After widely expected winning of Macron, The single currency has been exposed to profit taken following upside opening gap across the broad.

As supporting Macron was the legacy of all other candidate for presidency in France, Macron could easily get presidency by wide gap showing the French will of being in EU.

The gold could easing creep up with the profit taken sentiment to be traded close to $1235 per ounce, after dipping down to 1225 in the beginning of the week.

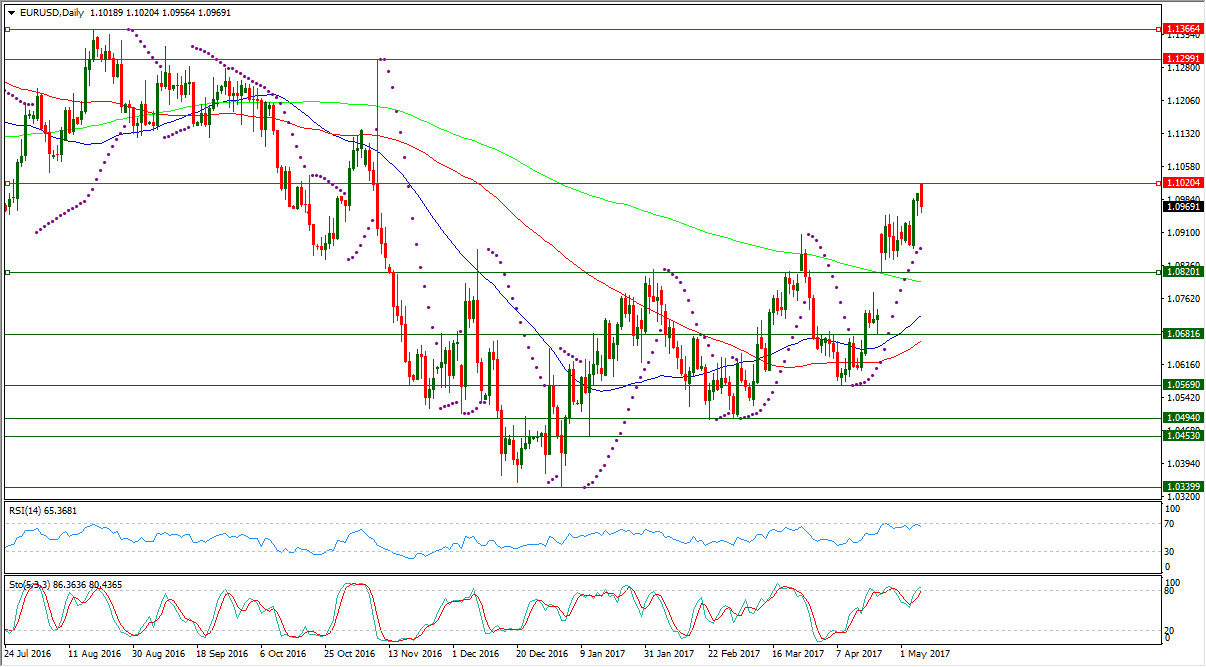

After reaching 1.1020, EURUSD came under selling off pressure to be traded in the same first Asian session of the week near 1.0970.

The risk appetite which has been boosted by the end of last week by the expected winning of Macron came under pressure after the winning occurrence on buying on rumor selling on fact.

After opening near 113 but below it, USDJPY came under pressure to be traded in the same Asian session near 112.65, as the demand for the low yielding Japanese yen could increase again on unfolding of the risky assets.

As the French presidential results could drive the investors to unwind their previously loaded risky assets following the initial results of the first round in April.

The opening of the EU session is expected to be exposed to the same profit taken wave in the equities markets but the economic optimism can be in check later during the day.

After closing last week at 1.0998, EURUSD opened the new week on an upside gap at 1.1020 but quickly it came under pressure to fill that gap trading currently near 1.0970

EURUSD could form previously an upside gap in beginning of the week opening on last Apr. 24 at 1.0908 but its retreating from it was limited above 1.0820 to keep existence until now above its daily SMA200.

EURUSD is still underpinning by forming series of higher lows above 1.0339 which has been reached on the third day of this year to be the lowest level since December 2002.

EURUSD daily RSI-14 is referring now to existence inside the neutral region reading 65.368.

EURUSD daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is still having its main line in the overbought region at 86.363 leading to the upside its signal line which is at 80.436 because of the opening gap of the week at 1.1020.

EURUSD is in its eighteenth day of existence above its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today 1.0874.

Important levels: Daily SMA50 @ 1.0725, Daily SMA100 @ 1.0666 and Daily SMA200 @ 1.0800

S&R:

S1: 1.0820

S2: 1.0681

S3: 1.0569

R1: 1.1020

R2: 1.1299

R3: 1.1366