The market sentiment is still possessed by Trump's protectionism policy and its consequences ahead of today expected formalization of 25% tariffs on steel and 10% on aluminum imports.

The director of the White House National Economic Council Gary D. Cohn resigned earlier this week.

The House Speaker Paul Ryan and also More than 100 Republican lawmakers argued Trump to cancel imposing these tariffs.

The split over Trump's protectionism policy could help the risk appetite to find a leeway to return to the investors and also The talking about initial excluding of Mexico, Canada and some allies from these tariffs could lower the markets tension.

While most of the markets participants downplayed the risks of trade war, after living relatively long period of free trade and working from G7 for that purpose, However that risks will always exists with Trump's existence in power revising all of US trading pacts.

Yes, The protectionism policy can lower the US trade deficit and afford some financing of the US debt deficit and it can boost also the domestic manufacturing expansion and the demand for hiring raising the capacity utilization.

But this policy is expected to be faced by retaliatory measurements from US counterparts can dampen the demand for US exports and hurt the business activities.

The tariffs can raise the producing costs and also the consuming prices by a way can hurt the US consumers' prosperity.

So, they can accelerate the inflation building up tackling the economic activity which will be more threatened by higher interest rates to come for containing the inflation upside risk which can be easily exported all over the world.

While the inflation in US is looking gathering momentum fueled by adopting $1.5 trillion in tax cuts taking effect this year.

From my side, I see that the economic activity in US was running well and wasn't in need meanwhile for such tax cuts which will work for overheating the US economy raising the inflation upside risks which can force the Fed to raise rates faster and higher.

So, Tramp's reflation plans which are looking in sake for financing anyway can be wasted like cutting the interest rate for boosting actually inflated economy!

UST 10yr yield gained back this week until now 0.04% to be now at 2.88% boosted by the risk appetite rebounding which lowered the demand for fixed returns assets.

While The JGB 10yr yield stands near at 0.05%, despite Bank of Japan Governor Haruhiko Kuroda's announcement about a possible time frame for discussing an exit from its extraordinary easing program.

Kuroda's first hint about ending the ultra easing policy could raise the potential of the Japanese yen which has been already underpinned by the end of last week by lower demand for loading risky assets on Trump's reference to accepting Trade War can be easily won as he tweeted.

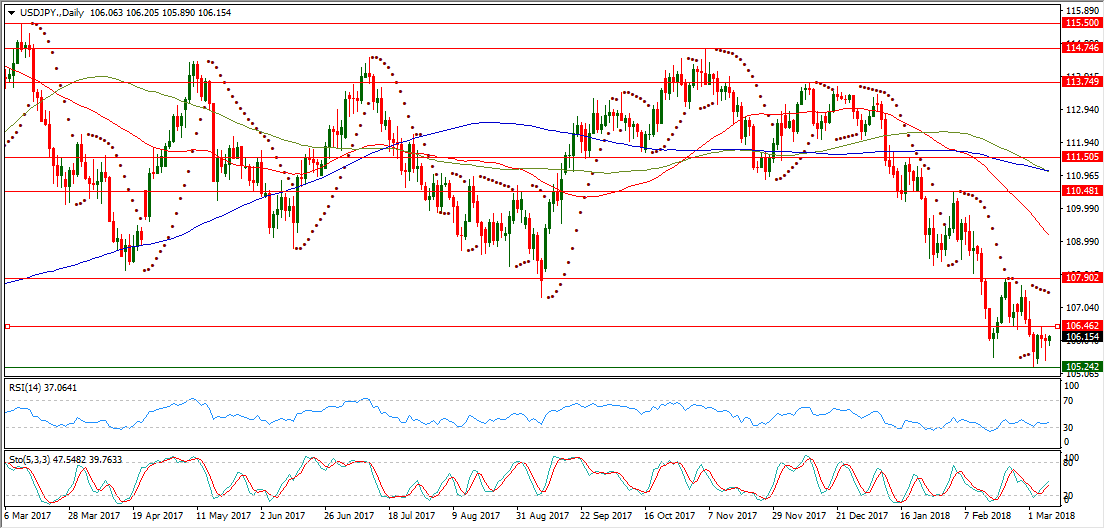

USDJPY could contain last Friday slide to 105.24 but its rebounding faced resistance at 106.46 and now it is trading near 106.15.

USDJPY is now trading in its fifth day below its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today 107.48 after bottoming out last Friday at 105.24.

The downside momentum of USDJPY eased down, but it is still undermined by continued trading well below its daily SMA50, its daily SMA100 and also its daily SMA200

USDJPY is still depressed by forming series of lower highs persisted its descending channel, after breaking out its key supporting level at 110.83.

While making lower low at 105.24 below last Feb. 16 low at 105.54 keeps the pair vulnerable to the downside.

USDJPY daily RSI-14 is referring now to existence inside its neutral territory reading 37.064 hovering over its oversold area below 30.

USDJPY daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line inside its neutral region at 47.548 leading to the upside its signal line which is lower in the same region at 39.763, after convergence to the upside by bottoming out at 105.24.

Important levels: Daily SMA50 @ 109.16, Daily SMA100 @ 111.07 and Daily SMA200 @ 111.10

S&R:

S1: 105.24

S2: 101.18

S3: 100.07

R1: 106.46

R2: 107.90

R3: 110.48