The US Treasuries yields slipped driving USD down across the broad depressed by the unchanged projections of the Federal Open Market Committee members who expected 3 times by 0.25% next year.

Despite their economic outlook optimism and over the longer run, they expected that the Fed’s benchmark fund rate would rise to 3.1% by the end of 2020, up from 2.9% they expected in last September.

The Fed expected GDP annualized expansion by 2.5% next year up from 2.1% it forecasted in September, while their forecast about inflation was referring to standing below the Fed’s 2% medium term target next year before, stabilizing around that target in 2019 and 2020.

In her press conference following yesterday meeting the Fed chairwoman Janet Yellen has indicated the reason why the Fed raised its economic growth forecast was its assessment of the $1.5 trillion tax cut through Congress.

She said that we continue to think that a gradual path of rate increases remains appropriate even with almost all participants factoring in their assessment of the tax cut policy which would deliver relatively modest economic benefits adding few tenths of the economic expansion rate.

Despite the members believe in better growth outlook in US to come next year, they looked again worried about the inflation predicting it to remain under control.

About The labor market, Their economic assessment said that it has continued to gain strength and The jobs gains have been solid and the unemployment rate declined further.

The Federal Open Market Committee raised The Fed fund rate by 0.25% to 1.5% yesterday following a two-day meeting with objections from Charles L. Evans, president of the Federal Reserve Bank of Chicago and Neel Kashkari the president of the Federal Reserve Bank of Minneapolis.

These 2 members who have seen no need to raise the interest rate yesterday have highlighted previously their worries about the persistence of the inflation low levels.

Their objection eroded from the interest rate outlook and weighed on the greenback, as the market was fully priced in yesterday hiking by 0.25% with no doubts.

The greenback came under pressure by profit taken on buying on rumor selling on fact phenomenon, specially as the fact came with no surprises to add to the inflation outlook but the opposite it came with.

But the positive factor to the greenback and US equities too remained that there has been no mention yet of worries about high taken leverage amid the current record highs of their indexes.

The committee has just maintained that the march toward higher interest rate will remain by the same gradual pace without referring to the current prices in equities market.

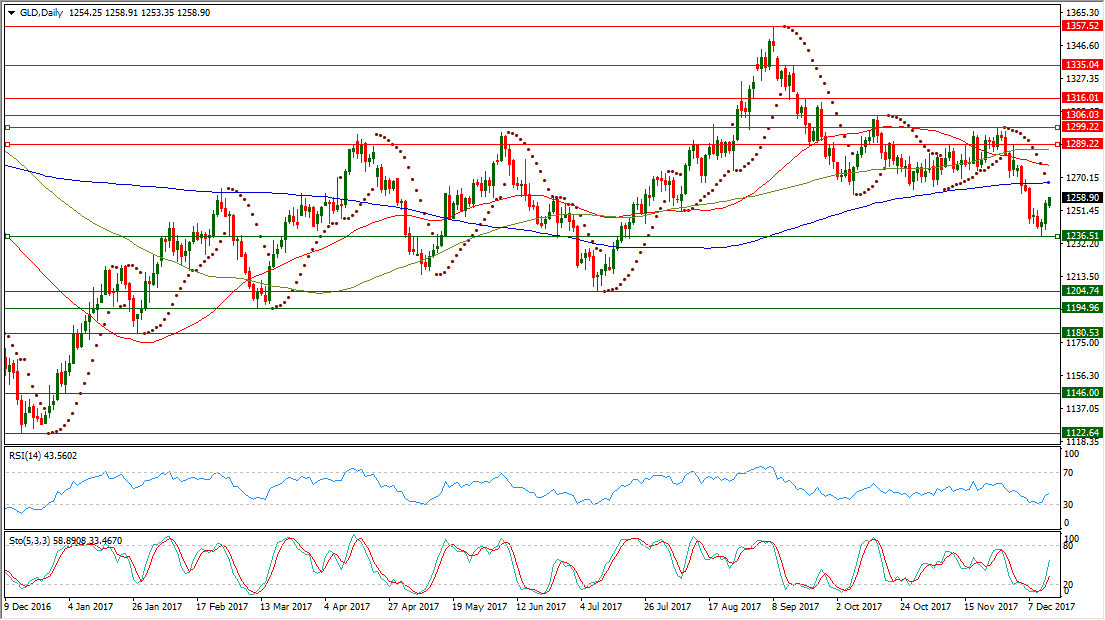

XAUUSD could be underpinned to extend its rebound from last Tuesday low at $1236.51 per ounce to touch now its 200 SMA hours average at $1258 per ounce.

However The Gold is still depressed by continued trading below its daily SMA50, its daily SMA100 and its daily SMA200 and The Gold is still exposed to forming a lower high below these important averages.

The Gold has accelerated its slide following failing to get back above $1300 psychological level on last Nov. 27 to cause breaking of its formed base on last Oct. 6 at $1260.60 in another dovish sign.

XAUUSD is now trading in its 12th consecutive day of being below its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today $1267.

XAUUSD daily RSI-14 is referring now to higher existence inside its neutral area reading 43.560.

XAUUSD daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in its neutral territory at 58.890 leading to the upside its signal line which is in the same area at 33.467, after bottoming out inside the oversold area below 20.

Important levels: Daily SMA50 @ $1277, Daily SMA100 @ $1286 and Daily SMA200 @ $1267

S&R:

S1: $1236.51

S2: $1204.74

S3: $1194.96

R1: $1289.22

R2: $1299.22

R3: $1306.03