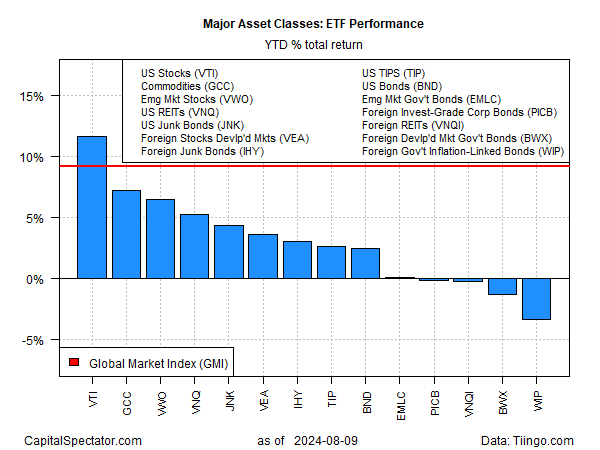

It’s been a rough ride in recent weeks, but trend data still leaves room for debate on the prospects for maintaining bullish bets. Using a set of ETFs shows that most of the major asset classes in 2024 through Friday’s close (Aug. 9) are posting gains.

The US stock market continues to hold the top spot for year-to-date results, based on S&P 500 (NYSE:SPY), which is up nearly 13%. Commodities (GSG), stocks in emerging markets (VWO) and US real estate (VNQ) are posting next-best results. The worst performer: inflation-indexed government bonds ex-US (WIP) via a 3.3% loss so far in 2024.

The overall trend for a globally diversified portfolio, however, remains comfortably positive this year. The Global Market Index (GMI) is up 9.2% year to date, which is a solid performance – all the more so given the recent volatility. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios.

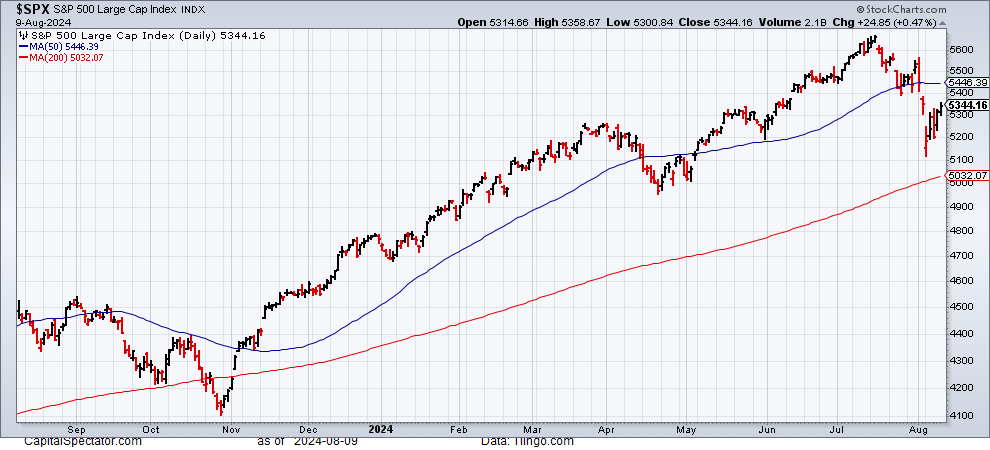

Yet the recent correction has rattled investors and raised doubts about what comes next for the market. But reviewing the trend through a US-equities lens suggests it’s premature to confidently declare that the bull run is over. The S&P 500 Index has fallen from a record high set in mid-July, but the correction at the moment falls into the category of “normal”.

Meanwhile, the S&P’s 50-day average remains well above its 200-day average, which suggests that a positive trend bias still prevails.

What might change the calculus and deliver a fatal blow to the market’s trend? On the short-list for what could go wrong: Hotter-than-expected inflation data that delays the case for the Fed’s rate cuts, which are considered likely at next month’s policy meeting. But Wednesday’s report (Aug. 14) on consumer prices for July is expected to show stable year-over-year comparisons.

Meanwhile, relatively upbeat data for jobless claims and July retail sales the following day (Friday, Aug. 15) are expected to provide a degree of support for downplaying the “hard landing” scenario for the US economy.

“There is some significant evidence of some slowdown of the economy, but I don’t think the data suggest that we’re going to have a hard landing anytime soon,” advises Economist Nouriel Roubini, a.k.a. Dr. Doom. “If anything, actually, there’s some elements of strength in the economy.”

The Atlanta Fed’s Q3 nowcast for GDP also offers an upbeat profile for the US economy. The GDPNow model’s Aug. 8 estimate: +2.9%. If accurate, the increase will mark a fractionally stronger improvement over Q2’s solid 2.8% advance.