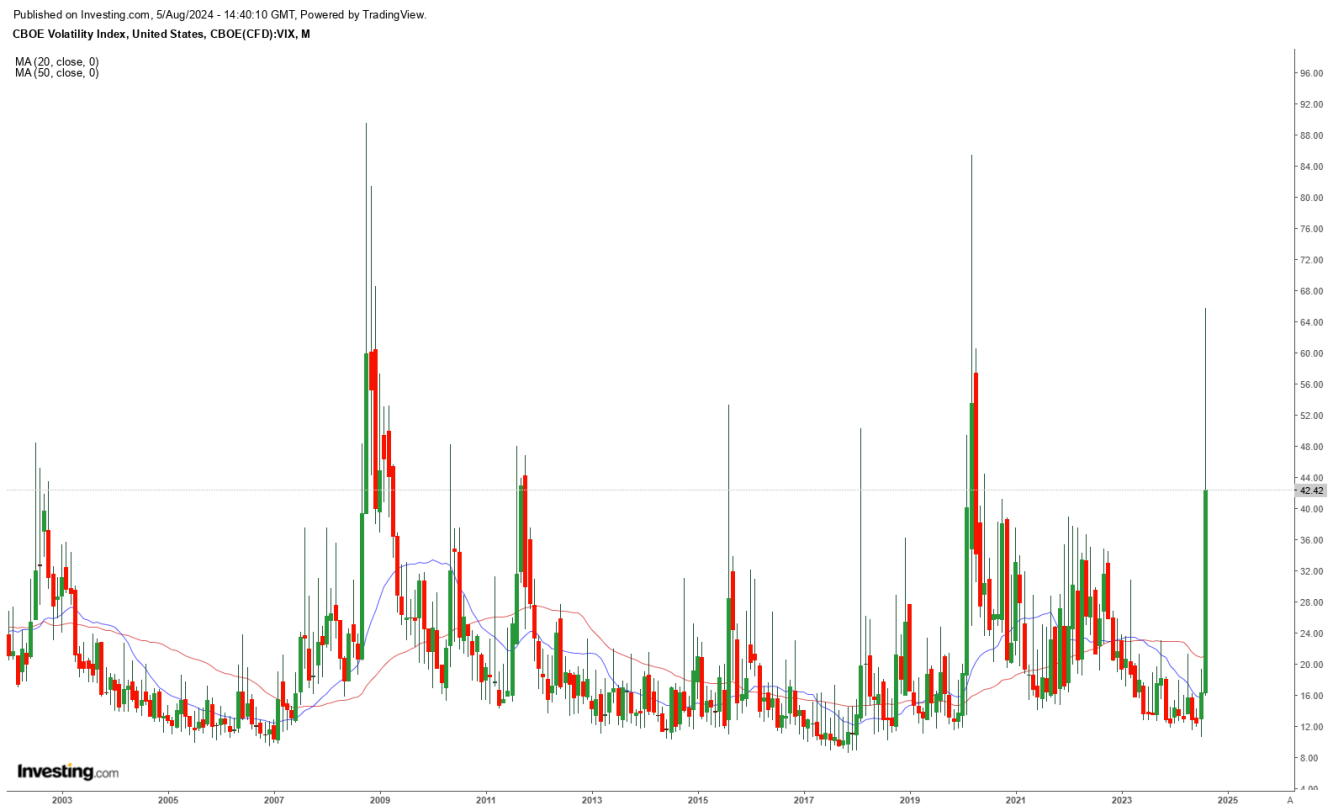

The recent surge in the CBOE Volatility Index (VIX) has captured the attention of traders and investors alike. As of early August 2024, the VIX has soared past 42, reflecting heightened market uncertainty and fear. This chart-grab below shows the monthly history of the VIX, where the largest spikes in recent history have been 2008, 2020 and this week. However, there are several medium-high groups of spikes at similar levels, so the question becomes, is this week's spike as high as it gets this year, or is this start of something bigger?

Economic Concerns

The latest jobs report has been a major catalyst for the spike in the VIX. The report revealed that the economy added only 114,000 jobs in July, far fewer than economists had anticipated. Additionally, the unemployment rate increased to 4.3%. These figures have raised concerns about the health of the economy and the possibility that the Federal Reserve might have delayed necessary rate cuts for too long, exacerbating fears of an economic slowdown.

Tech Sector Volatility

The tech sector, a significant driver of market movements, has seen considerable turbulence. Amazon (NASDAQ:AMZN)'s recent earnings report disappointed investors, missing revenue estimates and providing a cautious outlook. This follows similar sentiments from other tech giants, contributing to a broader sell-off in the sector. Intel (NASDAQ:INTC)'s announcement of a wider-than-expected quarterly loss and subsequent layoffs further dampened investor confidence in tech stocks.

Global Market Influences

Global economic conditions have also played a role in the recent volatility. Semiconductor stocks, which had previously performed well, experienced a sharp decline following disappointing earnings reports and forecasts from companies like Lam Research and Microchip Technology. These developments have had a ripple effect across global markets, adding to the uncertainty.

Sector-Specific Issues

Certain sectors have faced their own unique challenges, contributing to the overall market volatility. For instance, MGM Resorts International reported concerns about soft bookings for an upcoming Formula 1 event in Las Vegas, leading to a significant drop in its stock price. Such sector-specific issues highlight the varied factors influencing market sentiment.

Interest Rate Expectations

Treasury yields have also been a focal point for investors. Following comments from Federal Reserve Chair Jerome Powell about potential monetary easing, Treasury yields fell sharply, adding to the market's uncertainty【10†source】. The yield on the 10-year Treasury dropped below 4% for the first time since February, reflecting shifting expectations around interest rates.

What Does This Mean for Investors?

The surge in the VIX indicates a period of heightened volatility and uncertainty in the market. For investors and traders, this environment requires careful attention to risk management and potential opportunities. Staying informed about economic data releases, corporate earnings, and global events is crucial. Additionally, employing hedging strategies and maintaining a diversified portfolio can help navigate this volatile period.

So, the recent spike in the VIX underscores the complex interplay of economic concerns, sector-specific issues, and global market influences. As the market adjusts to these developments, staying vigilant and adaptable will be key for investors. My adage is- Keep Calm and Carry On Trading, for now.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

VIX is Spiking: What’s Driving Market Volatility?

Published 06/08/2024, 07:11

Updated 10/12/2024, 07:33

VIX is Spiking: What’s Driving Market Volatility?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.