Vive La France!

For most traders, the focus last week was on the ramp up into peak Q1 earnings season. We saw solid results from Tesla (NASDAQ:TSLA), the trillion-dollar market behemoth, and brutally bad earnings data from Netflix (NASDAQ:NFLX), leading to the streaming platform shedding a full third of its value.

Perhaps its time to replace Netflix with Tesla in the popular FAANG acronym? Maybe we could get FANTA soda to sponsor the rebrand?

Looking ahead, traders will spend Monday digesting the market implications of this weekend’s French Presidential election. Heading into the middle of the week, the focus will once again be on earnings with heavy hitters like Alphabet/Google (NASDAQ:GOOGL), Meta/Facebook (NASDAQ:FB), Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), and Amazon (NASDAQ:AMZN) all scheduled to release their results between Tuesday and Thursday.

Later in the week, macroeconomic data will also drive markets, with the first estimate of Q1 US GDP on Thursday, along with inflation data from both the Eurozone and the US (Core PCE) on Friday with potentially big implications for central banks.

75Bps?!

Speaking of central banks, the pressure is growing on the US Federal Reserve as it enters the “blackout period” before the May 4 meeting. Notably, the last comments we heard from Fed policymakers were Fed Chairman Powell stating that “50 basis points will be on the table for the May meeting” and noted hawk James Bullard refusing to rule out a 75bps interest rate hike next month.

Indeed, it’s increasingly clear that the US central bank is coming around to the idea that it needs to raise interest rates extremely aggressively to rein in inflation.

In that light, the hint at a 75bps rate hike, a move the Fed hasn’t made since 1994, isn’t as outlandish as it may seem to traders who haven’t been in the game for the last 28 years (which is almost all of us!).

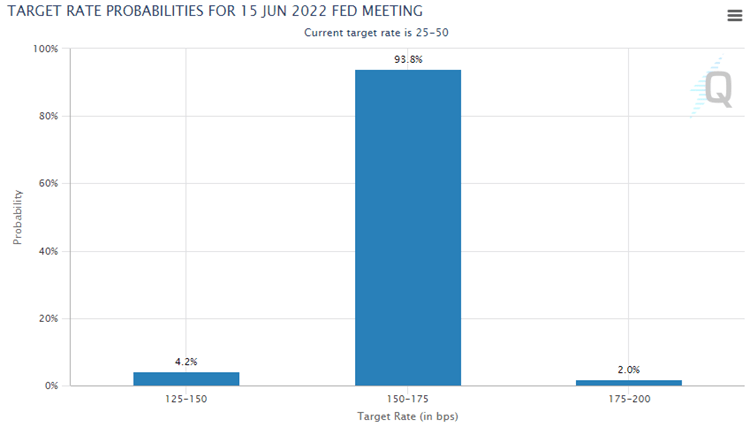

Indeed, according to the CME’s FedWatch tool, traders are currently pricing in a 95%+ chance of AT LEAST one 75bps rate hike in the Fed’s next two meetings:

Source: CME FedWatch

In other words, traders are convinced that the Fed is going to raise interest rates aggressively “until something breaks.” Given the imprecision of monetary policy and long lag times for interest rates to impact the underlying economy, volatility across markets will likely remain elevated throughout the rest of the year.

In terms of what to watch on this front in the coming week, Friday’s Core PCE report will be key. The Fed’s preferred inflation measure has risen for each of the last five months, though early estimates are that it may merely hold steady at 5.4% y/y in this week’s iteration.

An upside surprise, if seen, could open the door to a 75bps as soon as next Wednesday (with potentially big bullish implications for the US dollar, and bearish implications for US equities), so readers should keep a close eye on the release.

French Presidential Election

Investors have certainly underestimated some high-profile populist candidates and initiatives in recent years (Trump, Brexit, etc.), but make no mistake, a victory by Marine Le Pen would be a big surprise.

Following last week’s TV debate, incumbent President Emmanuel Macron is holding a 12-point lead in the polls. Many analysts have speculated that a Le Pen victory could trigger a constitutional crisis (and would certainly inject volatility into French and European markets), so traders holding positions over the weekend should be aware of the risk, even if it’s not a particularly likely outcome.

Make-Or-Break Week For Earnings

This week marks the peak of Q1 earnings season, highlighted by five of the seven largest US firms by market cap all reporting results.

So far, earnings season has been a bit of a mixed bag, with prominent “misses” like Netflix garnering plenty of headlines. Overall, the percentage of S&P 500 companies beating EPS estimates is roughly in-line with historical averages, though the overall earnings growth rate tracking to “just” around 5%, which would mark the smallest increase in profits in the past five quarters.

Key earnings reports to watch this week:

- Monday: Activision Blizzard (NASDAQ:ATVI)

- Tuesday: MSFT, GOOG, Texas Instruments (NASDAQ:TXN), Visa (NYSE:V), HSBC Holdings (NYSE:HSBC)

- Wednesday: FB, Boeing (NYSE:BA), Ford (NYSE:F), Lloyds Banking (LON:LLOY) Group (NYSE:LYG), PayPal Holdings (NASDAQ:PYPL), Qualcomm (NASDAQ:QCOM), Spotify Technology (NYSE:SPOT)

- Thursday: AAPL, AMZN, Intel (NASDAQ:INTC), Mastercard (NYSE:MA), Caterpillar (NYSE:CAT), McDonald’s (NYSE:MCD), Twitter (NYSE:TWTR)

- Friday: Chevron (NYSE:CVX), Exxon Mobil (NYSE:XOM), Natwest (LON:NWG) Group (NYSE:NWG)

Check out my colleague Josh Warner's thorough earnings preview article for more detail!

Economic Data

A complete list of major economic data due out this week follows:

Monday

- German IFO Business Survey (8:00 GMT)

- BOC Governor Macklem Speech (15:00 GMT)

Tuesday

- BOJ Core CPI (5:00 GMT)

- US Durable Goods Orders (12:30 GMT)

- US Consumer Confidence (14:00 GMT)

Wednesday

- AU CPI (1:30 GMT)

- US Pending Home Sales (14:00 GMT)

Thursday

- BOJ Monetary Policy Meeting (TBD)

- German Preliminary CPI (TBD)

- US Advance GDP (12:30 GMT)

Friday

- AU PPI (1:30 GMT)

- German GDP (8:00 GMT)

- Euroone CPI (9:00 GMT)

- CA GDP (12:30 GMT)

- US Core PCE (12:30 GMT)

Chart Of The Week

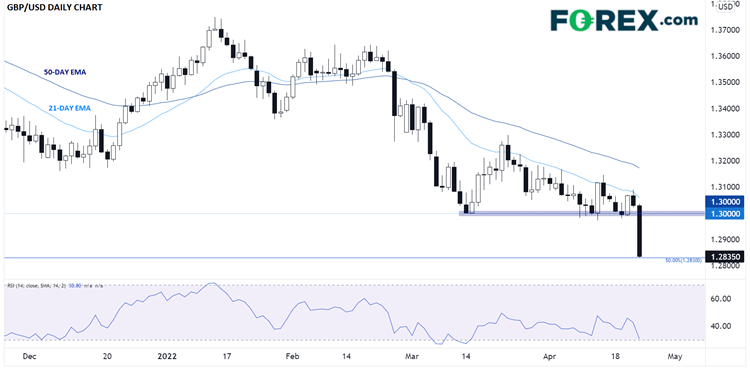

Source: TradingView, StoneX

After barely holding onto the widely-watched 1.30 handle for the last several weeks, GBP/USD bears were able to break that support level with conviction on Friday.

Earlier in the day, BOE Governor Bailey came out with some downbeat comments on the UK economy, prompting traders to question how aggressively the central bank will raise interest rates throughout the rest of the year.

That, combined with technical selling below the key 1.30 level led to a near 200-pip collapse in the pair on Friday.

Looking ahead, bulls may see some respite if cable can bounce off the 50% Fibonacci retracement of its post-COVID rally at 1.2830, but the bias will remain for lower prices as long as previous-support-turned-resistance near 1.3000 caps rates.

A break below 1.2830 could expose the September 2020 low near 1.2700 next.