This article was written exclusively for Investing.com

Earnings season is approaching, and it could be an important one for the overall stock market, given how much stocks have moved up in the last few weeks. Since Mar. 25, the S&P 500 has risen by nearly 8% in almost a straight line. One has to think part of this move higher has been driven by the expectation that earnings season will be a powerful one.

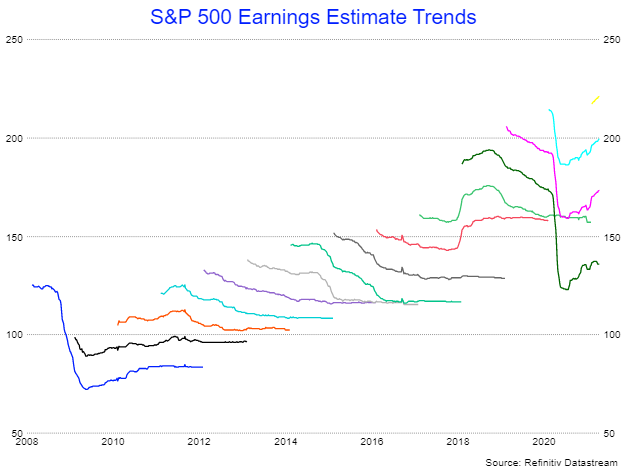

Earnings are now estimated to rise to around $173.53 in 2021, and that is up from $163.59 on Dec. 31, an increase of about 6%. Over the same time, estimates for 2022 have risen to $199.46 from $191.46, an increase of about 4.2%. With increasing earnings estimates going into this quarter's results, earnings will have to be much better than expectations for estimates to continue climbing and to keep the S&P 500 moving higher.

Expectations Come Down Over Time

Historically, it is not common for earnings estimates to continually push higher. In fact, since 2010, earnings estimates have started higher, only to move lower over time in many cases. This is because analysts' and investor's expectations have tended to be too high. While this time may be different due to the re-opening of the economy from lockdowns, as a result of the coronavirus. One needs to wonder if that will be the case for 2022 and even 2023.

The years 2010 and 2011 could be the most comparable to what earnings are now experiencing, coming out of the 2008 to 2009 recession. Earnings estimates in those two years started low and were able to push higher. But from 2012 through 2016, the opposite was true, with earnings estimates starting high and finishing the year at much lower levels.

The one recent exception was in 2018, where earnings estimates pushed higher and stayed up as corporate taxes were slashed and the US economy improved. However, that was a one-year anomaly because 2019 went back to the same outcome of starting high and finishing low, as it had during the rest of the decade, with expectations falling throughout the year.

Will History Repeat

Even with the earnings estimates pushing dramatically higher for this year and next year, they are still well below what investors had initially hoped for. Before the pandemic, analysts' forecasts for 2021 earnings were for $205 per share, while 2022 earnings estimates were thought to be over $214 per share. So, while estimates are down a lot from what they may have been at one time before the pandemic, those same estimates have been moving higher again.

Valuations Are High

However, the higher the earnings estimates climb, the higher the expectations grow as well. It means there will be continued pressure on earnings to come in even better than expected to keep those estimates rising to even higher levels.

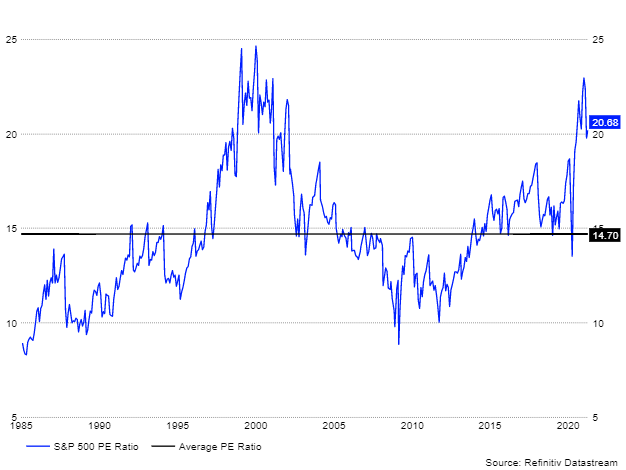

It may be even more critical this year, considering the S&P 500 is currently trading at 20.7 times one-year forward earnings estimates. This is the highest the S&P 500 PE ratio has been since the late 1990s. It means that there is very little room for error during this earnings reporting period.

Therefore these first-quarter results could be more critical than they have in the past, especially if investors hope to keep the bullish momentum in the equity market from fading fast.