- July's CPI report may show a 3.3% increase, up from June's 3.0% reading.

- I believe inflation will likely rise in the coming months due to higher energy and food costs.

- So, I used InvestingPro's stock screener to find high-performing stocks that do well as inflation rises.

- Looking for more actionable trade ideas to navigate the current market volatility? The InvestingPro tool helps you easily identify winning stocks at any given time.

- ExxonMobil (NYSE:XOM):

- Dividend Yield: 3.4%

- InvestingPro Upside: +12%

- Analyst Upside: +10.8%

- Chevron (NYSE:CVX):

- Dividend Yield: 3.8%

- InvestingPro Upside: +29%

- Analyst Upside: +13%

- AbbVie (NYSE:ABBV):

- Dividend Yield: 4.0%

- InvestingPro Upside: +7.5%

- Analyst Upside: +10.5%

- Bank of America (NYSE:BAC):

- Dividend Yield: 3.1%

- InvestingPro Upside: +41.3%

- Analyst Upside: +11.8%

- Pfizer (NYSE:PFE):

- Dividend Yield: 4.7%

- InvestingPro Upside: +41.1%

- Analyst Upside: +17.1%

- Bristol-Myers Squibb (NYSE:BMY):

- Dividend Yield: 3.8%

- InvestingPro Upside: +29.1%

- Analyst Upside: +23.2%

- Goldman Sachs (NYSE:GS):

- Dividend Yield: 3.1%

- InvestingPro Upside: +13.9%

- Analyst Upside: +10.1%

- Gilead Sciences (NASDAQ:GILD):

- Dividend Yield: 3.8%

- InvestingPro Upside: +39.6%

- Analyst Upside: +14.4%

- CVS Health (NYSE:CVS):

- Dividend Yield: 3.3%

- InvestingPro Upside: +55.9%

- Analyst Upside: +24.7%

- Altria (NYSE:MO):

- Dividend Yield: 8.5%

- InvestingPro Upside: +36.2%

- Analyst Upside: +13.6%

- Target (NYSE:TGT):

- Dividend Yield: 3.3%

- InvestingPro Upside: +19.5%

- Analyst Upside: +24.5%

- Phillips 66 (NYSE:PSX):

- Dividend Yield: 3.8%

- InvestingPro Upside: +38.8%

- Analyst Upside: +12.2%

- MetLife (NYSE:MET):

- Dividend Yield: 3.3%

- InvestingPro Upside: +11.9%

- Analyst Upside: +21.2%

- Valero Energy (NYSE:VLO):

- Dividend Yield: 3.2%

- InvestingPro Upside: +29.6%

- Analyst Upside: +12.3%

- Kraft Heinz (NASDAQ:KHC):

- Dividend Yield: 4.5%

- InvestingPro Upside: +39.7%

- Analyst Upside: +13.4%

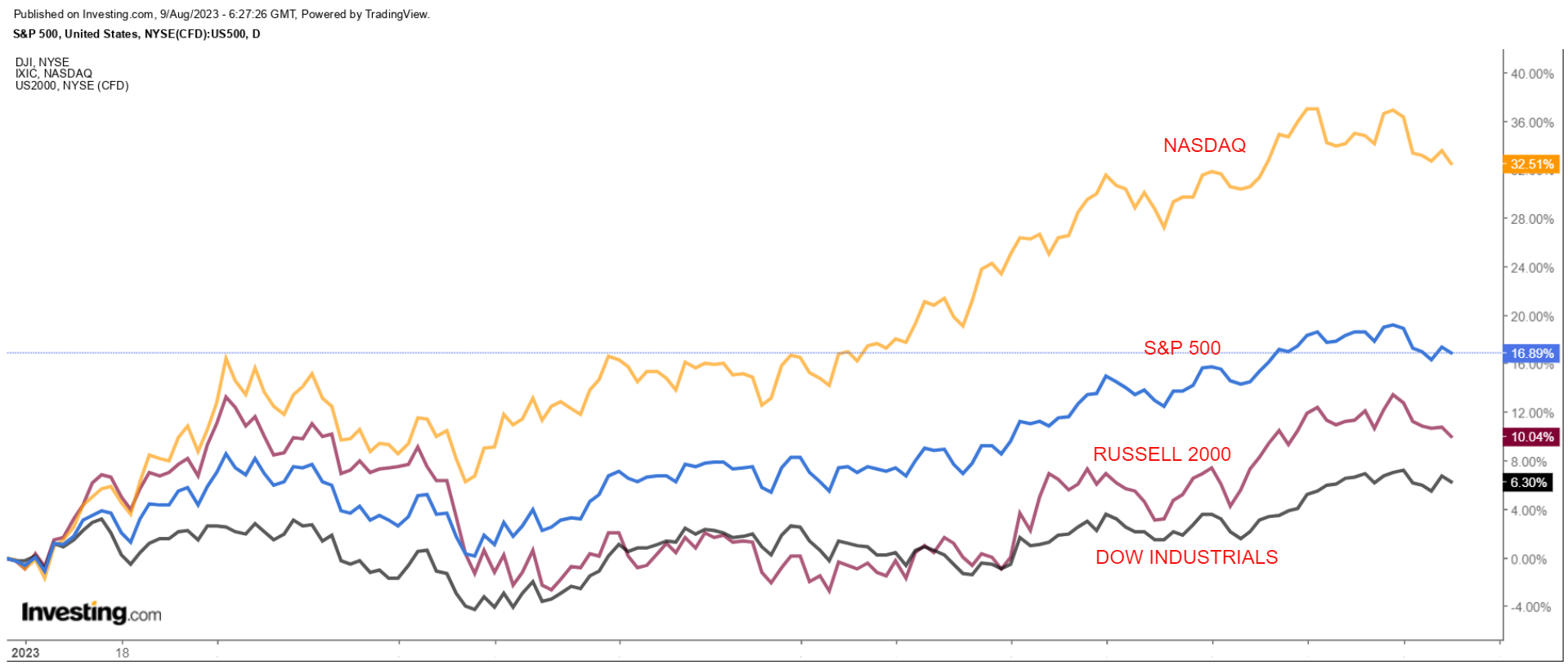

The year-to-date rally on Wall Street seems to have lost momentum, with stocks coming under pressure recently due to renewed fears over the health of the U.S. banking sector and lingering global growth concerns.

After a five-month rally pushed the benchmark S&P 500 and the tech-heavy Nasdaq 100 to within 5% of their all-time highs, August has now recorded five losing sessions out of six, heading into Wednesday.

The S&P 500 is off by 2% this month, the Nasdaq is down 3.1%, while the economically sensitive Russell 2000 index of small-cap stocks has declined 3.5%. The blue-chip Dow Jones Industrial Average has fared slightly better, dipping just 0.7% thus far in August. That should come as no surprise to those who read my article, in which I warned that we are entering a seasonally weak period of the year, and a pullback in August would not be surprising.

That should come as no surprise to those who read my article, in which I warned that we are entering a seasonally weak period of the year, and a pullback in August would not be surprising.

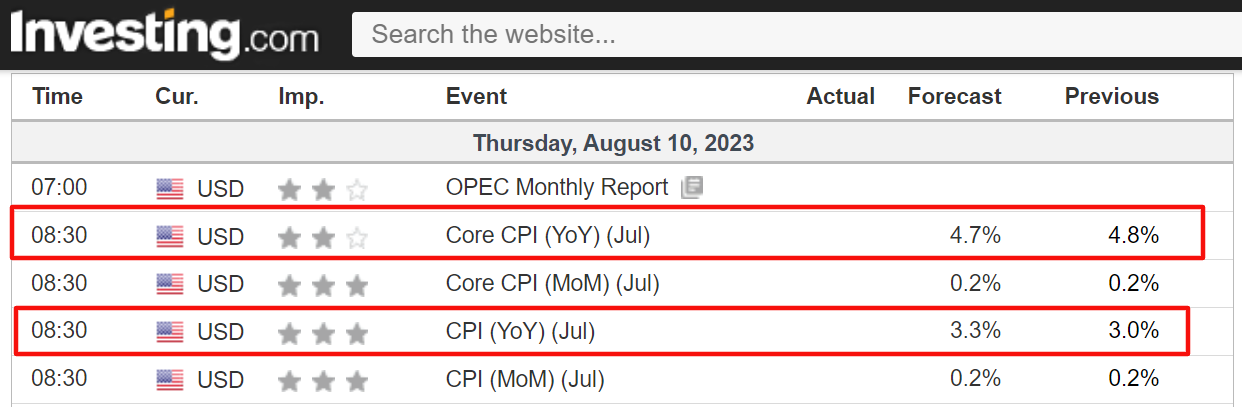

We are not yet out of the woods, as the release of the highly anticipated U.S. July CPI report on Thursday could result in heightened volatility continuing in the days and weeks ahead.

The consensus estimate is that the data will show the headline annual consumer price index accelerating to 3.3% from the 3.0% increase seen in June.

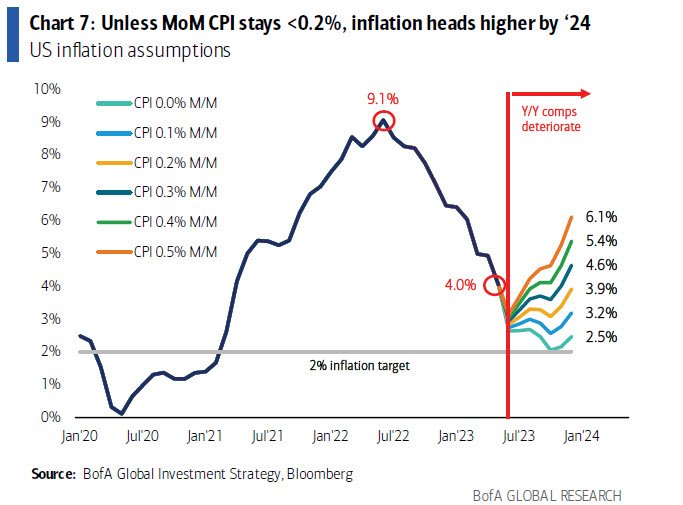

Meanwhile, estimates for the year-on-year core figure - which does not include food and energy prices - call for a 4.7% gain, compared to June’s 4.8% reading. In light of the recent notable increases in energy and food prices, I expect inflationary pressures to reaccelerate in the upcoming months.

In light of the recent notable increases in energy and food prices, I expect inflationary pressures to reaccelerate in the upcoming months.

This trend will likely persist until the end of 2023 and early 2024, with CPI potentially rising back towards a 4.6%-to-5.4% range.

I believe that inflation levels could remain elevated for a more extended duration than what is presently anticipated by financial markets.

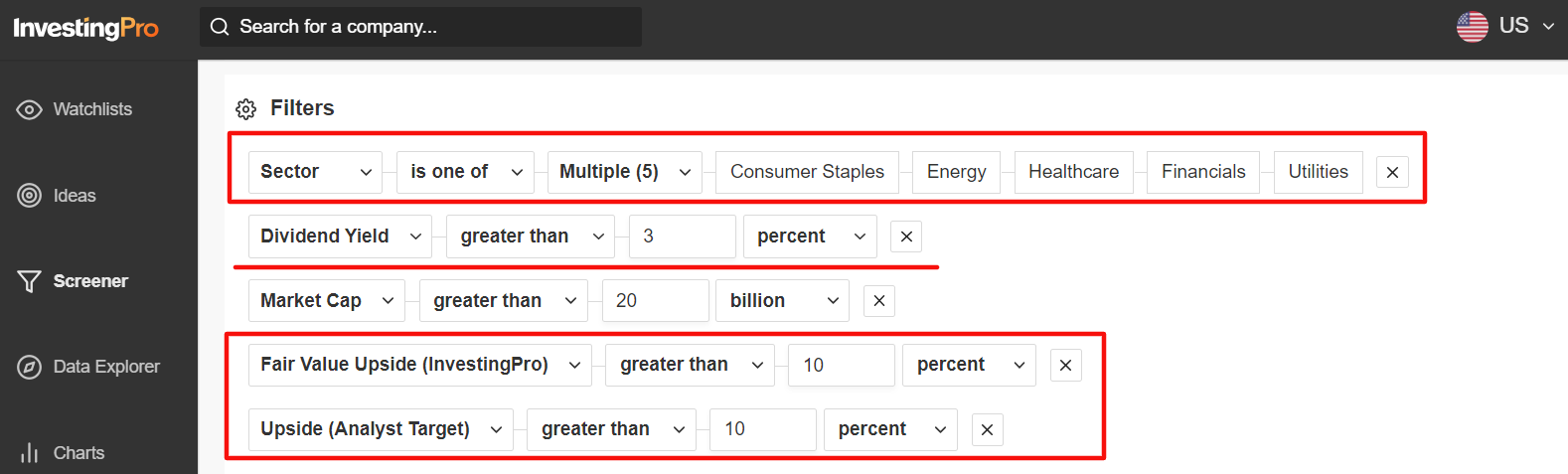

To help you navigate the uncertain macro backdrop successfully, I used the InvestingPro screener to identify some of the best stocks that tend to deliver strong returns during periods of heightened inflation.

In such times, high-quality dividend-paying stocks with solid fundamentals and robust free cash flows tend to stand out as attractive options.

To kick off my process, I first searched for stocks that hail from defensive sectors of the market, such as consumer staples (XLP), energy (XLE), healthcare (XLV), financials (XLF), and utilities (XLU), as their products and services, are essential to people’s everyday lives.

Companies from these industries usually sell a range of goods consumers need regardless of the economy's condition, making them smart buys amid the current environment.

I then filtered for stocks with a dividend yield above 3%.

Finally, I scanned for names with a potential upside of at least 10% based on both InvestingPro ‘Fair Value’ models and Wall St. analyst price targets.

Those companies with a market cap of over $20 billion made my watchlist. Source: InvestingPro

Source: InvestingPro

All the stocks have an InvestingPro Overall Financial Health Label of either “Great” or “Good.” The grade is based on the company’s balance sheet strength, cash flows, and cash flow trends.

Once the criteria were applied, I was left with 26 companies that can weather prolonged periods of high inflation and provide investors with a reliable income stream.

Interestingly enough, all the companies that made my shortlist manufacture products and deliver services that U.S. consumers can’t live without, regardless of economic conditions.

By utilizing the InvestingPro screener's comprehensive analysis and filtering capabilities, investors can uncover dividend-paying stocks that provide a reliable income stream and exhibit the potential for long-term growth, making them resilient options in uncertain economic climates.

15 Best Companies to Invest in During High Inflation Times

Among the S&P 500, these are the best companies to invest in when inflation fears are on the rise:

Source: InvestingPro

Source: InvestingPro

For the complete list of stocks that made my watchlist, start your 7-day free trial with InvestingPro. If you're already an InvestingPro subscriber, you can view my selections here.

*** Disclosure: At the time of writing, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P 500 ETF (SH), ProShares Short QQQ ETF (PSQ), and ProShares Short Russell 2000 ETF (RWM). I am long on the Dow Jones Industrial Average via the SPDR Dow ETF (DIA). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Disclosure: At the time of writing, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P 500 ETF (SH), ProShares Short QQQ ETF (PSQ), and ProShares Short Russell 2000 ETF (RWM). I am long on the Dow Jones Industrial Average via the SPDR Dow ETF (DIA). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.