The demand for safe haven eased down this morning waiting for US opening, after yesterday closing because of the independence day.

The market participants will be curious to see the outcome of the G20 Meeting in Hamburg, after the North Korean ICBM test which could spur demand for safe haven instrument yesterday.

The gold came down to be traded again near $1220 per ounce and USDJPY rose to be traded close to 113.50 helping the Japanese equities to recover, after weighing on them by its declining to 112.73 following the North Korean ICBM.

While the monetary policy unchanged stance of BOJ is still weighing down on the Japanese yen, with no signal yet from BOJ of changing its ultra easing policy.

BOJ targets raising the inflation to 2% yearly meanwhile by keeping the governmental bonds yields at the current low level close to zero.

After driving down the interest rate to -0.1% on Jan. 29, 201 to work be beside its QE which has started to expand by yen 80tr yearly since Oct. 31, 2014.

BOJ's members have refrained from sending any signal of tightening its policy showing that there is no probability of watching this step as long as there is no reaching of the 2 yearly target and as long as they are in office.

Last Friday release of Japan National CPI ex fresh foods which is the favorite gauge of inflation to BOJ has shown rising yearly by only 0.4% as expected which has been the highest scale of rising since March 2015 a year after implementing raising the sales taxes by 3% to 8% in the beginning of April 2014 which could add to the inflation annual rate about 1.7%, before diminishing with the release of April 2015 inflation rates.

After receiving signals of shifting towards tighter monetary policy in EU, UK and Canada, the major governmental bonds yields across the globe could score exceptional progress last week but JGB h are still unchanged making the Japanese yen less attractive.

JGB 10YR yield is still close to 0.05%, while US 10YR yield could gain 0.16% to rise to 2.33% last week boosted by Yellen's assurance on the gradual path of tightening continuation in US.

While the markets will be waiting today for the release of the FOMC recent meeting minute of last June 15 when it raised the Fed fund rate by another 0.25% to be between 1% and 1.25% as widely expected expecting another tightening by 0.25% by the end of this year.

The FOMC committee underscored its appreciation of the current inflation pressure easing down in its released assessment following that meeting.

The committee expected the inflation rate to continue to be in the short run below its 2% yearly inflation target, before stabilizing around this rate over the medium term as it targets.

The committee expected the inflation rate to be at 1.6% this year down from 1.9% it's expected in March, but it kept its forecast for 2018 and 2018 at 2% yearly.

April US PCE broad figure and also core figure rose by only 1.4% year on year, while the Fed's target over the medium term is 2% yearly. The PCE is the Fed's Favorite inflation barometer.

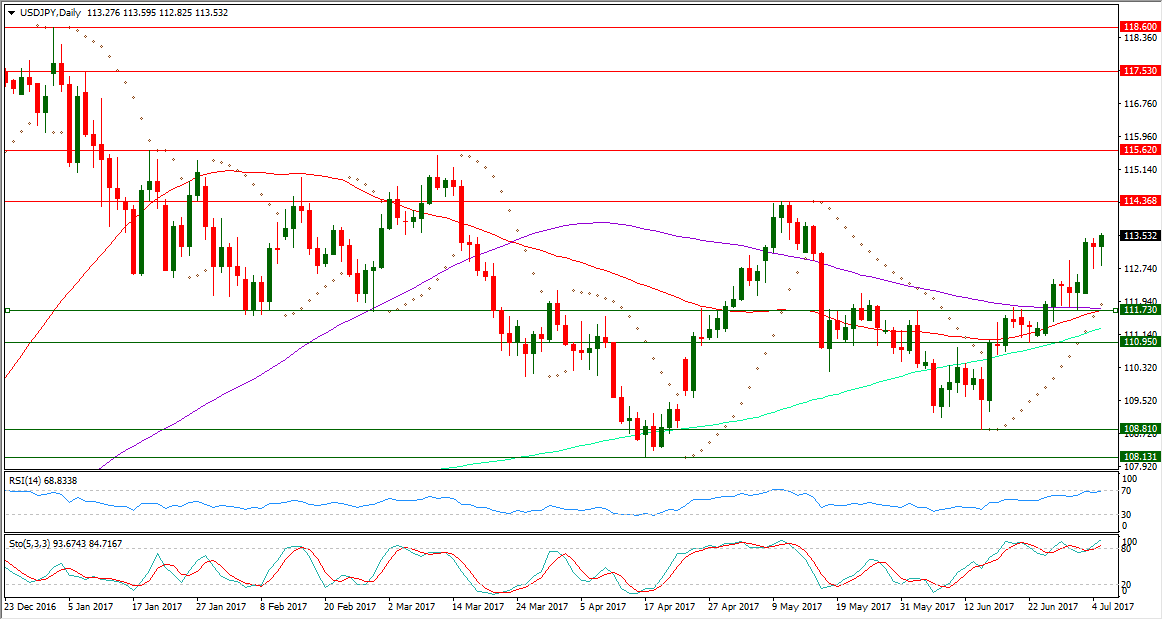

USDJPY could gain momentum to be traded now at a higher place above its daily SMA50, its daily SMA100 and also its daily SMA200

USDJPY is now in its 15th day of being above its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading 111.87 today, after forming a higher low on last Jun. 14 at 108.81 above its bottom at 108.13 which has been formed on last Apr.17.

USDJPY daily RSI-14 is still referring to existence inside its neutral territory but at a closer place to its overbought territory above 70 reading now 68.833.

USDJPY daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line inside its overbought region above 80 at 93.674 leading to the upside its signal line which is lower in the same region at 84.716.

Important levels: Daily SMA50 @ 111.70, Daily SMA100 @ 111.76 and Daily SMA200 @ 111.28

S&R:

S3: 111.73

S2: 110.95

S3: 108.81

R1: 114.63

R2: 115.62

R3: 117.53