The concerns of watching depleting inflation pressure in US could dampen the interest rate outlook, after Apr US CPI has shown by the end of last week rising yearly by only 2.2%, while the median forecast was referring to increasing by 2.3% after rising in March by 2.4% year on year.

US 10-year Treasury note yield slipped 0.06% to 2.32% last Friday following the release of this figure which makes the Fed in no rush to raise the interest rate to contain the price upside pressure.

The FOMC has already weakened the odds of raising rates by highlighting the lower than expected US GDP annualized expansion in the first quarter by only 0.7% in its economic assessment following the committee members meeting on May. 3.

But The committee has suggested that lower than expected expansion can be transitory expecting upward revision of this dovish reading and also better growth rate later this year underpinned by the labor market continued improving which supports the inflation outlook to reach The Fed's 2% yearly target.

The gold could get use of the lower interest rate outlook in US and also could be boosted by North Korea missile test during the weekend.

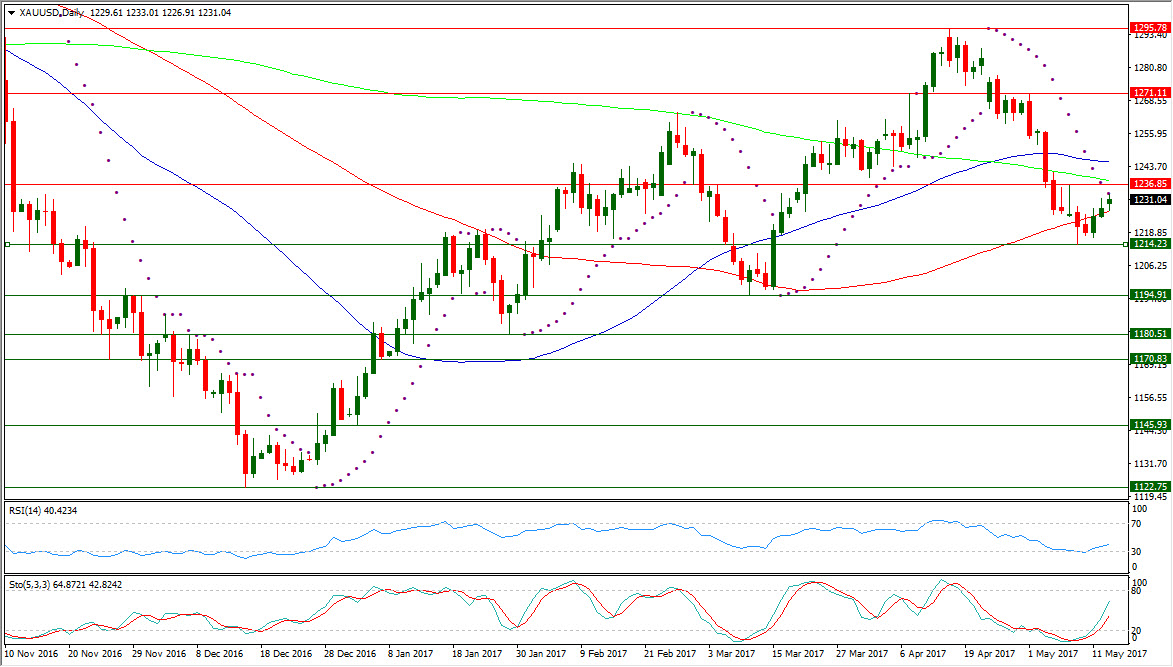

After finding bottom to rebound at $1214.23, the Gold could creep up to be traded just above $1230 to find a place again above its daily SMA100, but it is still undermined over longer term by continued existence below its daily its daily SMA200.

XAUUSD is still also below its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today $1233.55 in its 16th day of being above the trading rate.

The gold has been exposed to selling off drove it down below $1239.62 per ounce supporting level which could prop it up previously on Mar. 31.

the gold lived in overlapping price range of the upside wave from $1180.51 to $1263.85 undermining the ascending channel, but it could hardly have a higher low at $1214.23 above its previous formed bottom at $1194.91 on last Mar. 10.

XAUUSD daily RSI-14 is now referring to existence at a higher place inside its neutral area reading 40.423.

XAUUSD daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in its neutral region at 64.872 leading to the upside its signal line which is in the same territory at 42.824, after bottoming out inside its oversold region below 20.

Important levels: Daily SMA50 @ $1245.54, Daily SMA100 @ $1226.82 and Daily SMA200 @ $1238.45

S&R:

S1: $1214.23

S2: $1194.91

S3: $1180.51

R1: $1236.85

R2: $1271.11

R3: $1295.78