The gold could extend its rally to be traded now near $1287 per ounce, after last Tuesday surpassing of $1270.50 which stopped it last Friday following the dovish release of Mar US non-farm payrolls which have shown adding only 98k of jobs, while the consensus was referring to gaining 180k.

These are the highest levels of Gold since the Aftermath of Trump's winning of the presidency in US on last Nov. 9 which has been read as good news for Gold "for his aggressive reactions" and bad of the US dollar "for his criticism of its value".

The Gold rose to $1336.33 per ounce following his winning of the presidency, before tumbling to $1122.85 on the reflation optimism and the higher interest rate outlook in US.

The US dollar slide yesterday across the broad came exactly on these same markets expectations, after Trump signaled to Wall Street Journal that it's too strong refraining from naming China currency manipulator.

Monetarily, The Gold could find it easy to record gains versus the greenback, after The FOMC's last meeting minutes of last March have shown serious talking this time about unwinding the Fed's portfolio of treasuries and mortgage backed securities, not just reference to this holding as what has happened in the previous meetings minutes.

The Fed's balance sheet is containing now $4.5 trillion, After 3 Fed's QE rounds for propping up the US economy because of the credit crisis.

As The Fed has kept until now the principal of repurchasing these financial securities it holds on their maturities.

This considered action by the FOMC can give it leeway to slow its hiking of the interest further to be satisfied by tightening the Fed's holding of these financial securities somehow.

As New York Fed President William Dudley said that shrinking the Fed's $4.5 trillion bond portfolio would prompt only a "little pause" in the Fed's rate hike plans keeping market expectation of more than one rate increase this year alive.

But this waited action which can be considered a tightening action can be later looking a must during the Fed's current tightening cycle, but it should be done by a gradual way can be prematurely expected.

While the FOMC's members talking about that crucial subject is still looking to the market participants in a preliminary phase for testing the markets reactions.

The Fed can manage to reverse this twist by lower its Bonds maturities or stopping its reinvestment in the US debt.

After the Fed has made what's named an "Operation Twist" program in late 2011 and 2012 to stimulate the economy by buying longer term Treasuries selling some of its holding of short term treasuries for pressing on the long term treasuries yields in the secondary market.

The operation twist has been taken place in 2 rounds. The first has been from September 2011 till June of 2012 and its value was $400 billion, while The second has been from July 2012 to December 2012 and its value was $267 billion.

The Fed’s now holding $426 billion of Treasuries maturity in 2018 and also $352 billion for 2019.

The US administration has indicated this week that there could be also reaction against the exploding barrels using in Syria against civilians.

While Russia and Iran said in accompanied statement that "US has crossed the Red Line by its illegal military reaction which came without investigation reminding the world by its military attack against Iraq in 2003 for fake chemical weapons existence in Iraq.

The oil prices could be boosted by this tension in the middle east which can threat the supplies from it, while the odds of extending the OPEC's cut was underpinning the prices

After Kuwait and other countries supported prolonging the production cuts that are scheduled to expire in June, as the Persian Gulf emirate’s Oil Minister Issam Almarzooq said.

While the strategy of US in this phase is still the same dampening the prices by overwhelming production, driving its rigs utilization up, raising its inventories up further to new highs.

The far east was not in a better situation, after escalating between US and North Korea, after Trump has indicated in a new message of him on Twitter that "the Chinese help will be appreciated but "US would solve the problem with North Korea with or without China"

His message has already come after US has moved also naval warships from Australia not to Japan sea but to South Korea directly which means that it is taking attacking position.

The US 10 year note yield has fallen yesterday to its lowest level since last Nov. 17 reaching 2.26% on the current lower interest rate outlook and the mounting geopolitical concerns which spurred demand for fixed assets.

The Gold could be more attractive by the current lower yields in the US money market, while the demand for it can continue to be boosted by the risk-off sentiment could gather more momentum this week following Trump's military reactions in the middle east and the far east.

With this dovish market sentiment, the Japanese yen could be the most buoyed currency this week, as this low yield financing currency could be supported by unwinding of the carry trades putting more pressure on Nikkei 225 which is already depressed by the US equities losses.

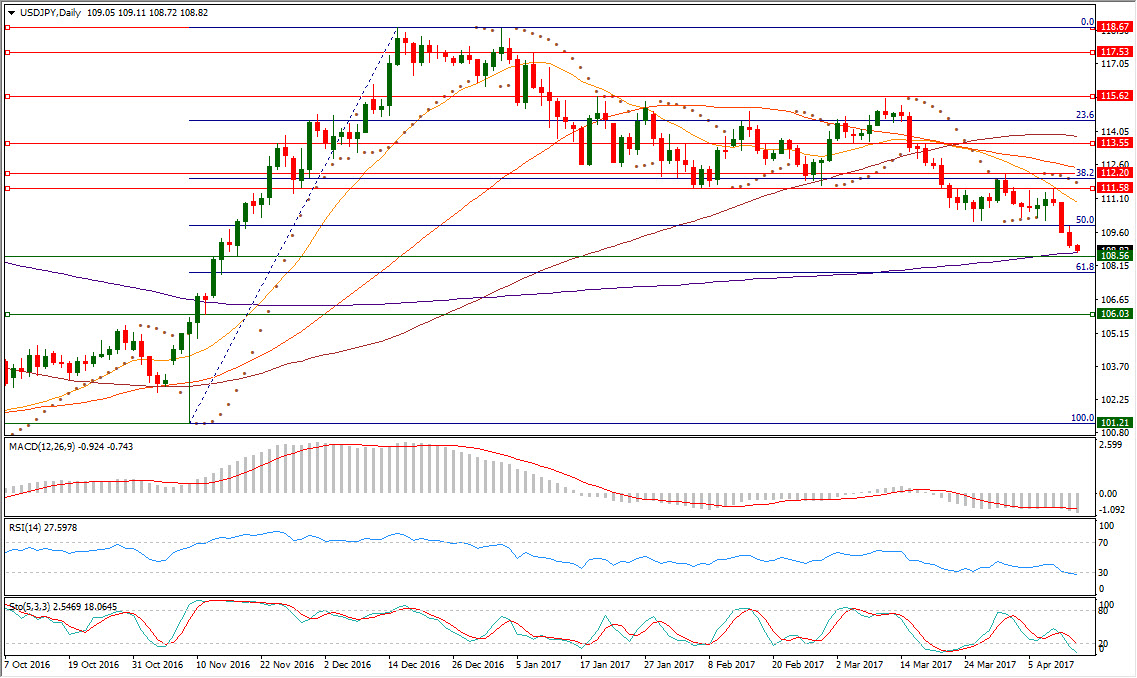

USDJPY has touched in the beginning of today Asian session its daily SMA200 by reaching 108.72

After failing to get back above 110 psychological level to be satisfied by reaching 109.87, whereas it has started to accelerate its slide to the current level.

The pair has already failed to get over its daily SMA20 again by forming a lower high at 111.58 below its peak at 112.20 which has been formed on last Mar. 31.

The pair is now in a closer place to 61.8% Fibonacci retracement of the rise from its bottom which has been formed following Trumps winning of the presidency at 101.21 to 118.67 which has been reached on last Dec.15.

USDJPY is now in its fifth day of being below its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today 111.83.

USDJPY daily RSI-14 is referring now to existence inside its oversold area below 30 reading 27.597.

USDJPY daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line also in its oversold region below 20 at 2.546 leading to the downside its signal line which is existing in the same region at 18.064.

Important levels: Daily SMA50 @ 112.47, Daily SMA100 @ 113.84 and Daily SMA200 @ 108.75

S&R:

S3: 108.56

S2: 106.03

S3: 101.21

R1: 111.58

R2: 112.20

R3: 113.55