- Sharp rally has pushed the S&P back into overbought territory

- Earnings estimates for the index are now declining

- A return to the historical average PE would value the S&P 500 at 3,950

Stocks have seen a powerful rally over the past couple of weeks, with the S&P 500 up sharply. This big rally hasn't accomplished much, and the speed may have done more harm than good. Now, the S&P 500 is overvalued again, and what may be worse here is that earnings estimates for this year and next year are declining.

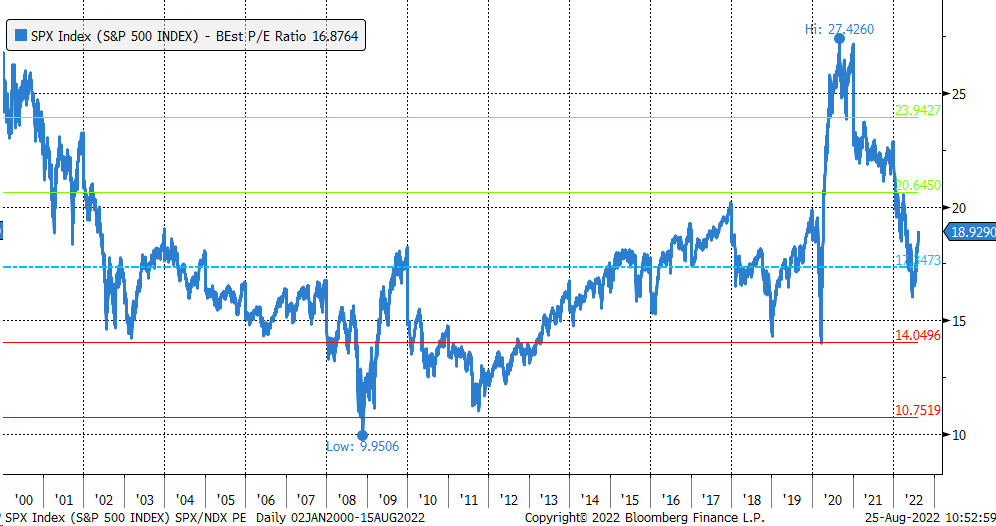

Since the mid-June lows, the S&P 500 saw its PE ratio for 2022 rise to 18.9 from 16.0. That is a massive move in a PE ratio over such a short period. It also makes the S&P 500 very expensive compared to its historical valuation. Since 1990, the average S&P 500 PE ratio has been around 17.4.

Another consideration when it comes to the valuation of the S&P 500 is that over that same period, interest rates have been very volatile but, more importantly, have risen and, in some cases, back to their June highs. This has narrowed the spread between the earnings yield (inverse of the PE ratio) and the 10-year Treasury rate to just 2.37%. The last time the equity risk premium was around 2.37% was in the fall of 2018, and the only time it was lower was in April 2022. In both cases, the equity market fell sharply.

Earnings Estimates Fall

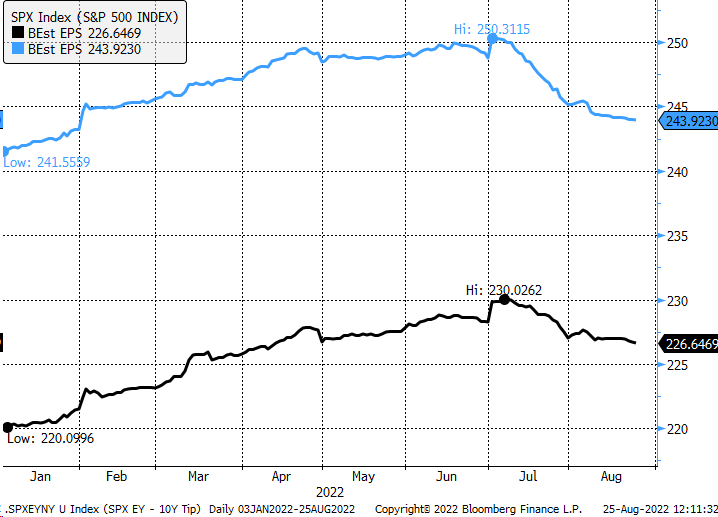

Also, helping to push the PE ratio higher, and the earnings yield has been falling earnings estimates. They haven't lost much, but the further those estimates fall, and the more the equity market rebounds, the higher the PE ratio will climb.

As of August 24, earnings estimates for the S&P 500 have fallen to $226.65 per share for 2022, from a peak of $230.02 per share, or 3.4%. Meanwhile, estimates for 2023 have fallen to $243.92 from $250.31 per share at the beginning of July, or 2.5%. The declines are minimal, but the trend is negative.

The falling earnings estimates and rising rates are helping to push the S&P 500 index back into an overvalued state. At the same time, the rally has undoubtedly helped to recover some of the losses, but unless rates start to fall materially and earnings start to improve. The equity rally will be tough to continue from a fundamental standpoint.

The Index May Only Be Worth 3,950

Obviously, momentum can be a powerful force, which has broadly pushed the index higher and put it back into this overvalued territory. However, at some point, if fundamentals do begin to matter again, it could result in the S&P 500 trading down to that historical average of around 17.4, valuing the index around 3,950, or even falling back to that June low of 16. Given all of the uncertainty around the state of the economy and the path of monetary policy, a drop back to 16 does not seem out of the question, pushing the index back to around 3,625.

As the market continues to push and pull between momentum and fundamentals, it will likely create plenty of market volatility, that is for sure.

Disclaimer: Charts used with the permission of Bloomberg Finance LP. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.