As 2021 winds down, 2-year/10-year yield curve has been flattening. And it may only worsen in 2022 as the front end of the curve rises while the long end falls.

There are two opposing forces at play: on one side of the equation is the Fed, and on the other side, a world with low rates and growth concerns. With these dynamics occurring in tandem, there will be a lot of confusion created in the markets about what signal the flatter curve may be sending.

It may turn out to be a distortion.

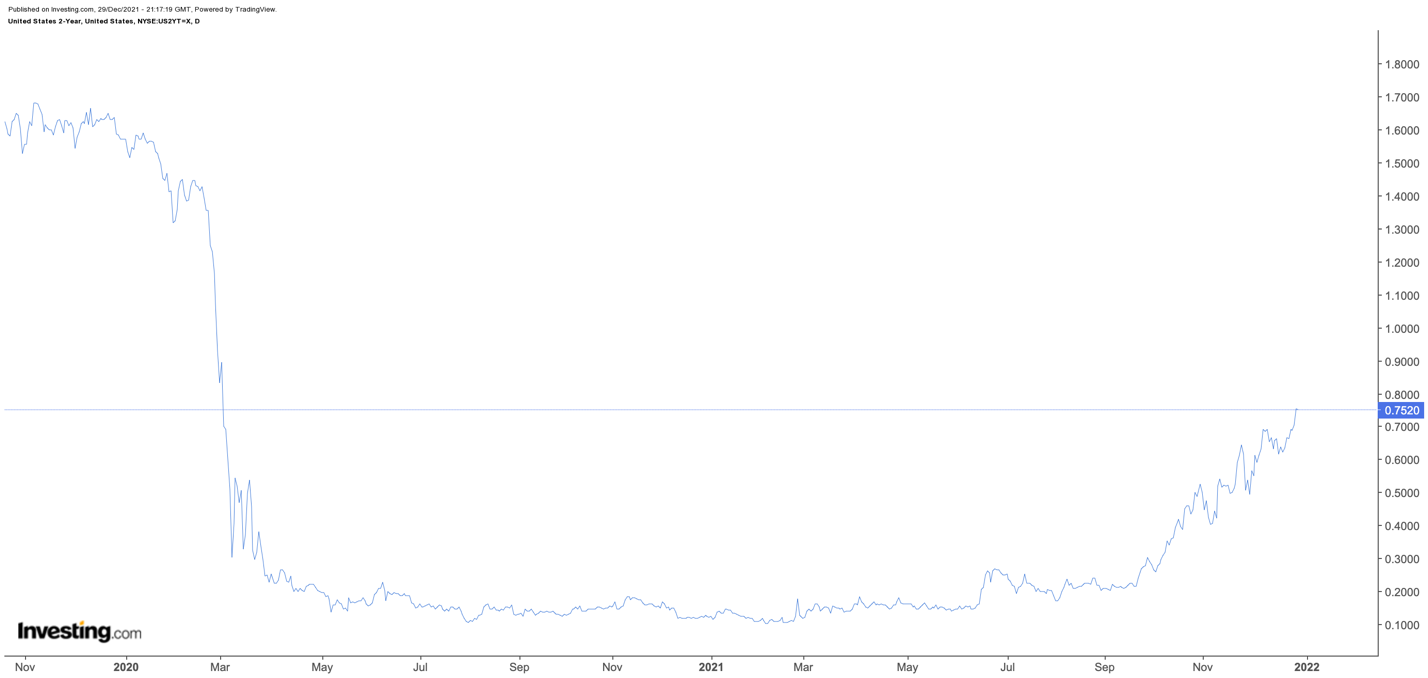

The 2-year Treasury yield has risen sharply in recent months as expectations grow for the Fed to begin to tighten monetary policy in response to high inflation rates. The US 2-year Treasury yield trades around 75 bps as of Dec. 29, up from approximately 14 bps in March. Meanwhile, the US 10-year Treasury yield is currently trading for about 1.54%, lower from its highs of 1.76% in March. This has sent the spread between the 10-year and the 2-year down to 78 bps, from roughly 1.6% in March.

Rising Short-Term Rates

Short-term rates are rising because of expectations the Fed may start to raise interest rates as early as March 2022, with Fed Fund Futures for March trading at 17.5 bps. Meanwhile, the December Fed Funds Futures suggest three rate hikes and are currently trading at 78.5 bps.

If the Fed Fund rate gets as high as futures indicate, the 2-year yield will need to rise dramatically from its current levels, pushing the front of the curve higher.

Meanwhile, the long end of the curve has been falling, which has surprised many investors, despite inflation rates reaching multi-decade highs. The declining rates could result from a market that believes the Fed will need to tighten aggressively and cause a recession, or that high inflation rates will cause a recession.

In either case, it seems the market is worried about a downturn in the future.

Global Yields Making US Rates Attractive

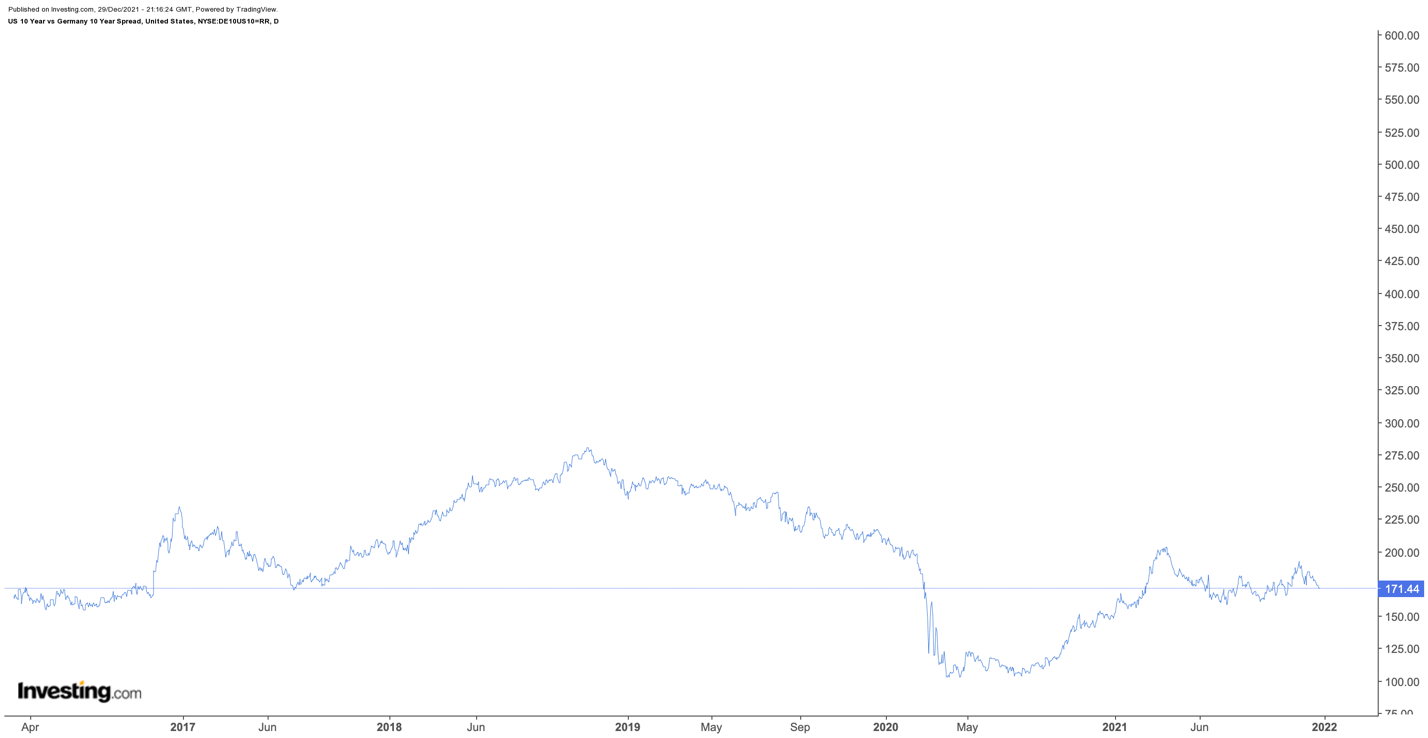

Also playing into these concerns may be how international investors view rates in the US, which are very attractive in comparison to many other sovereign bonds. For example, a German 10-year bund yields -17 bps, which means the US 10-year is 1.7% higher.

So, if the spread between US rates against rates in other parts of the world grows wider, it will attract more buyers of US debt, suppressing the longer-end of the yield curve.

Even Flatter Curve

Overall, this means the yield curve could flatten even further. The technical charts suggest such a decline in the curve could happen, falling potentially to as low as 50 bps.

The 10-2 spread has been hovering around 80 bps for several trading days now and appears to be forming a bearish flag pattern. The next support area might not come until 50-bps if the spread were to narrow.

It could result in a scenario where the 2-year yield climbs to around 1% and the 10-year yield remains around this 1.5% area. This would certainly accomplish the task of flattening the curve and based on where Fed Fund Futures are for 2022, a move to 1% on the 2-year shouldn’t be a huge task.

The flatter curve will lead to much speculation about what the bond market is signaling to investors, perhaps one of a recession or maybe just a market-driven distortion due to nothing more than international investors craving US yields.

Either way, the flatter the curve gets, the more attention it will grab. And at least initially markets will be sure to react just as they always have in the past.