The greenback is still depressed versus GBP, EUR and loonies, After last week comments from BOE, ECB and BOC chiefs who have signaled shifting towards tighter monetary policy raising the costs of borrowing significantly last week in the secondary markets.

As The ECB president Draghi has boosted demand from the single currency last week by his comments that the economic growth in EU is broadening but the prudence in adjusting the monetary policy is still needed, while the inflation risks have become to the upside not to the downside.

GBPUSD soared too to be traded above 1.30 psychological level, after Mark Carney commented that the BOE may be in need to begin raising interest rate soon.

BOE’s MPC members have voted in their last meeting on last Jun. 15 5-3 to leave the interest rate unchanged showing lower tolerance of watching the inflation level above its 2% yearly inflation target.

Bank of Canada Governor Stephen Poloz indicated too in a CNBC interview last week that interest rate cuts have done their job and that levels are now looking extraordinarily low.

his comments pushed USDCAD down to be traded well below 1.30, while the markets participants are waiting now for BOC to be the first major central bank to follow the Fed's tightening steps by starting raising the interest rate in its next meeting on Jul. 12 by 0.25%.

Poloz indicated that Canada major regions had watched strong growth but this growth likely to slow moderately in the upcoming quarters.

He said that the Fed is now two years ahead of Canada because of the recent oil price shock that forced the Bank to cut rates to that levels.

While the most recent surveys of BOC has shown that the Canadian business leaders have now the strongest outlook since 2011 reaching 2.81 from 0.73 in the previous quarter.

BOC’s quarterly Business Outlook Survey of summer 2017 has shown last Friday evolving economic activities in Canada broadly with improving of the inflation outlook and higher trust in hiring.

From another side, The inflation figures which came out from US last Friday have highlighted lower pressure on the Fed to raise rates.

As April PCE broad figure and core figure also rose by only 1.4% year on year while the Fed's target over the medium term is 2% yearly.

The PCE is the Fed's Favorite inflation barometer and The committee underscored its appreciation of the current inflation pressure easing down in its released assessment.

The committee expected the inflation rate to continue to be in the short run below its 2% yearly inflation target, before stabilizing around this rate over the medium term as it targets.

The committees expected the inflation rate to be at 1.6% this year down from 1.9% it's expected in March, but it kept its forecast for 2018 and 2018 at 2% yearly.

While monetary policy stance in Japan is still looking unchanged weighing down in the Japanese yen by its BOJ''s ultra easing policy which targets raising the inflation to 2% yearly meanwhile by keeping the governmental bonds yields too at the current low level close to zero.

After driving down the interest rate to -0.1% on Jan. 29, 201 to work be beside its QE which has started to expand by yen 80tr yearly since Oct. 31, 2014.

BOJ's members have refrained from sending any signal of tightening its policy showing that there is no probability of watching this step as long as there is no reaching of the 2 yearly target and as long as they are in office.

Last Friday release of Japan National CPI ex fresh foods which is the favorite gauge of inflation to BOJ has shown rising yearly by only 0.4% as expected which has been the highest scale of rising since March 2015 a year after implementing raising the sales taxes by 3% to 8% in the beginning of April 2014 which could add to the inflation annual rate about 1.7%, before diminishing with the release of April 2015 inflation rates.

The Japanese PM Abe has delayed the next 2% rising of the sale tax 2.5 years, instead of raising it with the beginning of the current financial year to support the economy.

Abe LDP ruling party is looking ahead of having a stronger than expected failure in Tokyo elections which can put many positions in his cabinet in check.

The major governmental bonds yields could score last week exceptional progress but JGB which are still unchanged making the Japanese yen less attractive.

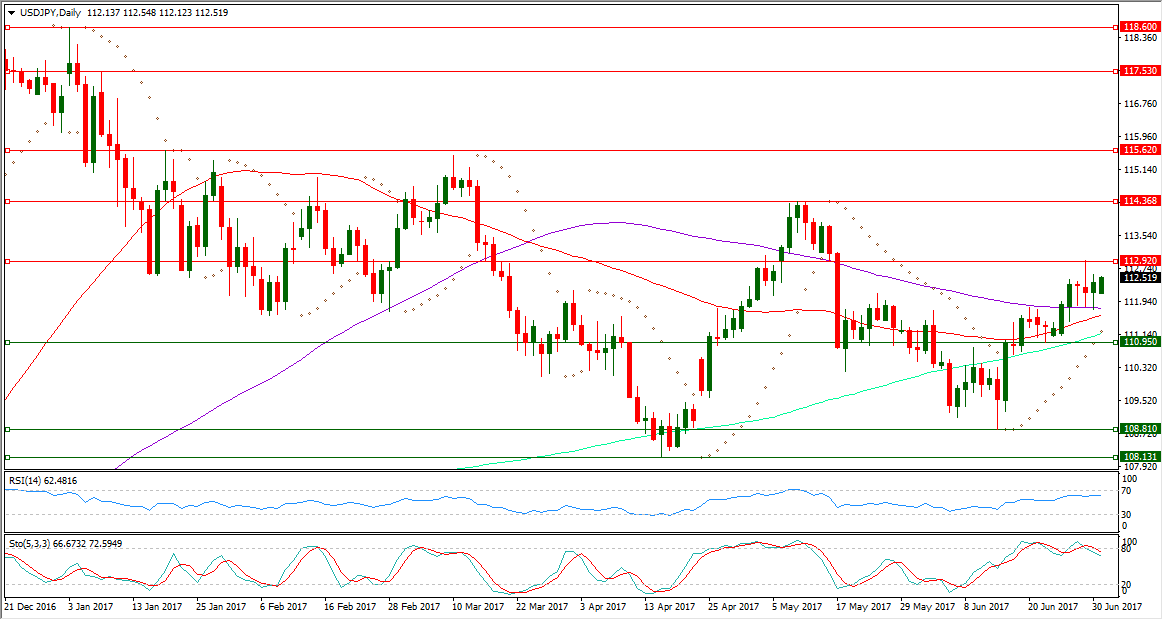

USDJPY is still keeping existence well below its daily SMA50, its daily SMA100 and also its daily SMA200

USDJPY is now in its 13th day of being below its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading 111.20 today, after forming a higher low on last Jun. 14 at 108.81 above its bottom at 108.13 which has been formed on last Apr.17.

USDJPY daily RSI-14 is referring now to existence inside its neutral territory reading 62.481.

USDJPY daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line inside its neutral region at 66.673 leading to the downside its signal line which is also in the neutral region at 72.594.

Important levels: Daily SMA50 @ 111.59, Daily SMA100 @ 111.77 and Daily SMA200 @ 111.15

S&R:

S3: 110.95

S2: 108.81

S3: 108.13

R1: 112.92

R2: 114.36

R3: 115.62