenants) that might come with being a property owner.

PGIM, the investment management business of Prudential Financial, highlights that in Q2:

“The best performers during the quarter were self storage and mall companies. Self-storage had a demand boost during the pandemic and is positioned well in a reflationary environment with monthly leases and low labor expenses. Malls continue to benefit from pent up consumer demand trends. The worst performing sectors during the quarter were lodging and healthcare.”

Regular followers of this column know that we cover the sector regularly. For example, in the past several months we have discussed the following ETFs:

- iShares Residential and Multisector Real Estate ETF (NYSE:REZ) — up 30.5% year-to-date (YTD) (covered here and here);

- Pacer Benchmark Data & Infrastructure Real Estate SCTR (NYSE:SRVR) — up 15.4% YTD (covered here);

- The Real Estate Select Sector SPDR Fund (NYSE:XLRE) — up 28.5% YTD (covered here and here);

- VanEck Vectors Mortgage REIT Income ETF (NYSE:MORT) — up 12.4% YTD (covered here);

- Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) — up 25.5% YTD covered here and here).

Today, we extend the discussion to two other funds.

1. JP Morgan BetaBuilders MSCI US REIT ETF

- Current Price: $100.35

- 52-Week Range: $68.76 - $101.86

- Dividend Yield: 1.98%

- Expense Ratio: 0.11% per year

Our first fund, the JPMorgan BetaBuilders MSCI US REIT (NYSE:BBRE), focuses on the the US real estate sector. NAREIT suggests:

“The recovery in commercial real estate, like much of the rest of the economy, is likely to be uneven across sectors and subject to various lags and delays.”

PwC takes a similar view as it points out:

“Industrial properties, data centers and single-family homes are expected to rise in value, while retail and hospitality will see the largest decline.”

BBRE, which has 138 holdings, tracks the returns of the MSCI US REIT Capped Index. The fund started trading in June 2018. The top 10 holding account for almost 40% of net assets of $1.42 billion.

In terms of the sub-sectoral breakdown, the Apartments segment makes up the highest slice with 24.6%, followed by the Diversified (19.0%), Industrial (12.9%), Healthcare (10.9%), Office (105%), Storage (9.2%), Regional Malls (3.9%) and Hotels (3.7%).

Prologis (NYSE:PLD), invests in logistics facilities; digital infrastructure group Equinix (NASDAQ:EQIX); self-storage facilities provider Public Storage (NYSE:PSA); real estate investment trust Simon Property (NYSE:SPG), which mainly develops and manages malls and premium outlets, and Digital Realty Trust (NYSE:DLR), which invests in data centers, lead the names in the roster.

Over the past year, the fund is up about 35.5% and 26.8% YTD. It hit an all-time high on Aug. 2. Given the strong performance in 2021, short-term profit-taking could be in the cards. Interested investors would find better value around $95.

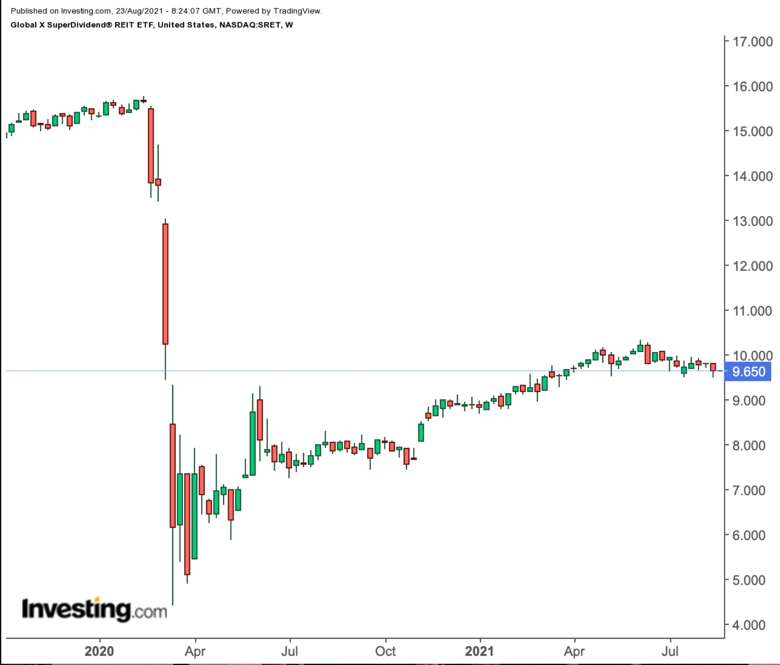

2. Global X SuperDividend REIT ETF

- Current Price: $9.65

- 52-Week Range: $7.43 - $10.34

- Dividend Yield: 6.58%

- Expense Ratio: 0.58% per year

The Aberdeen Standard Investments Research Institute (ASIRI) anticipates "reasonable mid-single digit returns for global real estate over the next three years, as price declines reduce and rents recover on the back of economies re-opening.”

Our next fund, the Global X SuperDividend® REIT ETF (NASDAQ:SRET), could be of interest to readers, especially to passive-income seekers who would like to benefit from global trends in the sector as well. SRET invests in 30 of the highest dividend yielding REITs globally.

SRET, which started trading in March 2015, has around $496 million in assets. In terms of the sub-sectoral breakdown, Mortgage REITs have the highest weighting with 32.10%. Next in line are Diversified REITs (21.01%), Health Care REITs (15.30%) and Specialized REITs (11.12%), which could “include movie theaters, casinos, farmland and outdoor advertising sites.”

About 70% of the REITs are US-based. Next in line are those from Canada (11.2%), Australia (9.7%), Singapore (6.2%) and Mexico (2.8%). The top 10 names account for about 35% of the fund.

Among the leading stocks are Iron Mountain (NYSE:IRM), which provides data storage and information management services; Chimera Investment (NYSE:CIM), which focuses on mortgage assets; Vereit (NYSE:VER), whose portfolio includes single-tenant retail, restaurant, office and industrial real estate assets; Canadian REIT SmartCentres Real Estate Investment Trust (OTC:CWYUF) and real estate Industrial Logistics Properties Trust (NASDAQ:ILPT), which owns and leases industrial and logistics properties stateside.

Over the past year, the fund is up about 22.5% and 8.5% so far in 2021. SRET saw a multi-year high in June. A potential decline toward $9.2 or even below would improve the margin of safety.