Technically, S&P 500 has become more vulnerable to the downside over the short term opened to meet 2300 psychological level, after forming a lower high at 2390.01 on Mar. 15 below its all times high at 2400.98 which has been formed on Mar. 1.

The market participants became unsure of the impact of the reflation plans, while the probability of executing them is coming down, as the new Administration facing rising criticizing in the congress.

While the higher interest rate outlook in US has become a clear threat to these financial stimulating plans,

As the Fed's fund rate rising direction can erode their influences showing that it is not the best time to take such plans by this cost which can reach 1tr USD as Trump announced previously.

EURUSD has become boosted by the probability of watching rising of the deposit rate before ending of the ECB's QE, After the ECB's member Nowotny indicated that there could be raising of the deposit rate, before its main refinancing rate, while the QE is still working.

GBPUSD could easily be underpinned by rising of the interest rate outlook in UK, after the inflation data over the consuming level in UK has shown rising of the CPI yearly by 2.3% last February which is the fastest pace of rising since September 2013, while the consensus was referring to increasing by only 2.1% after ascending by only 1.8% in January.

While BOE target is only 2% yearly and it has not been seen since December 2013.

The MPC has voted last week 8 to 1 to keep the interest rate unchanged at its 0.25% historical low as it has been since last Aug. 4.

As Kristen Forbes voted in favor of hiking the interest rate by 0.25% for containing the inflation pressure amid rising of the wages and increasing of the energy prices, while the British pound is still depressed by the Brexit voting consequences.

WTI came under pressure to be trade near $48.15 per barrel during the beginning of the Asian session, after API figure has show rising by 4.5m barrels.

While the energy market is waiting today for EIA Crude Oil Stocks change to show rising by only 2.8m barrels after decreasing by 0.237m barrels in the week ending on Mar. 10 drove the total inventory down to 528,156 from 528,393 a week earlier.

However the prices are still boosted by Saudi Energy Minister Mohamed EL Faleh's comment that the OPEC could extend its agreement to reduce output, if stockpiles remain above the five-year average.

After the Mohammad Sanusi Barkindo The General Secretary of the Organization of the Petroleum Exporting Countries has previously said the same in London oil Forum last month.

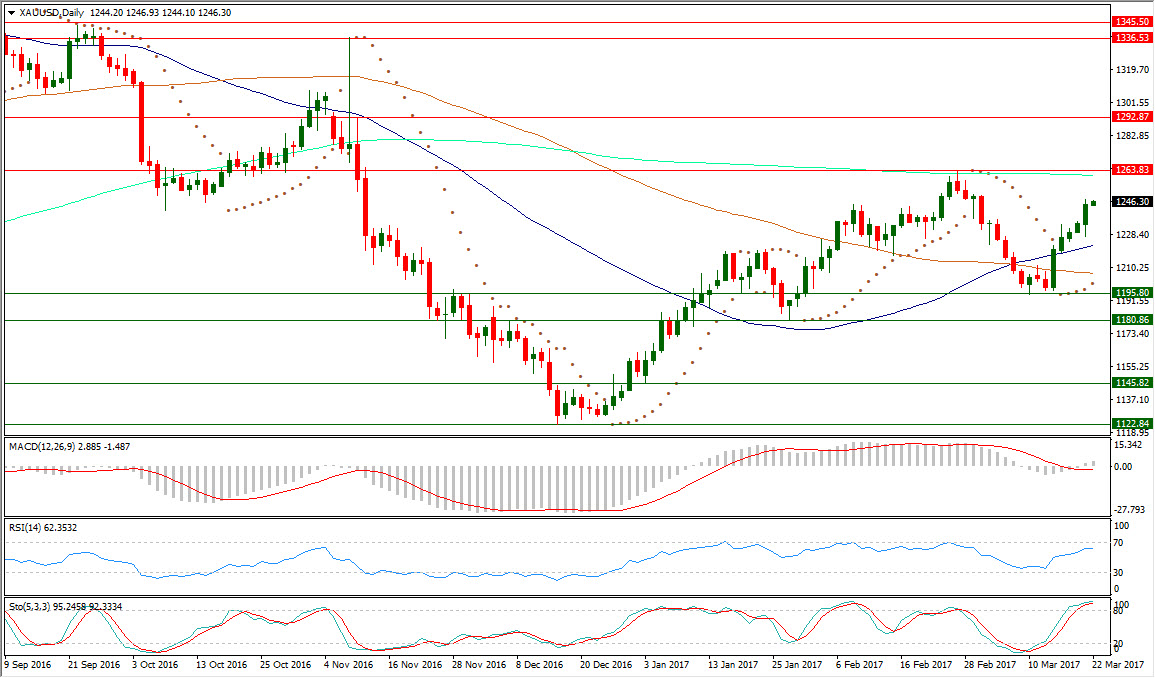

With this risk aversion sentiment, The gold kept its ascending pace up in its fifth day above its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading 1201.

After the gold had formed a higher low at $1195, above its previous low which has been formed on last Jan. 27 at $1180.53 which has previously formed above last Dec. 15 bottom at $1122.85.

The Gold is now above its daily SMA50, after surpassing its daily SMA100 but it is still under pressure over longer range by being below its daily SMA200, as it formed a peak with meeting with it on last Feb. 27 at $1263.83.

XAUUSD daily RSI-14 is referring now to existence in a higher place inside the neutral region reading now 62.353.

Also its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the overbought region above 80 at 95.245 leading until now to the upside its signal line which is at 92.333.

Important levels: Daily SMA50 @ $1222.38, Daily SMA100 @ $1206.78 and Daily SMA200 @ $1260.95

S&R:

S1: $1195.80

S2: $1180.86

S3: $1145.82

R1: $1263.83

R2: $1292.87

R3: $1336.53