The U.S. dollar is holding steady, with the EUR/USD currency pair hovering around 1.0780 as of Monday. This follows a robust performance by the dollar last Friday, driven by newly-released U.S. employment statistics.

The U.S. unemployment rate rose slightly to 3.8%, up from 3.5%, while the average hourly wage saw a modest month-over-month increase of 0.2%, falling short of the anticipated 0.3% hike. However, non-farm payrolls exceeded expectations by adding 187,000 jobs.

Given these mixed signals, the Federal Reserve may view the current labor market conditions with caution. The central bank could attribute the job market's volatility to the effects of elevated interest rates, among other factors. If these economic indicators continue to show weakness, it could imply greater susceptibility to high interest rates, suggesting that further rate hikes may be on the horizon.

Technical Analysis of EUR/USD Currency Pair

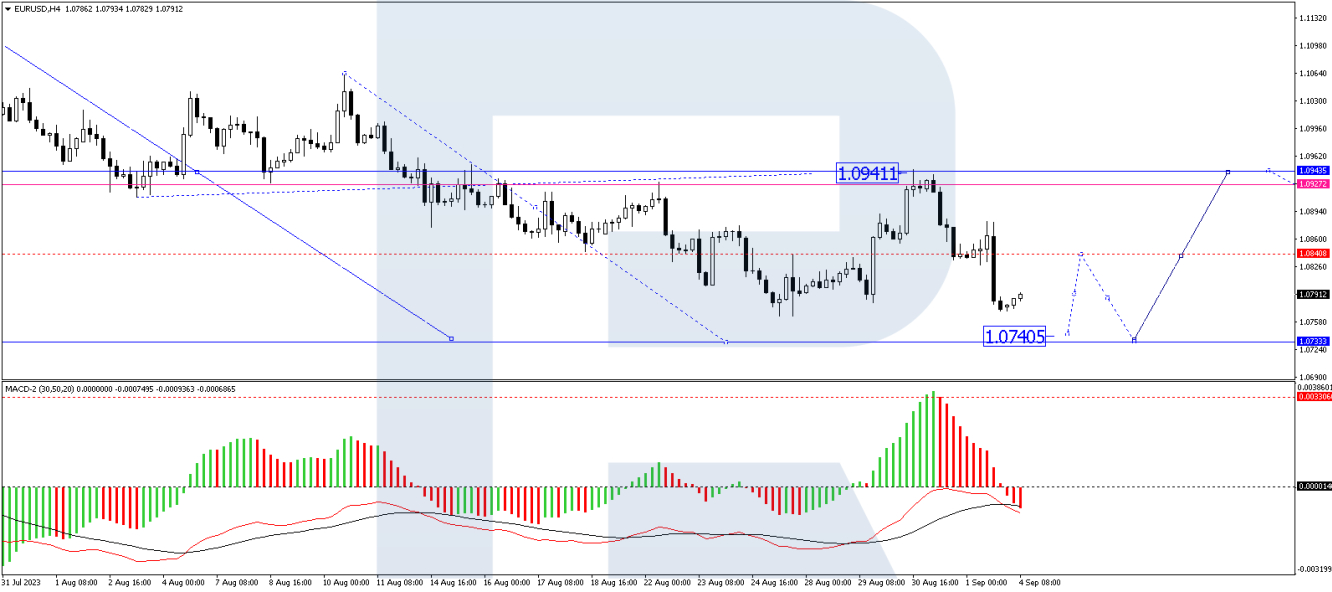

On the 4-hour chart, EUR/USD prices have concluded a corrective phase at 1.0941 and have commenced a downward trend targeting 1.0740. In the short term, the market may witness an upward adjustment to 1.0810, which would then be followed by a resumption of the declining trend toward the local target of 1.0740. This outlook is technically supported by the Moving Average Convergence Divergence (MACD) indicator, whose signal line is positioned below the zero threshold and is oriented downward.

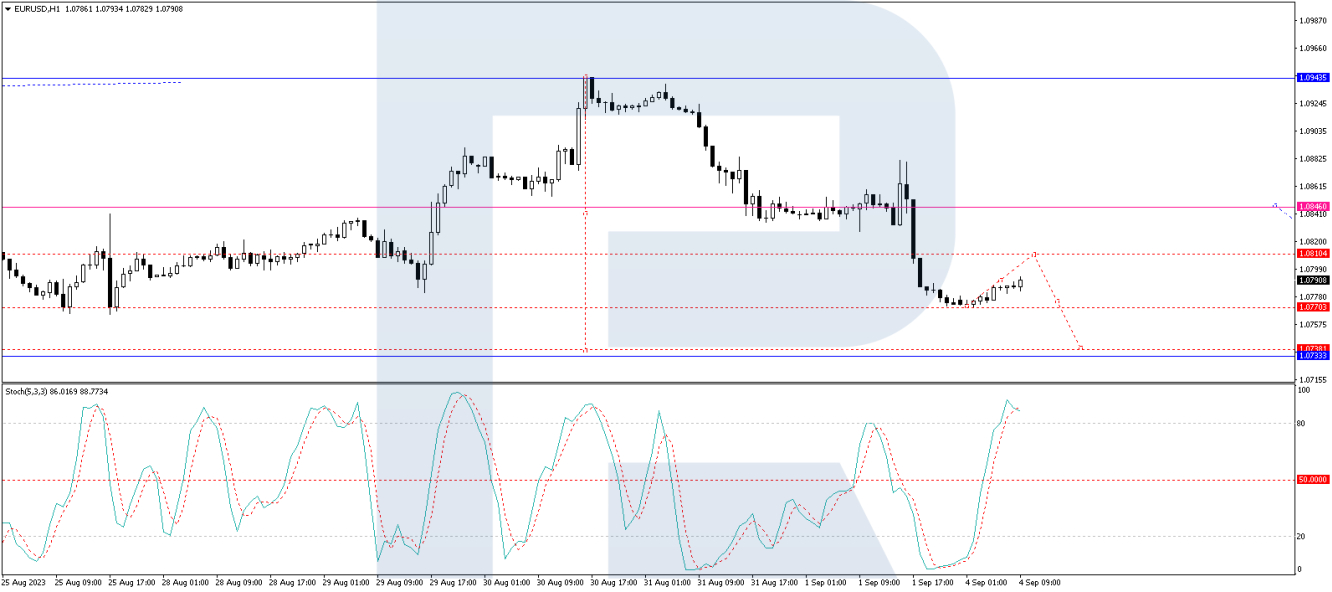

On the 1-hour chart, the EUR/USD has established a consolidation range around 1.0840. The pair briefly extended to 1.0881 before retreating, shifting the lower range boundary to 1.0771. A minor rise to 1.0810 is anticipated in the near term, followed by a decline to 1.0740, and potentially extending to 1.0733 thereafter. This scenario gains technical validation from the Stochastic oscillator, whose signal line currently resides above the 80 level and appears poised to descend toward 50. Should it cross this level, a further drop to 20 could become increasingly likely.

In summary, the U.S. dollar remains in a strong position, buttressed by mixed yet overall resilient employment statistics. Both short-term and medium-term technical analyses of the EUR/USD currency pair suggest a bearish outlook for the euro against the dollar, although market volatility may still be a factor.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Dollar Maintains Stability: An In-Depth Analysis

Published 04/09/2023, 13:49

U.S. Dollar Maintains Stability: An In-Depth Analysis

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.