- Are you struggling to identify potential bottoms in stocks?

- Don't fret, tools like InvestingPro's fair value can make that process a breeze.

- In this piece, we will take a look at 2 examples where the fair value tool identified a potential bargain before it rallied.

- Unlock AI-powered Stock Picks for Under $7/Month: Summer Sale Starts Now!

Not very often in your trading career will you fully ride a stock's 40%+ gain in a single stretch—let alone two at the same time. Even more uncommon is selling these stocks at the exact moment before they turn lower.

However, that's exactly what our users got to do with two energy giants, namely Diamondback Energy (NASDAQ:FANG) and ONEOK (NYSE:OKE), which skyrocketed over 40% after InvestingPro's fair value tool indicated they were trading at a discount.

Available for less than $7 a month during our summer sale, InvestingPro's Fair Value tool is a secret weapon that uses advanced analytics to identify stocks trading significantly below their true worth.

Here's the beauty: the tool not only identified their upside potential, but it also signaled when they might be nearing their fair value, prompting investors to potentially lock in profits before a trend reversal.

But don't take my word for it; let the real-world results speak for themselves.

Let's dive in.

1. Diamondback Energy: Unveiling a 51.5% Winner Before It Soared

Back in January 2023, while the oil and gas company was already trending upwards, it entered a brief consolidation phase.

That's when InvestingPro's fair value tool stepped in, identifying a potential 40.78% upside when Diamondback was trading at $134.

Fast forward to today, and Diamondback has zoomed past those expectations – skyrocketing a staggering 51.5%.

Closing at $197.88 in the previous trading session, this impressive return not only outpaced the broader S&P 500's 41% gain but also left the energy sector (XLE) in the dust – with a measly 9% increase during the same period.

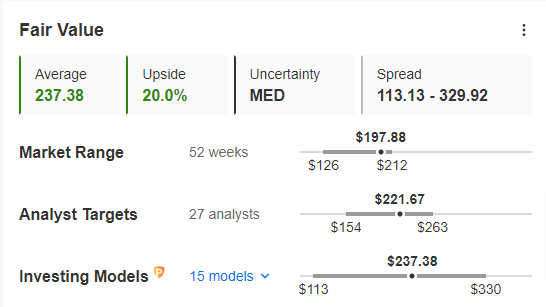

But wait, there's more: The fair value tool still sees a potential upside of 20% from current levels. And the momentum is building – the stock has already surged 6.4% in the last 6 trading sessions.

Source: InvestingPro

This isn't a one-off success story. InvestingPro helps uncover hidden gems across the market. Let's explore another example: ONEOK (NYSE:OKE).

2. ONEOK: Stock Zooms 41% After Fair Value Identifies Upside

On May 26, 2023, this stock underwent a correction but the bulls were ready to step in and buy the dip, as we found out later on. The stock was trading near the $57 level when fair value identified an upside of 44%.

Since then, ONEOK has rallied a staggering 41%, closing at $81 in the previous session.

This impressive performance significantly outpaced the broader market: the S&P 500 returned 31% during the same period, while the energy sector (XLE) lagged with a 15% return.

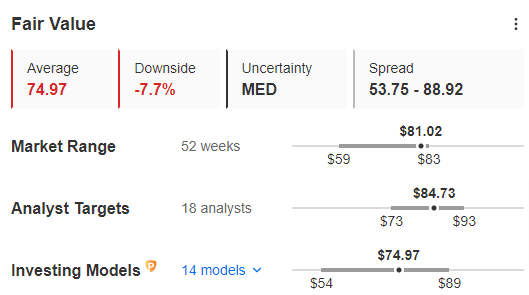

Source: InvestingPro

After rallying to fulfill its upside potential, the fair value tool is now signaling a potential downside for the stock. This means it could be the right time for investors to lock in profits and move on to other potential bargains.

Want to find them?

InvestingPro's fair value tool is your secret weapon for identifying potential market bottoms before stocks explode to fulfill their upside potential.

The proof is undeniable: Diamondback rocketed 51.5% and ONEOK soared 41% after the tool flagged them as undervalued.

Get an extra 10% off by clicking on the banner below:

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.