The political ascending tension in US could have its toll on the greenback driving EURUSD to have a higher place above 1.11 during the Asian session.

after it could raise the demand for safe assets, as FBI former remote Director James Comey has said that Trump asked him Comey to drop an investigation into former National Security Advisor Michael Flynn.

Closing the case of Flynn closes as well the investigations about Trump's campaign relation to Russia.

Comey has figured out this point, after released report from the CIA about Trump's sharing of terrorism intelligence classified information with Russia.

Trump became really in a defending situation receiving hits from everywhere, after his decision to fire Comey who has dampened Hillary Clinton campaign by announcing days before the US presidential election that her email usage for sending classified information is still under investigations.

The media in US is keeping amplifying this case adding risk to the political situation in US, as the result of this tension cannot be in the benefit of this situation.

The safe haven assets could aggregate demand again sending XAUUSD above its daily SMA200 again to be traded now close to $1245, after forming a higher bottom at $1214.23 above its previous formed bottom at $1194.91 on last Mar. 10.

With this worrying market sentiment, the Japanese yen could be the most buoyed currency.

As this low yield financing currency could be supported by unwinding of the carry trades as usual putting further pressure on Nikkei 225 major exporting companies.

After S&P 500 lost 1.65 closing at 2400.67 following recording new all times high at 2405.77, while UST 10 years note yield came down by 0.02% to 2.33%

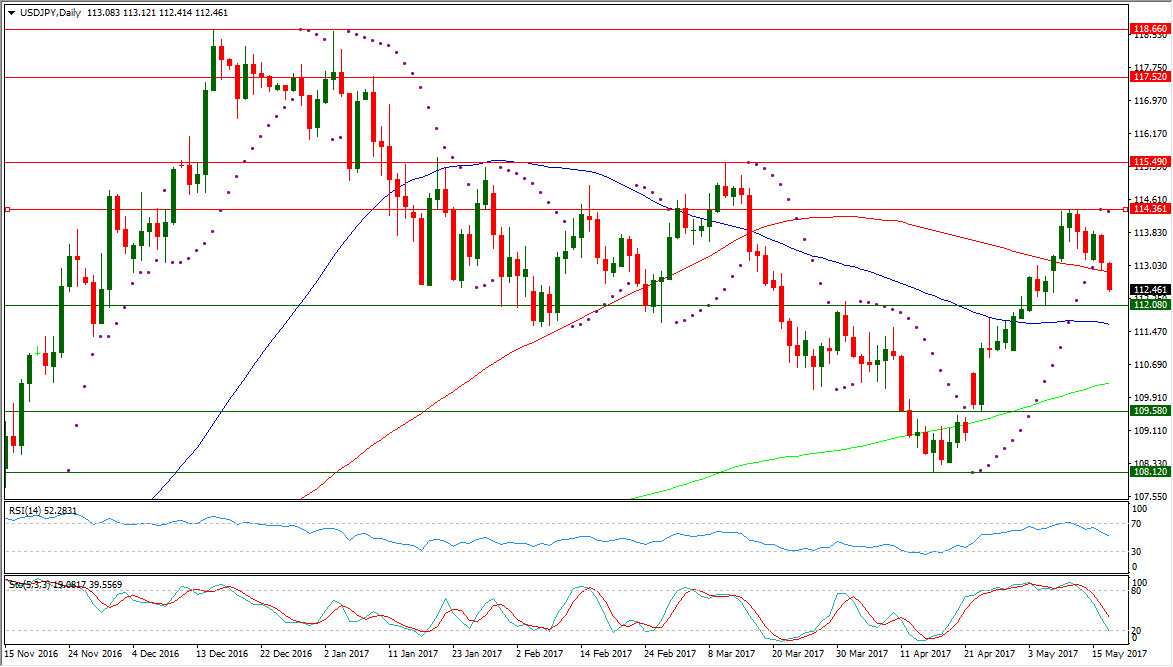

After forming another lower high at 114.36, USDJPY managed to dive below its daily SMA100 again to be traded now near 112.50 in its second day of being below its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading 114.33 today.

USDJPY daily RSI-14 is referring now to existence inside its neutral territory reading 52.283.

USDJPY daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line also in its oversold region below 20 at 19.081 leading to the downside its signal line which is still existing in the neutral region at 39.556.

Important levels: Daily SMA50 @ 111.64, Daily SMA100 @ 112.87 and Daily SMA200 @ 110.24

S&R:

S3: 112.08

S2: 109.58

S3: 108.12

R1: 114.36

R2: 115.49

R3: 117.52