Just because we’re in a recession, doesn’t mean there aren’t growth opportunities for you!

The UK has recently entered a technical recession, defined by two consecutive quarters of negative GDP growth. This downturn has been identified in the last quarter of 2023 and continued into 2024, marking a significant shift in the nation's economic landscape. Despite this, it's important to note that the economy's contraction, while signifying a recession, masks a more complex economic scenario. The backdrop includes a longer-term hit to living standards and challenges that extend beyond mere GDP figures.

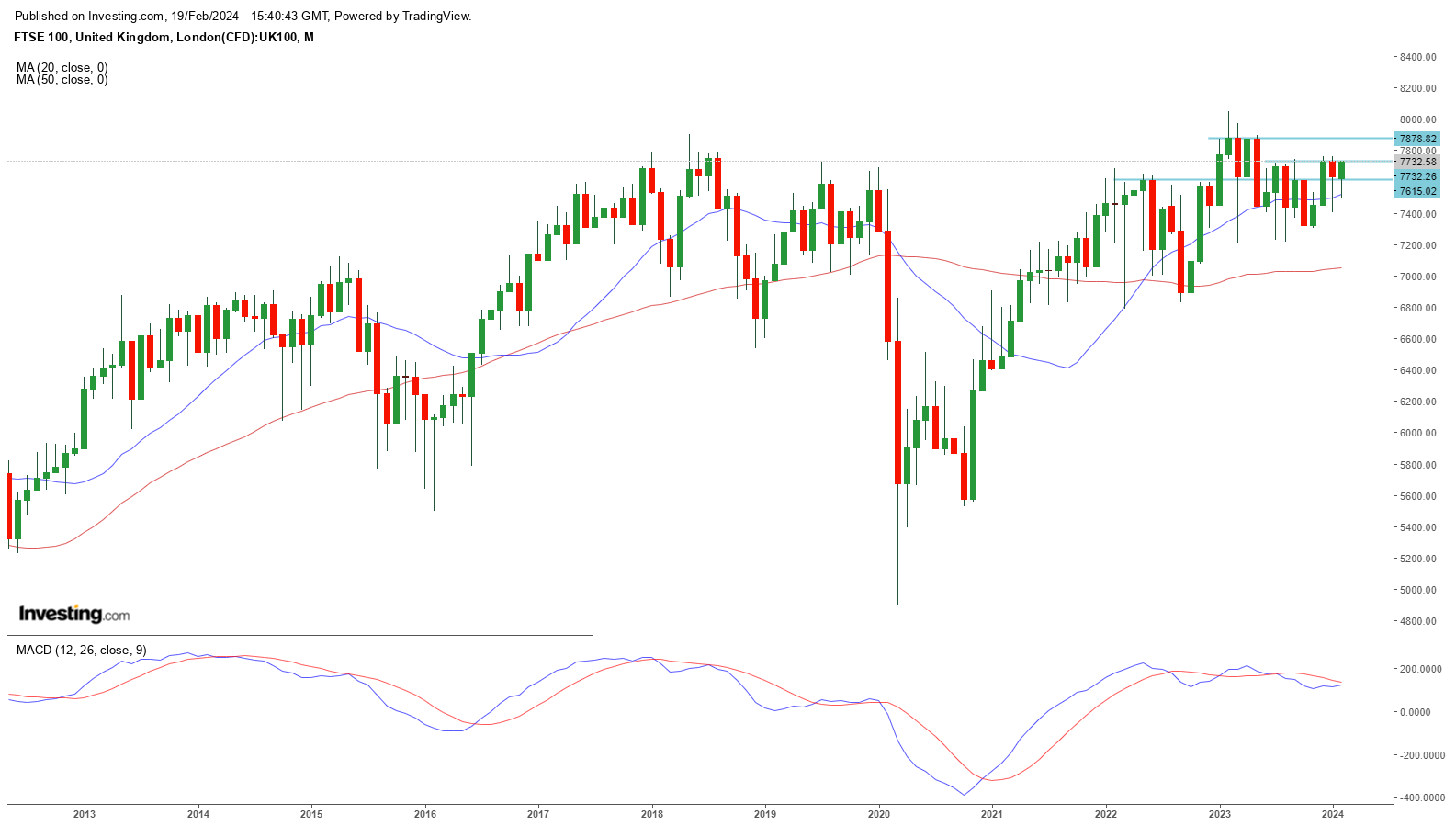

I think it’s worthwhile taking a moment to see how well the FTSE has been performing of recent, not when compared to U.S. indices, but when compared to itself:

In the monthly chart below, going back to 2012, we can see that the FTSE has continued to climb higher, and also been operating near all time highs since the ned of 2022.

At the time of writing, price appears poised to break out to new highs in the coming weeks.

It’s not all doom and gloom.

Anecdotally, most people seem to be fine- there’s work, pay is acceptable, people are living their lives and moving forward.

It’s just frustrating that other parts of the world appear to have been enjoying even greater growth over the last decade. To add insult to injury, we’ve also been subject to more than a decade of austerity in response to the 2007-2009 Global Financial Crisis, and it’s getting old.

That being said, for me personally, there are plenty of U.K. stocks that are performing very well, and could offer outstanding returns over the rest of this year, ESPECIALLY supported by the FTSE about to move to new highs!

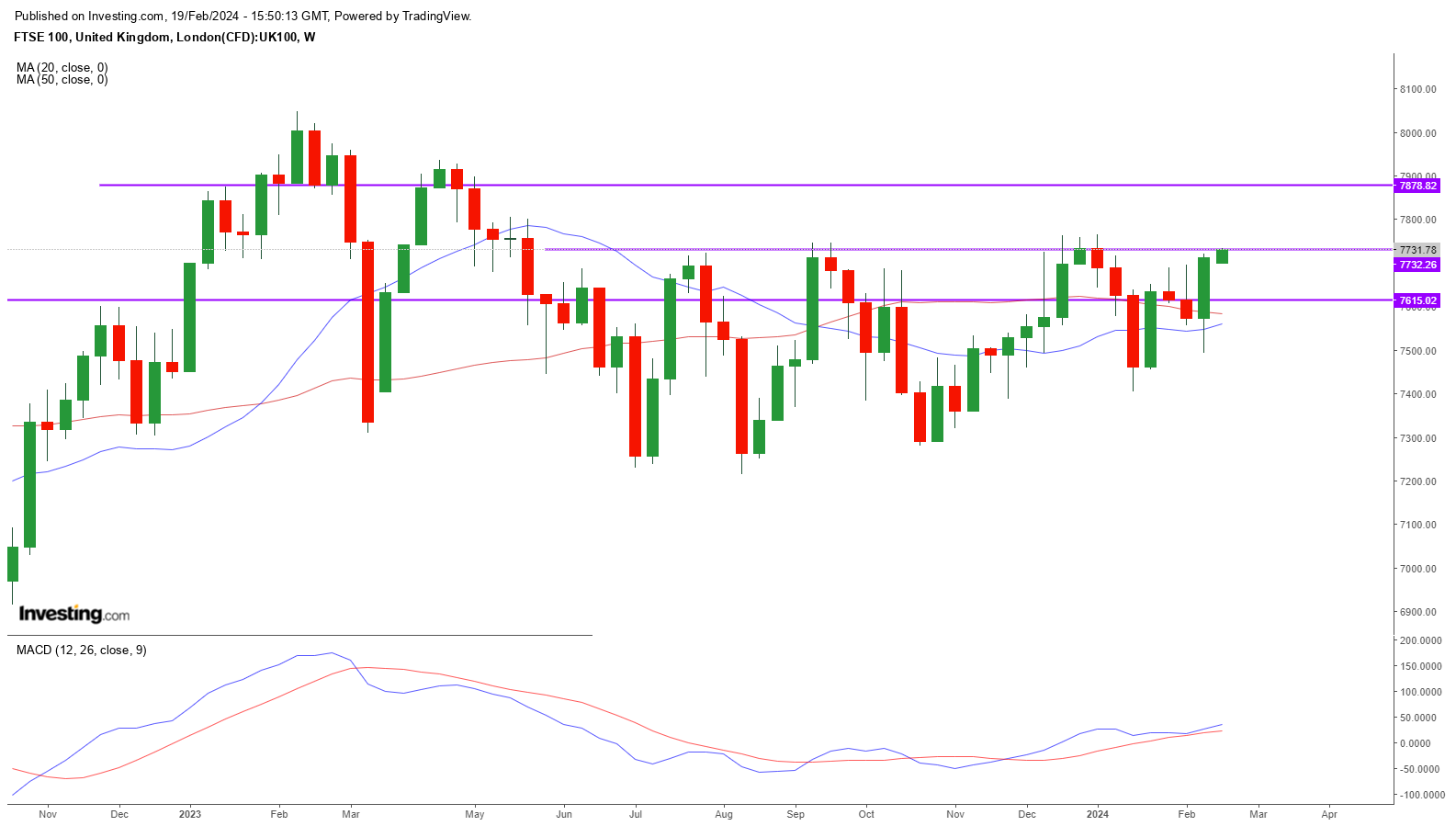

This weekly chart shows solid bullish sentiment. Unsuaully, there are 3 levels of historical resistance very close to each other, the good news beng that once price breaks free of these, there’s a good chance it could run for a while.

Rolls-Royce

Take a look at Rolls-Royce (LON:RR) over the last year, it has sky-rocketed! IT is looking good, especially compared to say…Tesla (NASDAQ:TSLA)? Jokes aside, it’s future looks bright.

F&C Investment Trust

F&C Investment Trust (LON:FCIT) stands as a notable entity in the FTSE, known for its legacy and performance in the investment trust landscape. F&C Investment Trust operates with a market cap of 4.90 billion GBP and total assets amounting to 5.74 billion GBP. The trust's commitment to delivering shareholder value is underscored by its diverse and globally oriented investment portfolio, aiming for long-term growth and income. And honestly, it’s outperforming Cathie Wood’s ARK ETF.

London Stock Exchange Group

Next, the London Stock Exchange Group plc (LON:LSEG) is a global financial markets infrastructure and data behemoth, offering a diversified portfolio of services through its three main divisions: Data & Analytics, Capital Markets, and Post Trade. The Data & Analytics division, inclusive of the core Refinitiv and FTSE Russell businesses, delivers critical data products, indexes, and benchmarks. The Capital Markets division, covering the London Stock Exchange, Tradeweb, FXall, and Turquoise, facilitates access to capital and secondary market trading across equities, fixed income, and FX. The Post Trade division offers comprehensive clearing, risk management, and regulatory reporting solutions.

Looking at it’s performance here, it’s on fire, and also looking good.

RELX PLC

Finally, to wrap up today’s piece, take a look at RELX plc (LON:REL), which is a British multinational information and analytics company headquartered in London, England. Formed in 1993 from the merger of Reed International, a British trade book and magazine publisher, and Elsevier, a Netherlands-based scientific publisher, RELX has evolved into a leading provider of scientific, technical, medical information and analytics; legal information and analytics; decision-making tools; and organisation of exhibitions. Operating in 40 countries and serving customers in over 180 nations!

However, this one is a over-priced and I would avoid it until there is a correction, which should happen over the next few months. A better price to get in would be closer to the 36-38 area.

So, my point is this- there are a lot of well-performing constituents within the FTSE at the moment. Don’t be fooled into thinking that when you hear ‘recession’ that it means stagnation.

_______________________________

Like this article? Read more from my Investing.com profile here: https://uk.investing.com/members/contributors/256252463

Disclaimer: Any content in this article is purely financial markets discourse and not financial advice. Please consult a regulated professional before making any financial decisions.

All content and images are sole property of the author.