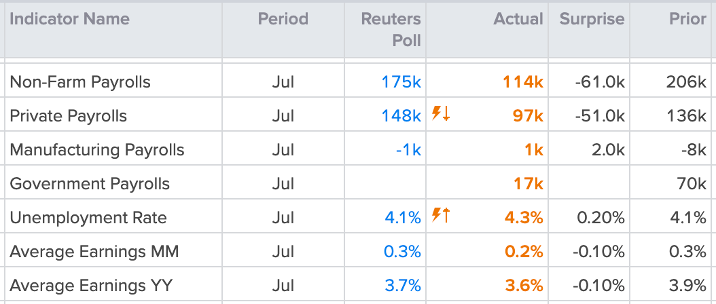

The July US labour market data has sparked some real concern in markets. Most of the data prints came in worse-than-expected, painting a picture of a slowing US labour market. Average hourly earnings and non-farm payrolls came in lower than anticipated, with the unemployment rate rising unexpectedly to 4.3%.

Source: refinitiv

Thursday’s rise in jobless claims let to a market meltdown in the US stock market as investors became concerned that the Federal Reserve made the wrong decision by keeping rates unchanged on Wednesday. Because of this, a lot of emphasis had been placed on the US jobs data released today. Specifically on the unemployment rate because of a theory based on the Sahm rule, which states that we are likely in a recession if the three-month moving average of the unemployment rate rises half a percentage point from its low point in the previous 12 months. A rise to 4.2% would have triggered this rule, but 4.3% makes it even worse.

The reaction in markets has alluded to this. The dollar and US yields pulled back alongside US equities, whilst gold picked up some solid bullish momentum. These all point to increased concern in markets that the Federal Reserve has gone too far, holding rates high for too long. It seems now like Wednesday would have been the perfect time to start cutting rates, at least according to markets.

We’ll have to wait and see what Powell and his team have to say about the data. What seems like a given now is that the Fed will cut rates in September, the question that now arises is by how much. Prior to the jobs data markets were pricing in over a 90% chance of a 25-basis point cut, with no mention of any other amount. Current pricing shows a 70% chance of a 50-basis point cut, with the remaining 30% assigned to 25bps. Once again, this alludes to how much markets think the Fed was mistaken on Wednesday.

It seems unlikely that the central bank would decide to do an out-of-cycle cut following the latest data as this would just induce more panic in markets. But we may see clear some clear messaging from FOMC members that cuts are imminent, in an attempt to calm market jitters.

That said, the stock market had overheated significantly over the past year so the pullback that is currently taking place is well within the bounds of a normal correction. The question now will be whether policy easing over the coming months will be enough to restore the bullish momentum in stocks.

Another area to look out for is the US dollar and bond yields. The 10-year yield, often used as a benchmark, has dropped 20% since mid-April, and is now looking to break to a new one-year low. Meanwhile, gold is likely to continue attracting bullish demand as the precious metals benefits both from fears of a recession and lower rates.

US 10-year yield daily chart

Past performance is not a reliable indicator of future results.

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.01% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

The information provided is not to be considered investment advice or investment research. Capital.com will not be liable for any losses from the use of the information provided.'

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Unemployment Spikes Causing Markets to Lose Confidence in the Fed’s policy

Published 02/08/2024, 14:02

US Unemployment Spikes Causing Markets to Lose Confidence in the Fed’s policy

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.