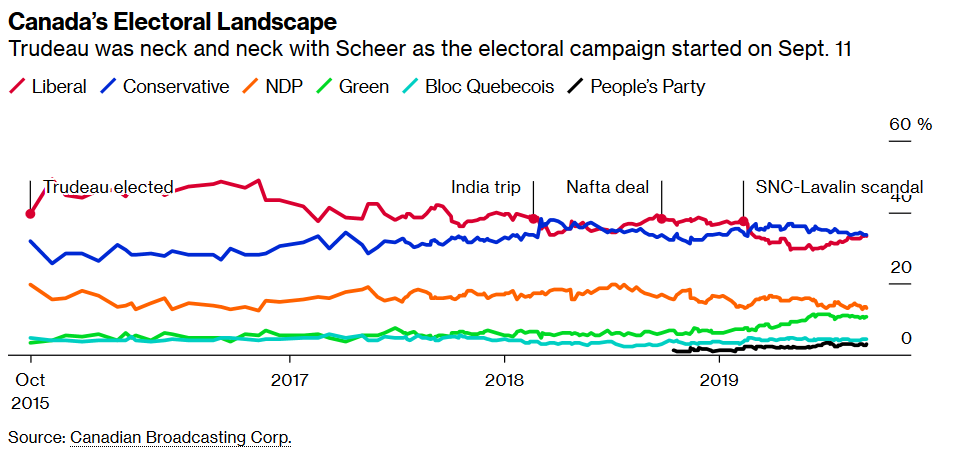

Canadians will head to the polls on Monday to vote in a federal election and the race between incumbent Prime Minister Justin Trudeau and Conservative challenger Andrew Scheer could not be tighter. Voters have only failed to re-elect an incumbent candidate to a second term on four occasions in the country’s history, but recent polls show Trudeau’s approval hovering around record lows, making him vulnerable against the former youngest-ever Speaker of the House of Commons:

With both candidates polling just above 30%, the winner will likely have to form a coalition with smaller parties in addition to working with a fragmented Parliament, but it’s still worth exploring what their economic policies may mean for the loonie and the Canadian economy more broadly.

Starting with the obvious: the Canadian economy has performed relatively well under Trudeau’s tenure, with unemployment levels near record lows, inflation subdued, and the stock market hitting a record high last month, though GDP growth has moderated to below 2% this year.

Beyond voters’ evaluation of the candidates’ personalities, the biggest policy-related issue will be around the environment. Trudeau has a stated goal to reach net-zero carbon emissions by 2050 and exceed the country’s 2030 carbon emission goals. By contrast Scheer plans to eliminate the country’s carbon tax if elected. Therefore, a victory for Scheer may provide a short-term boost to the country’s economy, and by extension, the Canadian dollar, though the longer-term outlook is more questionable.

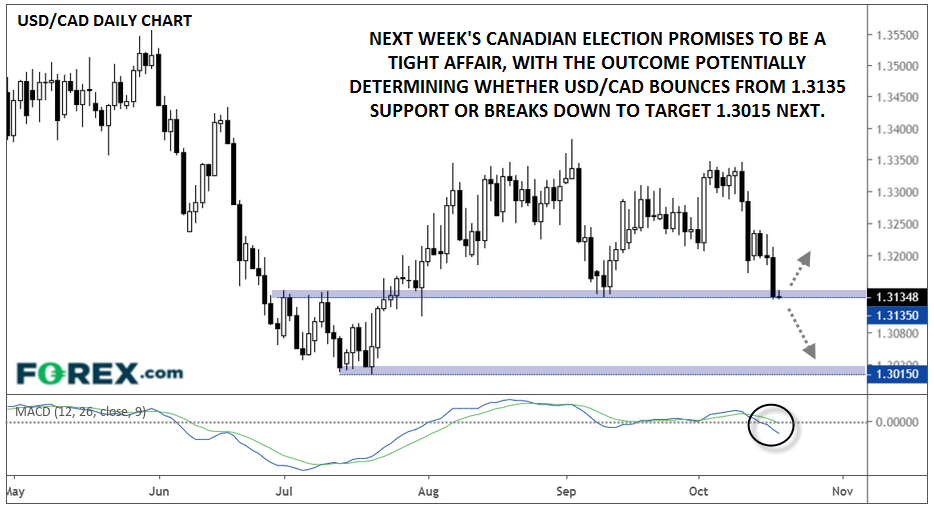

Outside of the election, the loonie has also benefited from strong economic data this week, with the private non-farm jobs report coming in better than anticipated (with strong revisions) and a better-than-expected manufacturing sales report. Technically speaking, the loonie has been the strongest major currency year-to-date and peeked out to an 11-week high against the US dollar just yesterday:

With the MACD indicator also showing a shift back toward bearish momentum, a confirmed breakdown below 1.3135 in USD/CAD could open the door for a continued drop (rise in the loonie) toward the year-to-date low at 1.3015. Meanwhile, a bounce from this support level, perhaps on the back of a Trudeau victory, could extend into the 1.3200-1.3300 area before encountering meaningful resistance.

With the major candidates polling neck-and-neck on the eve of the election, and a minority government likely in either case, USD/CAD is poised for elevated volatility in the coming week!